The Canalys managed services survey 2022 results are in, and some interesting points have emerged:

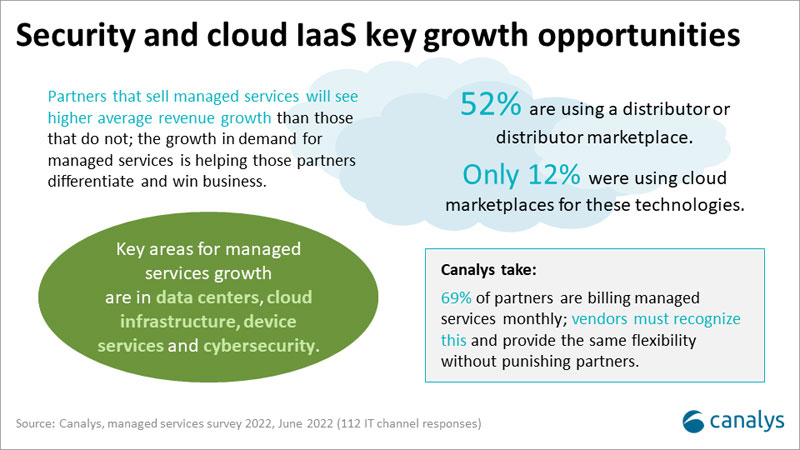

- The most significant areas for managed services by revenue are data centers, cloud infrastructure, device services (PCs, smartphones) and cybersecurity. These data points reveal how the complexity of customer environments post-pandemic has accelerated the need for comprehensive services and solutions. But this complexity has also increased the number of partner-to-partner relationships, as companies work together to offer specializations across the customer technology stack. If the word “ecosystem” has become ubiquitous in the channel it is for good reason. Even the largest resellers selling managed services can find themselves needing to partner with specialists in certain key areas, either because of vendor certifications or vertical knowledge.

- Cybersecurity tops the growth expectations for managed services among partners. Endpoint cybersecurity managed services are an opportunity for partners to build solutions around training, remote monitoring, backup and disaster recovery, and managed detection and response. Network security also brings with it cross- and up-sell opportunities, though the difficulty in securing hardware devices, such as servers and physical firewalls, due to supply chain constraints has had some effect on the growth of managed services.

- Distribution is a key route to market for technology that is being used to deliver managed services, as 52% of partners say they are using distributors or their marketplaces to access these solutions. But distributors are in a process of transformation and must work hard to deliver more value in areas of services to support MSPs in building their stacks and giving partners access to some of the latest technologies.

- Billing remains an issue for partners delivering managed services. 69% of respondents say they are billing their customers monthly, which is not surprising, but vendors must align themselves with this if they are to protect partners from potential pitfalls. For example, partners often take on the liability for non-payment or insolvency among their customer bases, but for the technology portion of those contracts, vendors can do more to offer flexibility without forcing partners to settle the balance of any contracts in these extreme cases. The shifting of liability for customer non-payment onto the channel in as-a-service technology sales has become a major sticking point and is creating tension for smaller partners that find their risk profiles disproportionately affected.

The managed services survey results for 2022 have offered many more conclusions and talking points, but we wanted to highlight some of the top areas to emerge from the channel responses. Get in touch for access to the full survey results and Canalys analysis.