Global PC shipment 2020 forecast

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Tuesday, 2 June 2020

Canalys forecasts that global PC and tablet shipments will fall 7% from 395.6 million units in 2019 to 367.8 million units in 2020. Canalys expects the global PC market will stay flat in 2021 and return to growth of 2% in 2022.

Though the PC market has been rattled by the impact of COVID-19, the worst is behind us as Q2, Q3 and Q4 are all expected to post smaller year-on-year shipment declines than Q1. This is mainly due to a return to a healthy supply chain and manufacturing base in China, which will serve pent-up demand in segments such as remote working and education. Nevertheless, the recessionary impact of the coronavirus on global economies will not be minor, and consumers, businesses and governments will prioritize vital spending ahead of PC refresh when times get tough.

“From a category perspective, notebooks have been at the center of a demand surge that has left vendors and channel partners scrambling,” said Ishan Dutt, Analyst at Canalys. “We expect this demand to persist as many businesses that have been forced into home working and found it successful are now choosing to implement it on a larger scale. The same holds true for education, where schools have made investments in digital curricula and are implementing only partial returns to on-premises learning. Desktop refresh will suffer to a greater degree as businesses face prolonged uncertainty about the scope of their operations and dedicated office space needs. Tablets, which have the greatest reliance on consumer spending, will face a slump as holiday season demand in Q4 is expected to take a hit this year.”

Looking further ahead, there are some reasons for vendors, channel partners and component suppliers to be optimistic, as the importance of PCs has come to the fore during the pandemic. “COVID-19 has given the PC industry a boost. Despite the progress that smartphones and tablets have made in recent years, the need for a high-performance mobile computing device has never been more pronounced. As countries emerge from this crisis and the ensuing economic slump, spending on technology solutions will be a key recovery driver,” said Rushabh Doshi, Canalys Research Director. “Canalys expects the global PC market to return to growth of 2% in 2022, with desktop and notebook shipments overcoming prolonged weakness in the tablet space. But it is important to keep things in perspective: a modest recovery from a weak 2020 will not see the PC market return to the highs of 2019 for some years to come.”

China

Canalys forecasts that PC and tablet shipments will fall only 3% in 2020 and will post growth of 4% in 2021. While China was the worst hit economy due the pandemic in Q1 2020, it is one of the best placed in Q2 2020 and beyond. It has already borne the brunt of the pandemic and, barring an unlikely second wave in the second half of 2020, we expect demand in China to be robust for the rest of the year. In particular, Canalys expects that the pent-up demand from Q1 2020 will lead to a big boost in sales in Q2 2020. While local demand may hold strong, China’s economy remains reliant on exports to countries that could face deeper recessions. This would have an especially strong secondary effect on its large base of export-focused SMBs. In the long-term, the government’s plan to invest around US$1.4 trillion over six years in the technology sector will provide ample opportunities for the PC ecosystem.

Asia Pacific

Canalys forecasts that the PC market in Asia Pacific will fall 1% year on year in 2020, and market recovery will start in 2021. Asia Pacific is a region that was hit hard and early by the COVID-19 pandemic, starting in late Q1 2020. While countries such as South Korea are already well on their way to recovery, the majority of South Asian and Southeast Asian countries are only now experiencing an easing of lockdowns. In these markets, while commercial demand is expected to be strong for the rest of 2020, consumer demand will not keep up. As PCs are not essential goods for most consumers, ongoing and upcoming recessions in these countries will adversely affect demand. Consumers will choose to delay and minimize spending on non-essential goods as far as possible, and so we may see a lengthening of refresh rates.

North America

Canalys forecasts total PC and tablet shipments in North America will drop 6% year on year in 2020. The United States, as the world’s largest PC market, was affected by supply shortages in Q1 2020. But Canalys expects a strong surge in demand in Q2, driven by large enterprises looking to enable their employees to work from home, as well as a demand boost for Chromebooks from the education sector. But with the economy in disarray and unemployment rising above the 20%-mark, consumer demand is likely to wane toward the end of 2020. Q4, which is a key quarter for the region, driven by festive sales and offers, might not enjoy its usual boost. If the economy does not show major signs of recovery by Q4, Canalys expects that consumers will move away from discretionary spending on non-essential devices, such as Apple tablets, at the end of the year. We expect the recovery in the US to be delayed until 2022, when the market will grow 4% year on year.

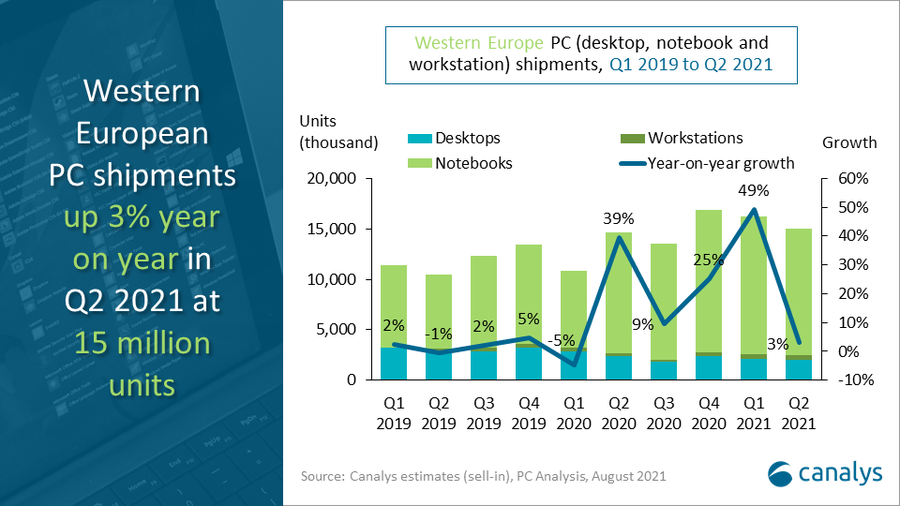

Europe, the Middle East and Africa

As most major markets in Europe are starting to relax lockdown measures, Canalys expects a short-term demand bump that will soften the shipment decline in Q2 to -1%. But with the bulk of commercial refresh having occurred last year, and businesses and consumers being forced to tighten their purse strings, the second half of 2020 will see sharp declines on the equivalent period in 2019. Countries in Africa and the Middle East, which have suffered from low prioritization due to limited supply by vendors and the channel so far this year, will see some demand start to be fulfilled from Q3 onwards. Overall, PC and tablet shipments to EMEA are set to fall 10% in 2020 before posting growth of 1% in 2021.

Latin America

Many countries in Latin America, including large markets such as Brazil and Mexico, are behind the curve on COVID-19, and are still reporting significant instances of infection and death. This, in addition to uncertainty about the scope of lockdowns and the likelihood of when they will be eased, means recovery of PC shipments is likely to take longer. On the supply side, local manufacturing in Latin America has also been disrupted by the pandemic. Canalys expects shipments to fall 16% year on year in Q2 2020, with further declines of 6% and 9% in Q3 and Q4. Latin America is expected to return to growth relatively late, in Q2 2021.

For more information, please contact:

Canalys China

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Jason Low: jason_low@canalys.com +86 159 2128 2971

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Varun Kannan: varun_kannan@canalys.com +91 92053 98246

Canalys Singapore

Ishan Dutt: ishan_dutt@canalys.com +65 8399 0487

Matthew Xie: matthew_xie@canalys.com +65 8319 8343

Canalys EMEA

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Mo Jia: mo_jia@canalys.com +33 785 683 766

Canalys USA

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2020. All rights reserved.