Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Key learnings from the global wearable band market in 2023

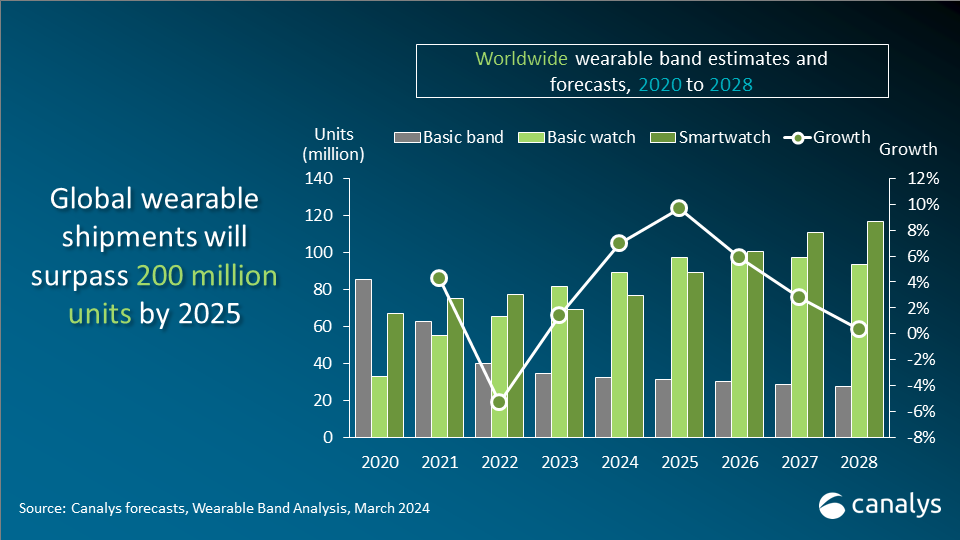

The global market for wearable band devices experienced modest growth in 2023, driven by emerging markets. Basic watches increased significantly despite a decline in smartwatches. Chinese vendors like Xiaomi and Huawei are at the forefront of innovation, fostering a move towards smarter wristwatches and adopting Wear OS to enhance consumer options and competitiveness in the smartwatch sector. Canalys forecasts that by 2025, total shipments of wearable band devices will reach 217 million units, with smartwatches leading growth among wearable band categories.

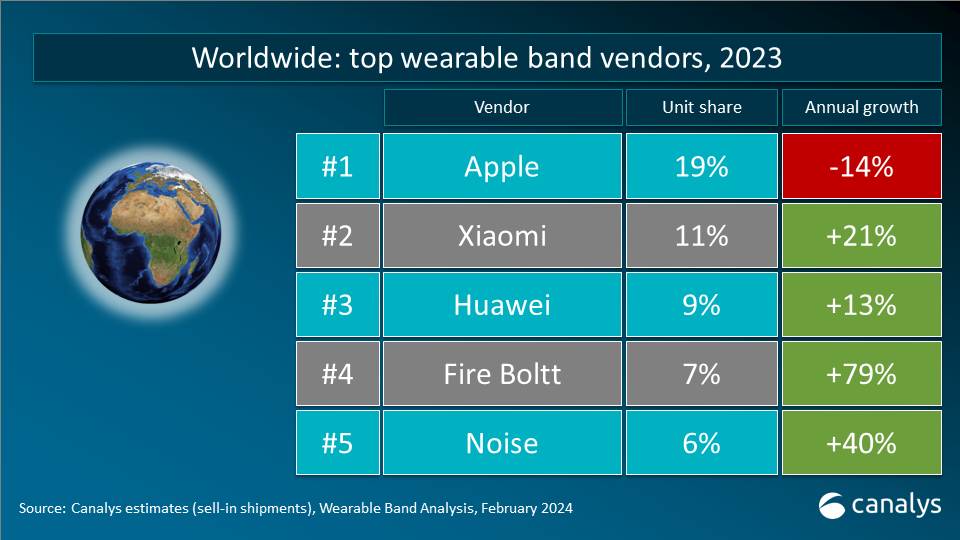

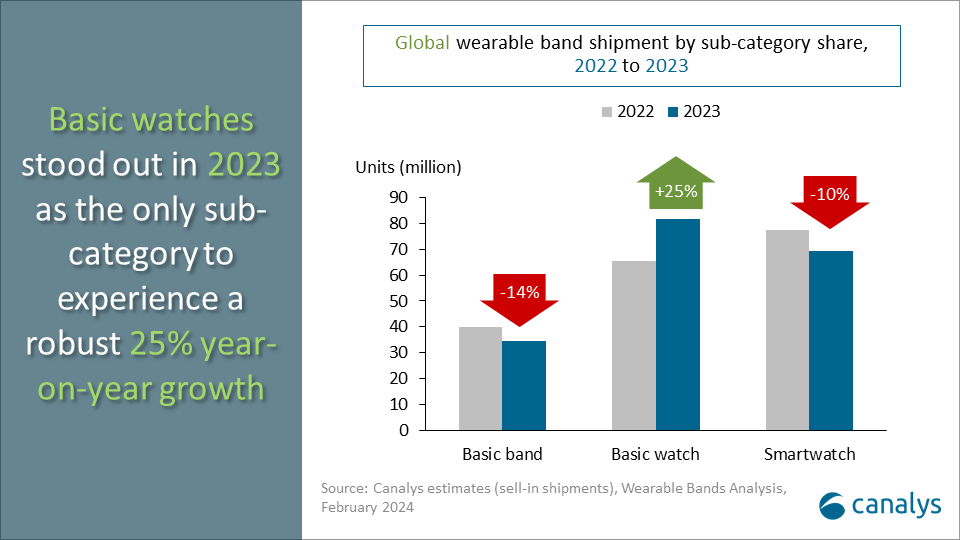

In 2023, the global market for wearable band devices experienced a modest growth of 1.4%, achieving a shipment volume of 185 million units. The contributions from emerging markets were particularly notable, providing significant momentum to overall growth. Additionally, the diversified development of basic watches infused the industry with renewed dynamism. However, excluding India’s 15 million additional shipments of predominantly basic watches, the overall wearable band market decreased by 8%, led by declining smartwatches and basic bands.

Wearable devices market witnesses mixed performance

Amid a dynamic economic landscape marked by inflationary pressures and shifting post-pandemic consumer sentiments, consumer spending in Europe and North America transitioned from discretionary purchases such as smart devices to services. This shift has impacted the smartwatch market, resulting in a substantial decline in shipments across North America and Western Europe, regions where smartwatch penetration was higher. It is evident that vendors such as Apple, Samsung and Google also struggled with insufficient innovation and competitiveness, failing to attract consumers as their appeal fell short of expectations.

In contrast, the market for basic watches exhibited robust growth potential, standing out as the sole segment growing 25% year-on-year annually. Several factors contribute to this growth. First, strong momentum persists in the Asia-Pacific region, particularly in India, propelling the expansion of basic watch adoption. Basic watches have become popular in emerging markets due to their affordability and practical features, highlighting untapped market opportunities as wearable band device penetration rates remain low.

Chinese vendors have been instrumental in driving growth in the basic watch market. Xiaomi has consistently innovated and expanded its product range, offering a variety of products at different price points globally. The company's emphasis on incorporating GPS technology into more affordable options and enabling ecosystem connectivity for entry-level devices has strengthened its position in the market. Meanwhile, Huawei has enhanced the appeal of basic watches by improving design and material quality, strengthening its premium image on top of its overall value proposition.

Moreover, vendors are actively introducing more pre-installed applications on basic watches, particularly in China, further blurring consumers’ perception of smartwatches and basic watches. These “smarter” basic watches not only offer rich functionalities but also come at affordable prices, meeting the daily needs of most consumers. These strategic initiatives have significantly boosted the global competitiveness of Chinese vendors, propelling Xiaomi and Huawei to the top three spots in 2023, closely trailing behind Apple.

Chinese vendors embrace Wear OS

An increasing number of Chinese smartphone vendors are opting to use the Wear OS platform, marking 2024 as a pivotal year for the expansion of Wear OS. For instance, Xiaomi and OnePlus's entry into the European market with their Wear OS smartwatches offer consumers cost-effective choices while putting competitive pressure on Samsung and Google in the region.

Chinese vendors are aspiring to leverage Wear OS as a springboard to enter the mid-to-high-end smartwatch segment, setting the stage for an enhanced, more up-market device ecosystem for Android. However, to maintain their momentum internationally and in the smartwatch sector, these vendors must focus on continuous improvement and innovation in use cases, connectivity, health and fitness tracking, and design, among other areas. This is crucial for staying competitive in a rapidly changing market and meeting evolving consumer expectations.

Innovation is key to market resurgence

Looking ahead, innovation will be key to revitalizing the wearable market. Advanced features like AI-driven insights, enhanced health monitoring capabilities and the rise of high-end and outdoor-focused devices are key growth drivers.

Canalys is maintaining a cautiously optimistic stance for 2024 with a 7% growth forecasted for the wearable band market. There are hurdles to overcome like recovering from declining shipments, global expansion and AI integration especially, as AI applications are in the exploratory phase and require collaborative efforts and time for market testing. At this crucial moment filled with transformation and opportunities, vendors must maintain strategic flexibility, actively seek innovative breakthroughs, and continually accumulate practical experience.

In the short term, the basic watch market continues to demonstrate strong growth potential as vendors are actively exploring product positioning in multiple areas such as health monitoring, sports tracking and daily interactions, enhancing product value and profitability through optimized design and materials. Looking ahead, with the integration of advanced technologies like AI and more advanced health monitoring capabilities, smartwatches are expected to have more advanced system capabilities and a broader range of applications. Therefore, Canalys predicts that by 2025, the overall shipment of wearable band devices is expected to reach 217 million units, with smartwatches outpacing other wearable band categories in growth.