Key EV market trends for 2023

21 February 2023

The pressure is increasing on channel and partner leaders to deliver at a new level of scale, complexity and personalization, and to figure out the people, processes, programs and underlying technology that will drive competitive advantage in the decade of the ecosystem. We aren’t there yet, but half of channel leaders report progress.

We are in such an early phase of ecosystem transition, and therefore no established maturity model exists to properly assess the range between the adoption of some basic ecosystem thinking and “mission accomplished”.

Here are some questions to think about (and score) as you determine where you are on the ecosystem journey. And, yes, it is a journey, not a destination.

Has your executive team shifted its go-to-market strategy?

Implementing an ecosystem model is not simply a program enhancement but a top-down cultural and strategic shift. Ecosystem models change the economics of partnering, transitioning from funding partners only at the point of sale (gross to nets or revenue reduction) to point of value (SG&A or capex).

Ecosystem models tend to be more customer friendly because they recognize and support the seven partners (on average) that your customer already trusts and reduces friction in the buying process. The customer can buy indirectly, through a marketplace (also indirect unless it is your own marketplace) or direct. The ecosystem model reduces the value placed on the transaction itself and instead puts value on moments where partners help get customers to the dance, get them on the dance floor and keep them dancing all night long.

Have you broadened your routes to market?

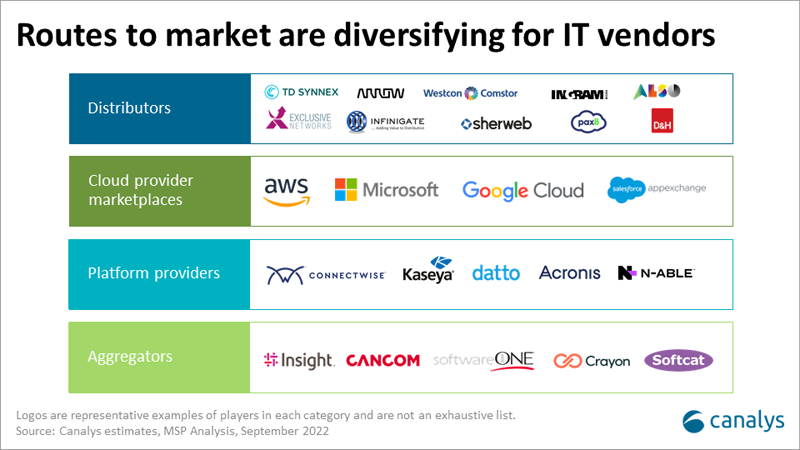

Ecosystem models recognize the entire customer buying journey – especially in the subscription and consumption models that most channel-friendly firms are moving toward. In addition to marketplaces being served by large hyperscalers, SaaS companies and traditional vendors, there are distributors that are investing billions in marketplace innovation and marketplace development platforms (MDPs), raising billions in private equity. Canalys forecasts cloud marketplaces will deliver USD$45 billion in revenue by 2025 and grow by a CAGR of 84%.

Distribution is going through a massive transformation, with market consolidation and new ecosystem-friendly services to help partners. New distributors, such as Pax8, Sherweb and NEXTGEN, that focus on cloud software have grown significantly while avoiding legacy supply chain, warehousing and capital/credit value adds. Finally, we have technology solution distributors in the telco space, such as Telarus, Avant, Intellisys and AppDirect, which are very active in M&A and crossing over into IT distribution quickly.

Have you changed your partner recruitment strategies?

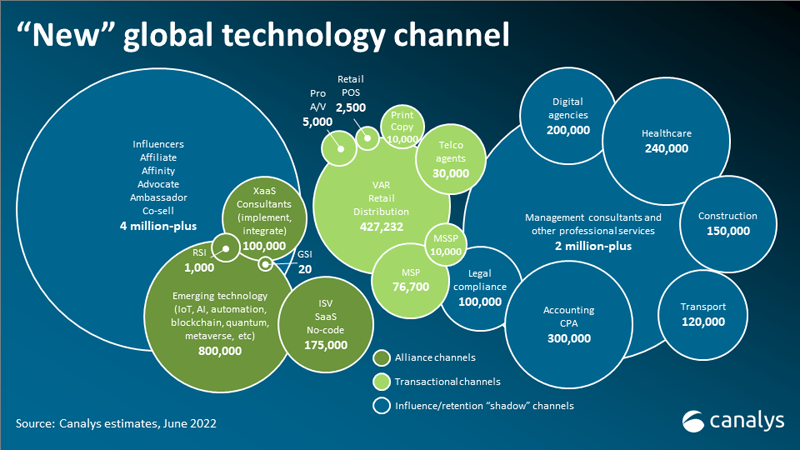

Beyond the target addressable market for your products and how they are bought and sold, have you considered how influence works with your customers and the keys to gaining customers for life? Again, the average customer trusts seven partners along their journey. One (or fewer) of those partners will ever function as a reseller for you.

The other partners will show up in key moments and either support, stay neutral, or worse, provide friction to your sales, marketing and CX efforts. Recruiting these partners, which may have over 20 different types of business models, can be untraditional. Understanding what they read, where they go and who they follow is probably outside of your current recruiting scope.

Are you speaking the right language to these potential partners?

When looking to recruit and develop more partners, which 86% of Channel Chiefs in CRN Magazine’s 2023 report said they were doing, it is important to recognize that non-transactional partners speak a different language. Moving from margins to multiplier language is the first step in engaging with the seven partners who are trusted at each of your customers.

Several cloud companies have already made the shift to this new language and are finding success in quantifying the customer opportunity for partners. Salesforce was the first to do it and is halfway toward recruiting 500,000 partners. Not bad for an almost fully direct company! AWS recently announced a US$6.40 multiplier at re:Invent (using Canalys research) and is quickly growing an ecosystem of systems integrators, ISVs, MSPs, agencies, integrators and consultants, none of which are interested in the reseller motion.

Is your program still anchored on precious metal tiers?

This is a tricky one. An ecosystem model relies on a blend of transacting and non-transacting partners. A tiering model is still best for driving performance in a reseller motion, while a points system can recognize, measure and incentivize those non-resell moments that drive new opportunities, revenue, profit and retention.

I talked about the economics of partnering above, but suffice to say a points system is how to execute an ecosystem model most effectively. Companies such as Microsoft, VMware, Smartsheet and Okta have begun the transition. Awarding points for partnering moments before, during and after the transaction, as well as co-innovation, value creation and network effects that stem from technology, strategic and business alliances is how to operationalize an ecosystem model.

Is there money on the table for your partners outside of resell?

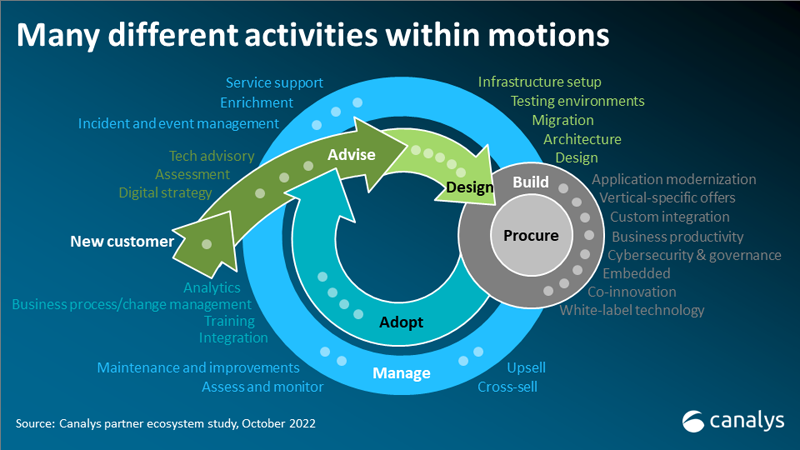

To expand on the points conversation above, there are dozens of moments that can be monitored, measured and managed across the customer journey as well as through alliance relationships. Applying incentive, motivation and loyalty strategies across these moments is critical to an ecosystem model.

Your top partners could be focused on the early 28 moments before vendor selection, getting the initial purchase done and provisioned (whether they take the customer’s money or not), every 30 days afterwards ensuring a customer for life, co-innovation or a combination of some or all of these. Spending money for moments is not a small task and for most companies, there isn’t additional “ecosystem partner” funding available. The strategic, financial and programmatic changes necessary to make this ecosystem model work will be a multi-year exercise.

Have you personalized your partner experience at scale?

Every partner now crosses over several different motions – segmenting your partners by type no longer works in an ecosystem model. Every person inside each of these partners is unique in what their onboarding, training and competencies need to be to drive success. Your ecosystem model needs to be delivered in a single global program but executed at an individual level.

Think of the program as a building. Every partner individual walks through the same front door (portal) and then requires a hyper-personalized experience with a digital concierge that moves them to the right rooms. An ultra-large partner such as Accenture (with over 750,000 employees) could be your largest marketing, resell, retention and co-innovation partner – all at the same time. It now comes down to each individual and their ability to find the right education, training, certifications, competencies, enablement, incentives and engagement necessary to be successful.

Do you have co-selling and co-marketing programs available to all partners?

Continuing the discussion on expanding routes to market, do you offer opportunities for partners to be enabled and engage in direct business, marketplace business or business transacted through other resellers? Implementing affiliate, advocate, affinity, ambassador, influencer and other types of programs that pay for performance is key to an ecosystem model.

This includes executing programs that map opportunities with partners in a secure and double-blind way earlier in the journey. This also includes attribution models that can quantify moments before, during or after the transaction. The moment could be a well-read ebook the partner created, an influential podcast they were on, a partner pressing buy on behalf of the customer on a marketplace, a key implementation that creates long-term stickiness or a critical integration that creates a 1 + 1 = 3 scenario.

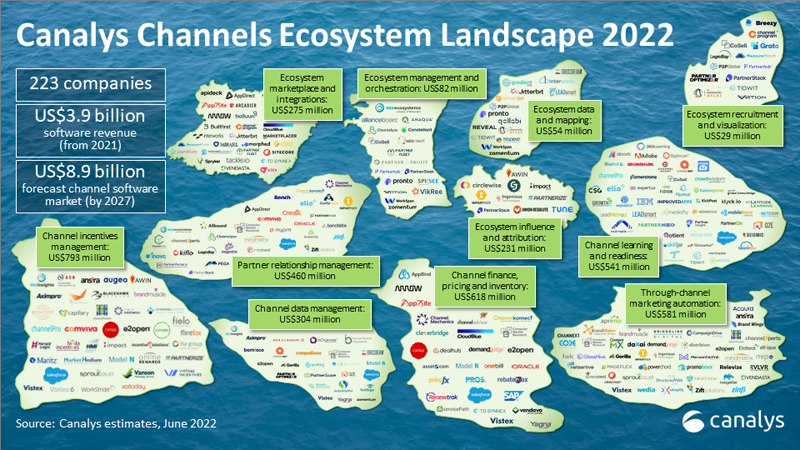

Have you made technology investments to drive an ecosystem model?

Automation, deeper integrations and data-driven decision-making are creating measurable competitive advantage through partnerships and are quickly becoming table stakes for delivering an ecosystem model.

Canalys research shows that there are now 223 companies forming the ecosystem software landscape and five new categories of ecosystem technology that entered the landscape in 2022, including data and mapping, recruitment and visualization, influence and attribution, marketplace and integrations, and management and orchestration. Over 35,000 vendors bought channel technology last year and Wall Street is taking notice, with billions of investments into ecosystem categories.

Have you made the leadership changes necessary to drive an ecosystem model?

One of the larger trends we saw last year was the establishment of the new Chief Partner Officer (CPO). This wasn’t just a promotion for the Channel Chief to the boardroom, it was a new job role with expanded KPIs and more broad objectives. Companies such as Microsoft, AWS and IBM made these appointments to coincide with their ecosystem model growth. Out of the 20 appointments we analyzed, very few of the new leaders have ever been present on the CRN Channel Chief list in the past.

In most cases, the Channel Chief now reports to the CPO and sits with peers who own marketing, CX, product, technology alliances and other partner roles beyond reselling. Monitoring, measuring and managing partners at the point of value in addition to the point of sale requires different skills, programs and organizational structure.

Are your partnering professionals still working in a channel silo?

In addition to the leadership changes, we are monitoring another trend of embedding channel people into the different lines of business with a matrixed dotted-line structure back to the Chief Partner Officer. In an ecosystem model, partnering is not a department but a horizontal function.

For example, having channel marketing professionals work in marketing and report to the CMO is important so that the organization can look holistically at the customer’s early 28 moments (before vendor selection) and make sure branding and demand generation is done both internally and externally. The same goes for sales, CX, product, strategy, finance and operations.

About a decade ago, the data science function did this successfully as a horizontal function. Instead of building an empire, the CTO or CDO embedded data scientists in every department and built a robust data lake around them that benefited all. The same theory works in partnering and is core to an ecosystem model.

Have you removed human gates to scale your partnering success?

Partnering at scale is a complex and sometimes convoluted thing to manage effectively. It requires repeatable processes, predictable workflows, scalable business logic and a strong degree of automation that is difficult because you are dealing with money and third parties. With the 35,000 vendors that we analyze, the average ecosystem model has 10 times more partners than a channel reseller model.

Given the 260,000 technology industry layoffs over the past four months, very few partnering organizations have the luxury of adding resources. Many channel leaders are asking themselves “what is the ChatGPT approach to expanding my partner recruitment, program, engagement and enablement?” Process automation combined with smart investments in technology are cornerstones to successful ecosystem models, but perhaps the biggest gap in this entire list.

Are you actively getting endorsed in the communities surrounding your prospective partners?

The expansion necessary in an ecosystem model means rethinking your partner coverage and capacity planning. Recruiting, onboarding, enabling and then engaging with 10 times more partners requires a community management strategy and execution that most companies are failing at.

Canalys has been researching community “watering holes” over the past year – the places that partners trust to engage with peers, listen to influencers, meet with superconnectors and cut through the noise and clutter this industry inundates them with. There is still a misconception that partner recruitment and activation centers on a good partner program and internal communities – it doesn’t. A broad “Moneyball” approach is required – getting more people on base instead of swinging for the fences. Effective community management is getting on base as many times as possible with the least amount of investment. There are no US$7 million Super Bowl ads here.

Have you ever asked your partners what they read or listen to, where they go, or especially who they follow? Do you have a list of watering holes? Have you created an algorithm that ranks the most influential people in these watering holes? Have you invested in nurturing these top 100 people? Not just to recognize you in a police lineup – but to know your 2023 elevator pitch and to endorse you (unprovoked) on the platforms they are trusted on?

Summary

We have a new digital-savvy, consumer-like end customer with a different psychology, behavior and buying journey. These new buyers surround themselves with upwards of seven different partners in a customer journey that now never ends. From the first 28 moments of a B2B considered purchase before vendor selection, to the new ways products and services are procured and provisioned, to the retention and renewals that rely on deep integrations, stickiness and enrichment every 30 days forever, the partner ecosystem strategy is now more important than ever.

The pressure is increasing on channel and partner leaders to deliver at a new level of scale, complexity and personalization, and to figure out the people, processes, programs and underlying technology that will drive competitive advantage in the decade of the ecosystem.

We aren’t there yet, but almost half of channel leaders report progress toward the goal.