AWS re:Invent 2023 – The partner perspective

15 December 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

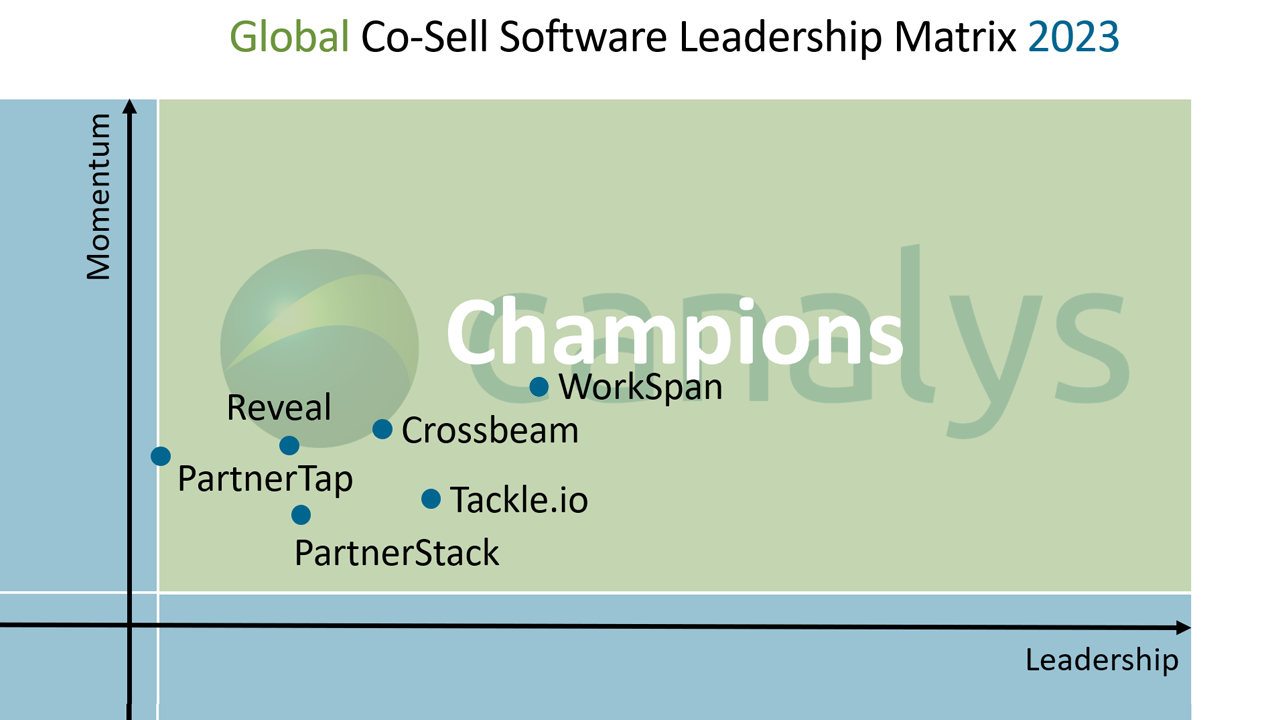

Six vendors have been crowned Champions in the 2023 Canalys Global Co-Sell Software Leadership Matrix: Crossbeam, PartnerStack, PartnerTap, Reveal, Tackle and WorkSpan.

Six vendors have been crowned Champions in the 2023 Canalys Global Co-Sell Software Leadership Matrix: Crossbeam, PartnerStack, PartnerTap, Reveal, Tackle and WorkSpan.

Canalys recently published its first Global Co-Sell Software Leadership Matrix, adding to its series of Leadership Matrix reports. The matrix’s objective is to assess which vendors are playing an integral role in driving the success of the partner ecosystem across their respective channel and technology areas.

The accompanying report focuses on 11 companies that are assisting vendors in co-selling with partners and covers a broad array of partner types, including influence/marketing, transaction-assist, marketplace and customer retention partners. In addition, it looks at the management, measurement, enablement and automation of technology, strategic and business alliances. These companies enable different aspects of co-selling, and Canalys recommends a layered approach to achieving co-sell success. There is not an end-to-end platform covering all the elements of co-selling today.

Effective co-selling programs, operational execution, people alignment and business workflows require technology automation that is repeatable, scalable and, most importantly, reliable. Co-selling requires effective data sharing and mapping, measuring and attributing influence, facilitating digital marketplaces and integrations, broader partner recruitment and visualization, and robust management and orchestration capabilities.

Defining Champions and vendor inclusion in the Canalys Co-Sell Software Leadership Matrix

A vendor’s position in the Canalys Global Co-Sell Software Leadership Matrix is based on vendor customer feedback, industry leadership in co-sell enablement and Canalys analyst assessments. Vendors rated as Champions demonstrated the highest levels of excellence in technology capability and execution over the last 12 months, compared with their industry peers, while continuing to innovate their functionalities further.

Canalys assessed the 11 leading co-sell software vendors globally, selected for their advanced co-sell enablement capabilities spanning data and mapping, influence and attribution, marketplaces and integrations, management and orchestration, and recruitment and visualization. Besides the six Champions, other vendors were rated as Contenders (those companies that have built and acquired strong co-sell capabilities and are growing momentum), Scalers (those that have built momentum in the co-sell space and are actively building out platforms and integrations) and Foundation vendors (those that are starting to develop and acquire functionality).

Vendors must continue to innovate to differentiate themselves

The five co-sell enablement software categories are still largely in their infancy. The average age of the 90 companies in this space is 11 years old, with over 36% being under five years old. Despite this, the growth potential in the market is tremendous. From 2021 to 2022, co-sell software revenue swelled by 33.6% from US$672 million to US$898 million, while numerous new players entered the market. Beyond the 90 established companies on our Channels Ecosystem Landscape, we are watching 55 more companies emerge from the early startup stage.

With limited competition and no clear leaders with double-digit market shares, the co-sell software market is primed to attract newcomers from outside the industry, including large companies from other technology areas. Therefore, it is vital for the existing players, including Champions, to continue to invest in further innovating their platforms to not only differentiate themselves from their competitors but also create a barrier of entry for outsiders looking to capitalize on this fast-growing industry.

The market is expected to grow to US$3.1 billion, at a CAGR of 28%, through to 2028. With the fast-rising complexity of customer technology demands, vendor customers increasingly recognize the importance of co-selling and co-delivering solutions with others in the channel ecosystem – which is promising for those in the co-sell software industry. For Champions looking to maintain their status next year and beyond, prioritizing the development of new functionalities, leveraging generative AI models and marketing to a new ecosystem-led buyer is vital.