Video cloud becomes a key market segment

1 September 2022

US education PC shipments have shrunk dramatically from its pandemic-era boom. Now the future of the market is uncertain but still offers tremendous potential.

The landscape of the digital education market has changed drastically since the onset of the pandemic. The advent of remote learning led to previously unthinkable shipment volumes of education-purposed PCs. Triple-digit growth in the education segment became common throughout much of 2020 and 2021, meaning the industry now sits in a far different position to its pre-pandemic situation. The world’s largest driver of education shipments, the United States, has now supplied nearly all its students with PCs and has seen shipments drop considerably from peak levels. What remains is a highly-inflated installed base, a market that remains immature compared to other segments, and waning demand that has made vendors question if the segment will bounce back.

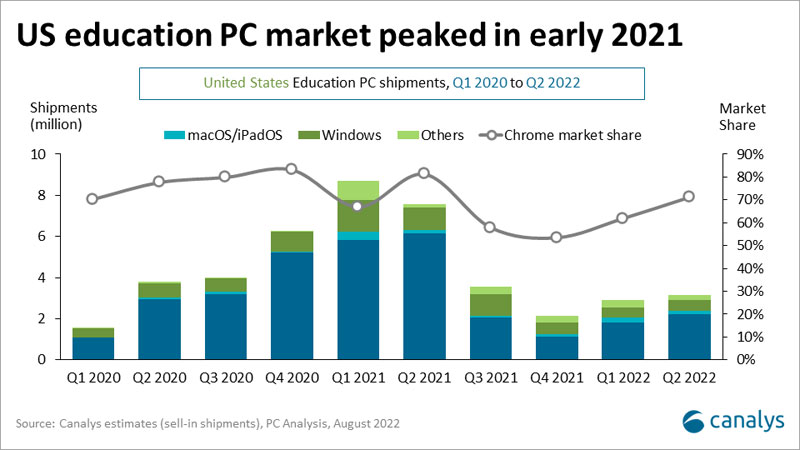

The US education market peaked in Q2 2021 at just under 9 million units shipped. The installed base has now ballooned to a point where nearly all students in the US are equipped with a personal device and in Q2 2022 the industry slipped to a far lower level of shipments of around 3 million units. Now the industry is awaiting the lifespan end of pandemic-era purchases in 2023 and 2024.

The overnight transition to remote learning during the pandemic sparked a cultural shift whereby most educators in the US consider PCs to be an integral part of the classroom. Tasks like grading tests by hand or asking students to collaborate on a hand-written project seem archaic to American educators. This cultural shift will ensure the education installed base will remain high.

In the long-term, the education market will become far less variable year to year and will return to a cycle that favors orders in the second and third quarters as schools prepare for the upcoming school year. The refresh cycle in the US will arrive earlier than many comparable education markets around the world, such as Japan. OEMs have done extensive durability testing of their education devices and consistently found American students to be less forgiving to their PCs, ensuring a timely refresh.

Chrome OS was the resounding winner in the initial wave of education purchasing for a variety of reasons. Chromebooks offer a great package for schools with an affordable price point, and an operating system that is famously easy to manage for often under-equipped IT teams. Chromebooks also succeeded due to their availability in a constrained market as Windows devices struggled to keep up stock in the initial stages of the pandemic due to high demand from segments beyond education. Chrome will face more competition in the coming stages of education purchasing as shortages will be a smaller factor as the market matures. Windows 11 SE has been thoughtfully designed to target the education market and offers many of the strong points that Chrome does with a more familiar platform for teachers. Also, some secondary educators have voiced concerns around educating students on devices that are unlikely to be used in their careers. The case for tablets in elementary level classrooms remains strong as the benefit of a fixed keyboard is diminished with younger students, especially now remote learning is a thing of the past.

Despite challenges, Chrome will maintain its standing as the leading operating system in the US education system as it is now highly integrated into the sector's IT infrastructure. As seen in the commercial segment with Windows, IT managers often balk at the idea of overseeing a multi-platform environment. Competitors will chip away at specific demographics within the education segment, but Chrome will prevail as the long-term winner of the market.

A massive platform swing is unlikely in the upcoming education refresh, but that does not mean the market is settled. Educators have become more particular about the devices they are supplying to students and teachers. Connectivity remains a concern for many educators, as varying Internet access at home leads to greater inequality in the digital opportunity. The share of education PCs with integrated mobile connectivity remains low, but educators are calling for the specification to become more widely available, especially to under-privileged students. The third installment of the US Emergency Connectivity Fund (ECF) will target this connectivity gap by providing US$1 billion to schools, which will target connected devices for students lacking Internet access at home. Educators have also become more particular with the form factors they purchase. Convertible and detachable PCs have become increasingly popular with teachers as they offer more mobility for students as they move around the classroom and find themselves in less stationary environments for lessons.

US education shipments will take time to mature and return to consistent growth. Education markets outside the US, such as Brazil and Indonesia, are showing promising signs of growth and will deliver new opportunities for vendors and the channel to offset the slowdown in the US. Ultimately, the US education market’s pandemic-related boom has rapidly expanded the installed base and placed devices at the center of new learning styles. This ensures the industry is set for long-term success despite weak demand in the short term.