Have the industry’s channel chiefs really moved to an ecosystem model?

22 February 2023

While most smartphone markets suffered big declines in 2022, select markets in Central and Eastern Europe experienced booming demand and strong performances. This blog post explores the reasons behind the growth in CEE (excluding Russia, Ukraine and Belarus) and discusses what's next and why vendors should continue to invest in the region.

2022 was a difficult year for vendors across the smartphone industry. Following two remarkably strong years in 2020 and 2021, defined by booming demand and supply shortages, 2022 stood in stark contrast, with mounting macroeconomic pressures and shrinking demand.

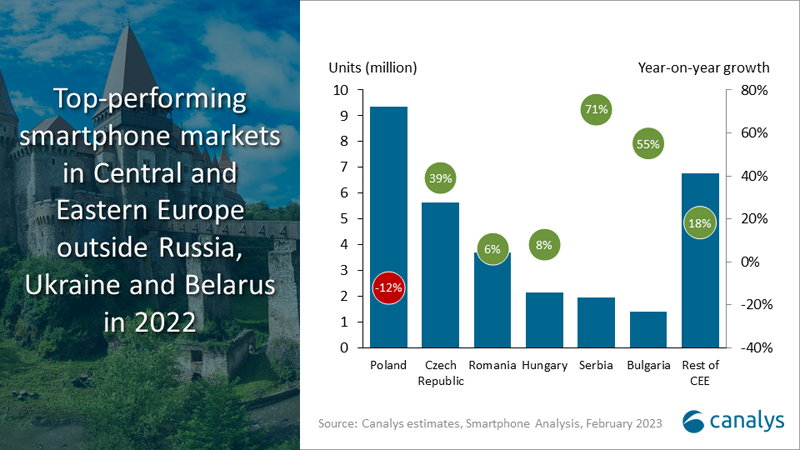

The worldwide smartphone market fell by 12% overall in 2022, which included an 18% drop in Central and Eastern Europe (CEE). But if we exclude Russia, Ukraine and Belarus, which have been severely affected by the military conflict and sanctions, the story of CEE was quite different. Smartphone shipments into CEE (excluding Russia, Ukraine and Belarus) increased by 11% in 2022, with markets such as the Czech Republic, Baltics, Bulgaria and the Balkan countries, in particular, experiencing big growth.

Despite double-digit inflation across many markets combined with a tough macroeconomic environment, the region achieved one of its strongest performances ever. This leads to two important questions: why did the CEE region boom in 2022 and what is next for the region?

A complex picture explains why 2022 was so strong across the CEE region, making it necessary to look at factors in 2022 but also from the years before.

Undersupply in 2020 and 2021

The region’s performance during the pandemic years in 2020 and 2022 was particularly bad, in contrast to many other markets around the world. We must go back to before 2015 to find lower shipment volumes than in 2021. The underperformance of the market over these years was not predominantly connected to demand factors but rather a lack of supply following Huawei’s struggles and other vendors’ supply problems.

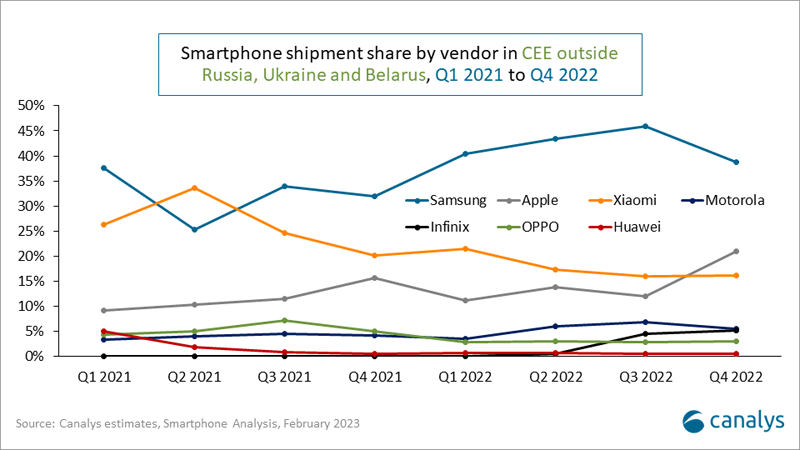

In 2019, Huawei held close to a 25% market share in CEE (excluding Russia, Ukraine and Belarus). The US sanctions that crippled its smartphone business worldwide caused a significant drop in the region and left a big gap in the market. Due to supply shortages, other vendors struggled to fill the Huawei-shaped hole. Often, the biggest vendors prioritized larger, emerging markets where they have strong competition and high long-term ambitions, rather than the many small countries in CEE where they were more confident about their ability to retake share after supply had improved. The shortages did not stop vendors such as Xiaomi and Motorola from growing significantly in 2020 and 2021, just nowhere near enough to fill the gap left by Huawei.

All this left the market significantly undersupplied in 2020 and 2021.

Strong demand and a booming tech sector

The undersupplied market delayed many purchases until 2022, and demand for smartphones has been high ever since. As the supply of affordable devices in particular has recovered, more people have been able to refresh their devices. In addition, the tech sector overall has seen positive development in the region in 2022, which has contributed to the growth of hardware shipments into the region as well. This is despite high inflation and currency depreciation that hit many countries significantly. But it should not be underestimated that higher inflation levels were experienced more recently across the countries than, for instance, in Western Europe. In Western Europe, both individuals and companies have changed buying behavior rapidly and significantly in response to changing macroeconomic factors.

Vendors out to take share

Both established vendors, which were limited by supply shortages in 2020 and 2021, and relatively new entrants had high growth ambitions in the region over the last year. Samsung was the biggest winner in terms of market share growth, driven by strong support from a channel confident in Samsung’s ability to sell through. For Samsung and Apple, some units initially intended for Russia were allocated to CEE and driven into the channel using strong incentives. In addition, several newer vendors pushed into the market with ambitions of establishing themselves in the region, including Infinix, HONOR, vivo and realme.

An incentivized, open-minded channel

After low supply in 2020 and 2021, the channel was open to taking on extra inventory. This was also driven by concerns about an increasingly worsened macroeconomic environment in 2023 that, for example, can make purchases using US dollars more expensive if local currencies depreciate further. The channel will look to leverage the strong demand for as long as it continues but will be prepared for a slowdown in 2023.

An inevitable market correction is due within the next couple of quarters. Spending and investments in the tech sector in CEE countries have already shown signs of a slowdown, and we can expect smartphone shipments to come down soon as well. For the smartphone market specifically, many of the channel and volume-driving incentives that helped to boost performance in 2022 will be restricted as vendors prioritize profitability. Simultaneously, it shouldn’t be underestimated that the market is starting to become saturated, which also will contribute to a short-term dip.

Still, the region should remain attractive to vendors for continued investment. As most vendors have had remarkable growth over the last year, there have been many first-time users of each vendor’s devices. Thus, only the foundation has been established to create a successful business in the market in the mid-to-long term. The first steps toward building brand awareness among end users have been taken, and vendors will need to continue showing commitment and investment in the markets to build on the foundation that has been created. This will be vital when a larger refresh cycle commences in 2024, supported by an easing macroeconomic environment.

Vendors will also find opportunities within a telco channel that just is starting to commit to 5G technology. As 5G devices start to reach lower price points, network operators will look to bring more users onto 5G-enabled devices. Vendors that have shown commitment to the market and worked on building awareness among consumers will be well-positioned to take share.