Canalys forecast: global PC market set for 8% growth in 2024

Thursday, 30 November 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

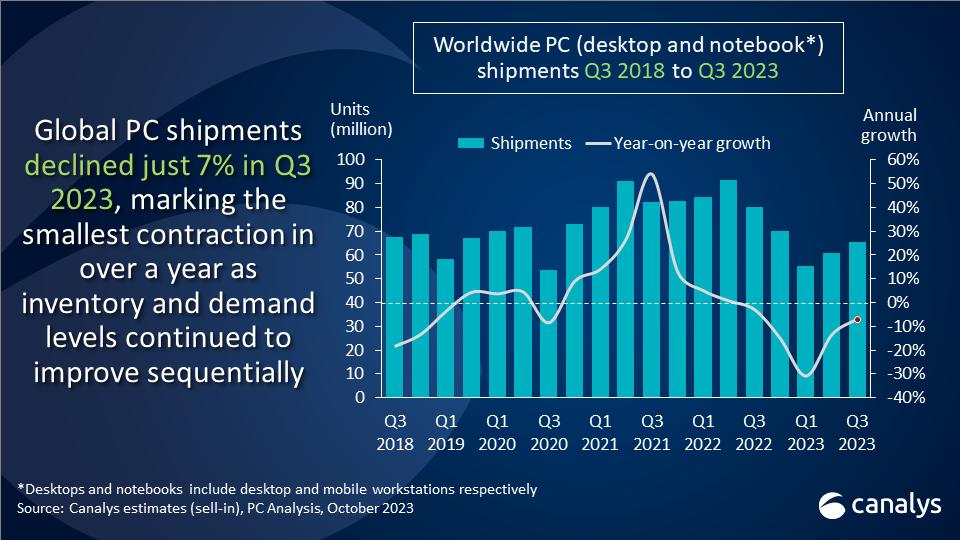

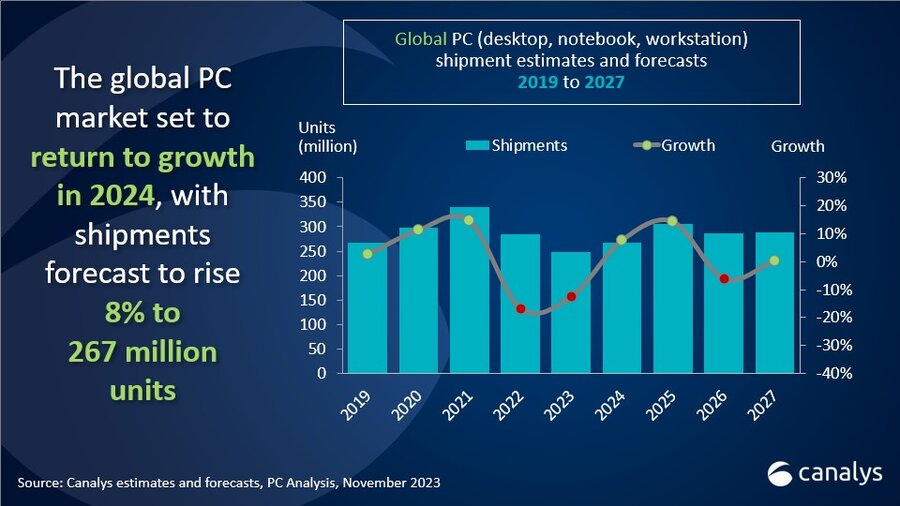

According to the latest Canalys forecasts, worldwide PC shipments are on the verge of recovery following seven consecutive quarters of decline. The market is expected to return to growth of 5% in Q4 2023, boosted by a strong holiday season and an improving macroeconomic environment. Looking ahead, full-year 2024 shipments are forecast to hit 267 million units, landing 8% higher than in 2023, helped by tailwinds including the Windows refresh cycle and emergence of AI-capable and Arm-based devices.

"The global PC market is on a recovery path and set to return to 2019 shipment levels by next year," said Canalys Analyst Ben Yeh. "The impact of AI on the PC industry will be profound, with leading players across OEMs, processor manufacturers, and operating system providers focused on delivering new AI-capable models in 2024. These initiatives will bolster refresh demand, particularly in the commercial sector. The total shipment share of AI-capable PCs is expected to be about 19% in 2024. This accounts for all M-series Mac products alongside the nascent offerings expected in the Windows ecosystem. However, as more compelling use-cases emerge and AI functionality becomes an expected feature, Canalys anticipates a fast ramp up in the development and adoption of AI-capable PCs.”

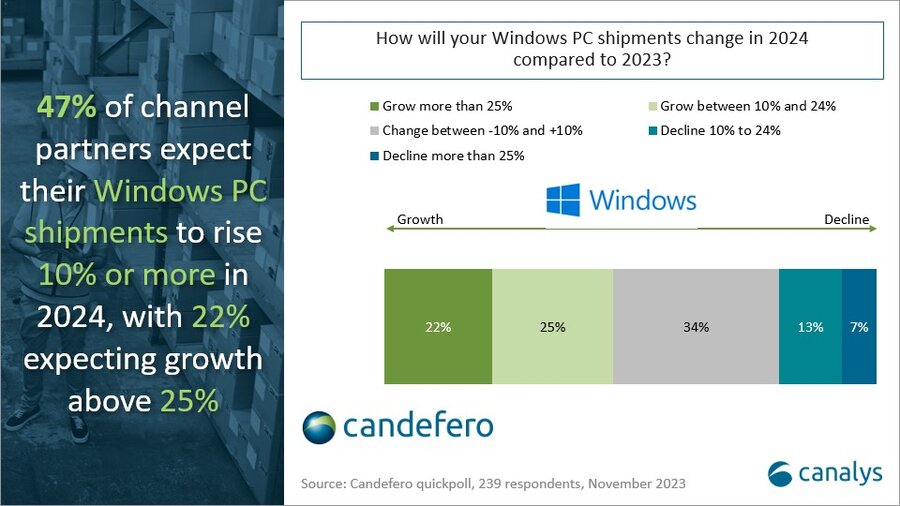

“Following a prolonged period of delayed purchasing, the commercial segment is poised for a demand bump in 2024,” said Canalys Principal Analyst Ishan Dutt. “Channel sentiment around PC business performance next year is positive, with 47% of partners polled in November anticipating their Windows PC shipments to grow 10% or more next year. SMBs have been highlighted as a strong opportunity, with the recent macroeconomic difficulties having had a proportionally larger impact on their ability to budget for PC procurement over the last several quarters. Next year will also bring a proliferation of Arm-based PCs, largely driven by Qualcomm’s X Elite chip. While uptake is initially likely to be restrained, particularly in commercial settings, the ability to deliver improvements in power efficiency and battery life will be a boon to offerings partners can bring to customers.”

|

Worldwide PC (desktop, notebook, workstation) shipment forecast and annual growth |

|||||

|

Region |

2022 shipments (million) |

2023 shipments (million) |

2024 shipments (million) |

Annual growth (2022/2023) |

Annual growth (2023/2024) |

|

Asia Pacific |

55.1 |

49.7 |

53.8 |

-9.8% |

8.3% |

|

Europe |

62.3 |

52.8 |

56.7 |

-15.2% |

7.4% |

|

Greater China |

53.2 |

43.6 |

45.5 |

-18.0% |

4.3% |

|

Middle East and Africa |

13.0 |

12.9 |

14.4 |

-0.1% |

11.6% |

|

Latin America |

20.1 |

17.1 |

19.2 |

-14.8% |

12.2% |

|

North America |

80.2 |

72.3 |

77.6 |

-9.7% |

7.3% |

|

Total |

283.7 |

248.5 |

267.3 |

-12.4% |

7.6% |

|

|

|

|

|

||

|

Note: percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments and forecasts), November 2023 |

|

||||

For more information, please contact:

Ben Yeh: ben_yeh@canalys.com

Ishan Dutt: ishan_dutt@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.