Canalys: North American smartphone market plunges to five-year low but Samsung rallies with Galaxy S10

Palo Alto, Shanghai, Singapore and Reading (UK) – Thursday, 9 May 2019

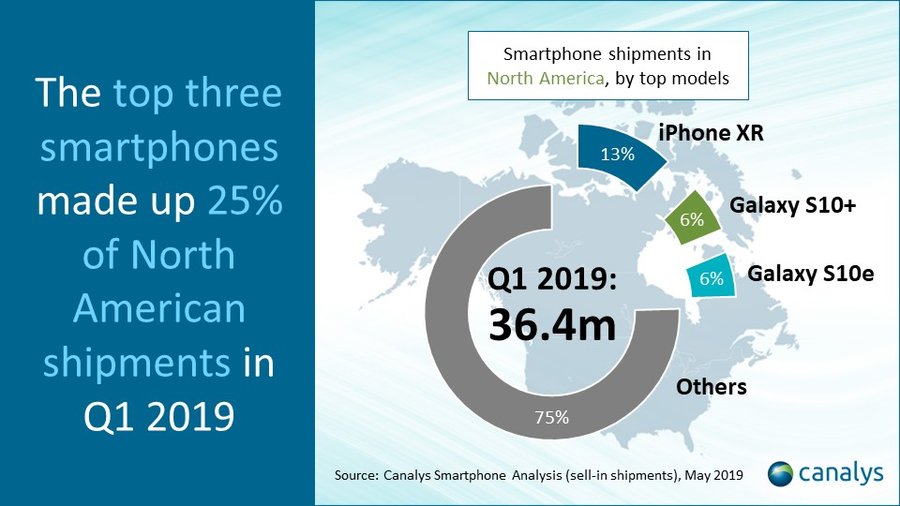

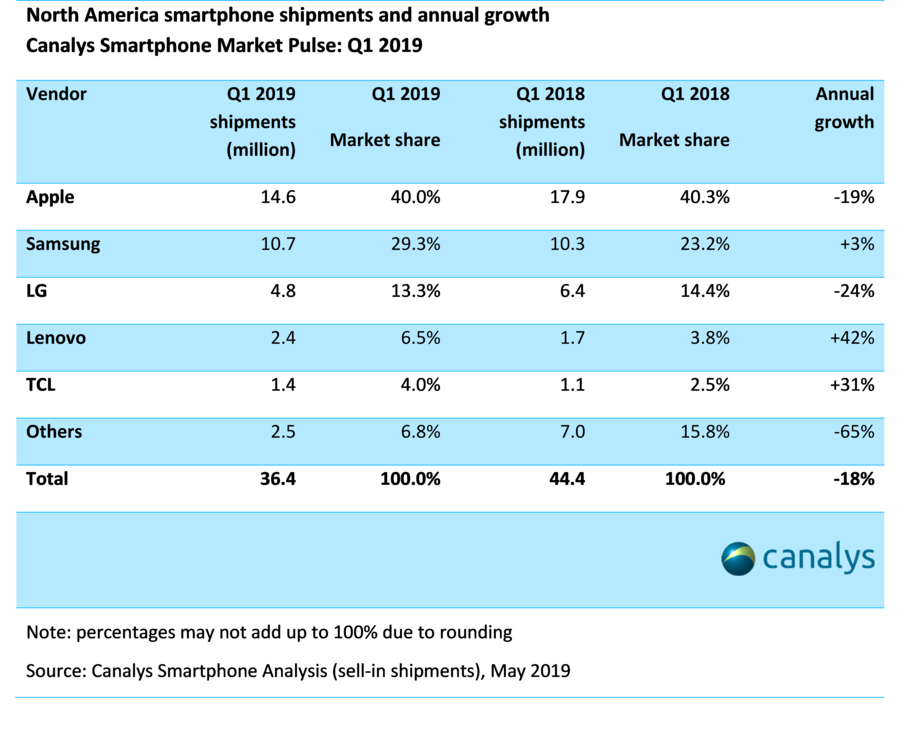

Smartphone shipments in North America plummeted 18% year on year in Q1 2019 to a five-year low of 36.4 million units, down from a record high of 44.4 million in Q1 2018. This is the steepest fall ever recorded, due to a lackluster performance by Apple and the absence of ZTE. But Apple remained the clear leader, despite suffering a regional decline of 19%. It shipped more than 4.5 million iPhone XR handsets in the quarter, while Samsung shipped more than 2.0 million each of its Galaxy S10+ and S10e models.

Samsung narrowed Apple’s lead in the first quarter, shipping 29% of North America’s smartphones, against 23% in Q1 2018. Samsung scheduled an earlier launch date for the S10 series, and more than doubled shipments over the S9 series in their respective launch quarters.

“Samsung brought real differentiation to its Galaxy S10 devices,” said Canalys Research Analyst Vincent Thielke. “Its triple camera, ultra-wide-angle lens, hole-punch display and reverse wireless charging all raised consumer interest. While these technologies are not new, Samsung is among the first to bring them to the US in a mass-market smartphone, and the appeal of such new features will be important for other launches this year. Samsung also benefited from carrier promotions in Q1, which used the Galaxy S10e as an incentive. But it will come under pressure later in 2019 as other vendors, such as OnePlus, follow suit with new features, while Google starts expanding into additional channels and price bands, and ZTE attempts to re-establish its footprint at the low end.”

Apple shipped 14.6 million iPhones in Q1 2019, down 19%, but maintained a 40% share of the North American market. It was helped by carrier and retail discounts on older models, such as the iPhone 6S and iPhone 7, as well as the growing use of trade-in promotions, but this was not enough to offset the shortfall in iPhone shipments in Q1.

“Apple’s fall in Q1 followed particularly high shipments of flagship iPhones in the previous quarter,” said Thielke. “But there was a disconnect between channel orders and consumer demand, which then caused early shipments in Q1 to be challenging for Apple. But moving into March, we did see an uptick in iPhone XR shipments, an early sign that these challenges may be starting to ease at home. Apple has shown how vital trade-ins have become by moving the mechanism to the front and center of its ordering process, and it now frequently uses the net price in its flagship iPhone marketing. The momentum of trade-in promotions in Q2 and Q3 will determine the extent to which Apple can counter negative market forces, such as longer device lifecycles. But the key challenge in coming months remains that its latest iPhones are just not different enough, though new ones are on the way. For its performance to improve in 2020, Apple will need to emphasize radical new features that are most likely to impress consumers.”

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Ben Stanton: ben_stanton@canalys.com +44 118 984 0525

Kelly Wheeler: kelly_wheeler@canalys.com +44 118 984 0529

Canalys APAC (Shanghai): +86 21 2225 2888

Nicole Peng: nicole_peng@canalys.com +86 21 2225 2815

Mo Jia: mo_jia@canalys.com +86 21 2225 2812

Canalys APAC (Singapore): +65 6671 9399

Rushabh Doshi: rushabh_doshi@canalys.com +65 6671 9387

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Canalys Americas: +1 650 681 4488

Vincent Thielke: vincent_thielke@canalys.com +1 650 656 9016

Marcy Ryan: marcy_ryan@canalys.com +1 650 681 4487

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

Americas: Suite 317, 855 El Camino Real, Palo Alto, CA 94301, US | tel: +1 650 681 4488

APAC: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China | tel: +86 21 2225 2888

APAC: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535 | tel: +65 6671 9399

EMEA: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK | tel: +44 118 984 0520

email: inquiry@canalys.com | web: www.canalys.com