Wasabi Technologies: new expansion targets APAC growth

1 July 2022

The pandemic turned the smartphone market on its head. Two and a half years later, online channels are more important than they were pre-pandemic, though offline channels remain essential. Canalys looks at the future of smartphone buying behavior and why both online and offline channels are growing in importance.

The online share of smartphone sales has shifted dramatically back and forth over the last two and a half years. Due to COVID-19, offline stores were forced to close or operate at a limited capacity, forcing consumers to look online. In Western Europe, at the pandemic’s peaks, over half of all smartphones were sold online, compared with 25% in the second half of 2019, before the pandemic hit.

Since then, the online share has fallen. But in the new, post-pandemic world, more than 30% of devices are still sold online, reflecting an acceleration toward online channels over the last two years. Rather than this being caused by new online channels emerging during the pandemic, it has been caused by an acceleration in the increasing importance of the current online channels that has been happening for a decade. The change has been driven by ecommerce players becoming more relevant, but more by retailers and telcos prioritizing the implementation of omnichannel strategies. For vendors and channel players, it’s now important to understand what drives consumers online and what the implications are.

What drives consumers to online channels?

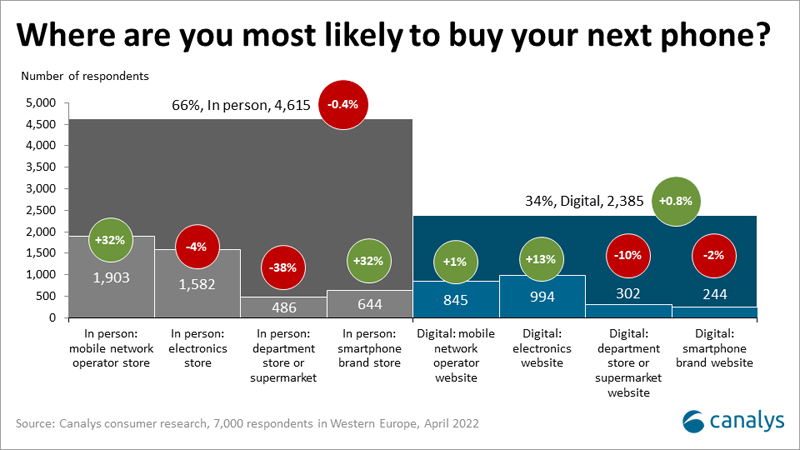

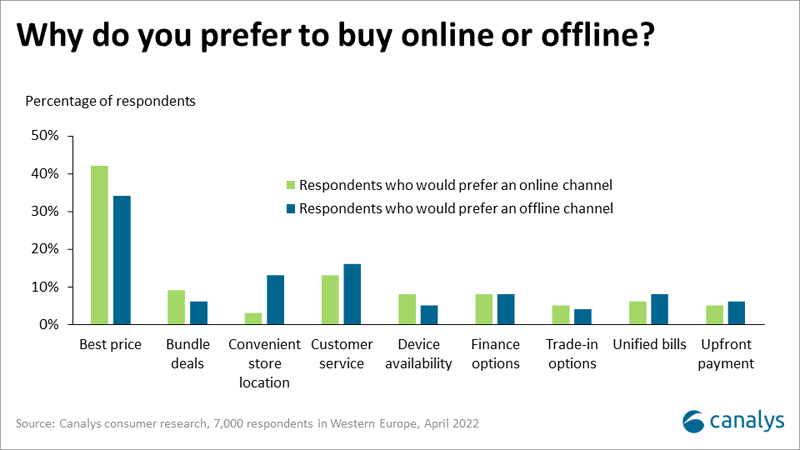

According to Canalys’ latest study in Western Europe, 66% of consumers said they would prefer to buy their next phone in person. In contrast to those who would prefer online channels, consumers were particularly drawn toward telcos and direct vendor stores as their preferred channel choices, reflecting a desire for customer service, convenient store locations and a good shopping experience. For the remaining 34% of consumers who selected online channels as a preference, price and bundling options rated highest. This is driven by online channels’ ability to present transparent and comparable information on devices and available deals.

Simultaneously, a high proportion of the respondents in Canalys’ latest study stated that they would use more than one channel as a part of the buying decision for their next device. A great proportion of these consumers will compare devices and gather information online while physically evaluating phones in person. Thus, both online and offline channels should be considered important as neither in isolation offers enough. This is no great surprise as retailers and operators have been adjusting to this buyer behavior for several years.

What is important to succeed online?

The share of smartphones sold online has reached a new normal and, moving forward, this share is likely to continue to grow gradually as omnichannel strategies improve and ecommerce players become more competitive.

It is vital for vendors to support their channel partners by having a strong online presence. This includes having a strong presence via their own websites but also their channel partners’ websites. Simple initiatives such as having detailed, clear and easily digestible information for every model makes a big difference for consumers searching for information. As websites become better comparison tools, staying up to date on models and having a consistent online presence will be key.

At the same time, offline sales will continue to account for most devices sold and a high-quality offline presence must be used to create an experience that supports consumers on the final part of their buying journey. Brand ambassadors and in-store sales representatives serve important roles to demonstrate devices, complement online information and support consumers in making decisions. With customer service as a key preferred difference between consumers who prefer offline to online channels, building a cohesive experience between online and offline information will ensure consumers are fully supported regardless of where they make their final buying decision.