Is it time to revamp channel incentive strategies?

1 December 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Samsung has several strategic advantages to take the lead in on-device AI. The ability to leverage its unique position to successfully navigate the future AI landscape will have huge implications for its long-term position as the leader in the smartphone and consumer electronics category.

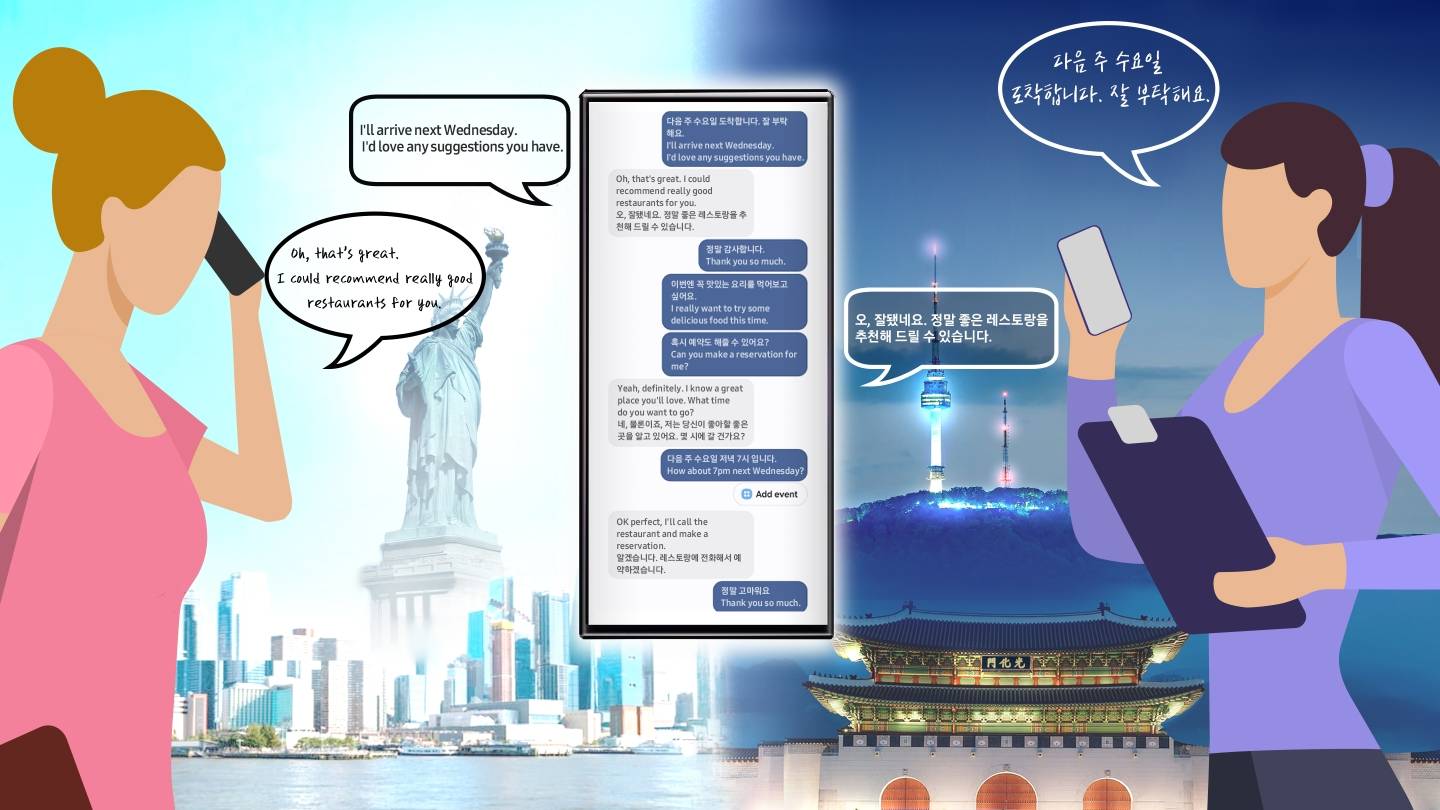

Samsung announced its entry into the on-device AI last week by introducing the Galaxy AI. They offered a glimpse of what to expect with a Live Transcribe feature integrated directly into the phone call function without the need for using third-party apps. The importance of succeeding in on-device AI cannot be understated. It is an opportunity to reshape not just the smartphone but the entire consumer electronics lineup.

Escape from the “Peak Smartphone” trap

The term “Peak Smartphone” has been thrown around recently to describe the lack of innovation coming from the smartphone product category. Mass market devices have become increasingly commoditized with little differentiation in features and hardware. This leaves vendors with few options but to compete on price, resulting in a race to the bottom and shrinking margins. Samsung’s mass-market smartphone portfolio is especially at risk. In 2023 its market share of devices priced below US$150 dropped to an all-time low of 9%, below Xiaomi and TRANSSION at 23% and 30% respectively.

In the premium segment, it is not any easier for Samsung. Its market share of devices priced above US$600 dropped to 19% in 2023 from 25% in 2019 with Apple gaining 8% in the same period. Foldables offer growth potential in this segment and Samsung was a first mover in this category in 2020. However, the space has become crowded and Samsung’s market share of global foldable shipments has dropped to 65% as of Q3 2023 from a high of 86% in 2021.

On-device AI is the opening Samsung needs to galvanize its smartphone category. Intelligent software experiences powered by on-device AI offer an opportunity to create truly personalized and unique value propositions for customers. Stand-out features can unlock new revenue streams through subscriptions and enterprise licensing, reinforcing Samsung's market dominance.

Diversification into software and services

Samsung’s current revenue contribution is highly dependent on device and hardware component sales with little contribution from services. According to Samsung Electronics’ 2022 published earnings, less than 4% of total revenue came from services and other revenue. The high dependence on device and hardware sales leaves Samsung highly exposed to downturns in device sales cycles. This was especially evident in H1 2023 where revenue for its memory business dropped by 49%, resulting in the division and recording an operating loss of US$7 billion.

Building a strong software and services revenue stream is vital for Samsung’s long-term profitability and sustainability. Customers may be waiting longer to upgrade their phones, but they are consistently spending on software and services. Apple has a steady monthly income stream from iOS users just from selling iCloud storage space, not to mention revenue generated from the App Store. Samsung’s challenge currently is creating truly unique software solutions from other Android solution providers. Samsung Cloud, for example, competes with Google’s cloud backup where both are equally effective in transferring data from one phone to another, but Google’s other products and services make Google a much more compelling option. For Samsung to meaningfully enter and win the on-device AI space, it needs to develop a foundational learning model that can create an ecosystem for future apps and solutions like iOS or Android.

Deep pockets and large size

There are large barriers to entry for developing AI learning models at a foundational level. It requires both R&D investment and reliable data inputs from real use cases for the AI to learn and refine its algorithm. Samsung ticks both these boxes as it has the financial resources to compete with tech giants in R&D and by simply being such a large organization, it makes sense for them to invest in AI learning models for its internal business and operations. This allows Samsung to build AI and test AI solutions for its internal use cases before commercializing to the public.

Strong foundation and product ecosystem

Samsung’s position as the market leader in many home appliances product categories is another strategic advantage. Samsung SmartThings already provides the capability to connect various Samsung devices under one app and gives a strong foundation to build personalized AI solutions in the smart home category. Samsung has unique assets that it must swiftly take advantage of. Apple has a limited product range in the home appliance category. Xiaomi has been growing its home IOT offerings in recent years but does not have the financial muscle to compete with Samsung in R&D investment.

In the cybersecurity and enterprise space, Samsung Knox will also likely play a vital role in the company’s future AI plans. Almost all Samsung smartphones are pre-installed with Samsung Knox, giving it a strong foundation to build on. Samsung’s Knox currently struggles to leverage its position as the device manufacturer to create clear competitive advantages over other software solution providers. The integration of on-device AI solutions with Samsung devices could potentially change the dynamics and give Samsung Knox a clear edge in this space.

Below is a potential roadmap for a successful rollout of Samsung’s on-device AI path and how it might play out.

1. Samsung develops foundation model:

Samsung creates a robust on-device AI foundation model for language learning. This model is trained on large datasets and designed to understand and process language effectively.

2. Opening the platform:

Samsung decides to open its AI platform, allowing external developers to access and leverage the capabilities of its foundation model. This could be done through APIs (Application Programming Interfaces) or SDKs (Software Development Kits).

3. App development:

External developers, including language learning app creators, can integrate Samsung's foundation model into their applications. This allows them to utilize the advanced language processing capabilities provided by Samsung's AI.

4. Innovation and diversity:

Opening the foundation model to external developers fosters innovation and diversity in the applications. Developers can produce unique language learning apps, each catering to different learning styles or linguistic challenges.

5. Community and ecosystem:

A developer community and ecosystem may emerge around Samsung's AI platform. This community can share insights, collaborate and collectively contribute to improving and expanding the capabilities of the foundation model.

6. Monetization and licensing:

Samsung may choose to monetize its AI platform by charging developers for access or usage. Alternatively, they might adopt a licensing model where developers pay based on the scale of their applications. It is too early to know exactly the monetization model though and the priority initially should be on rapid user adoption.