Global PC market returns to growth in Q4 2023

Wednesday, 10 January 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

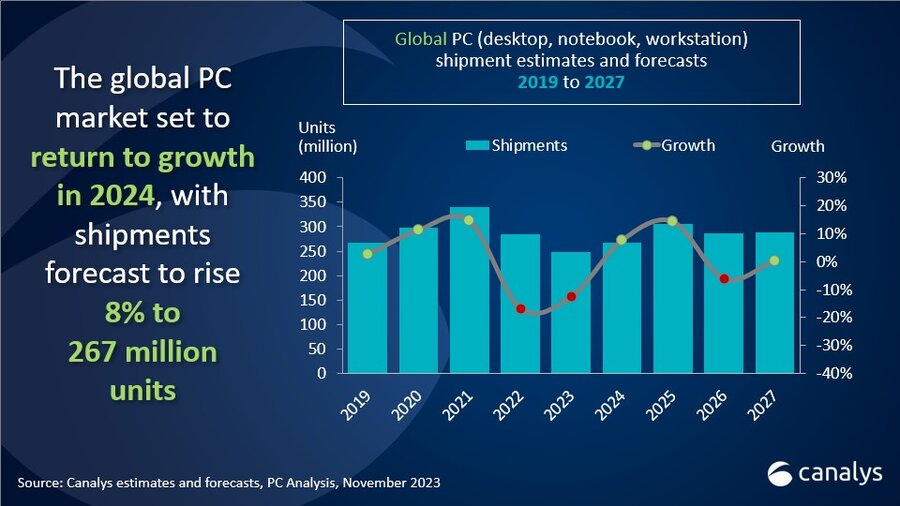

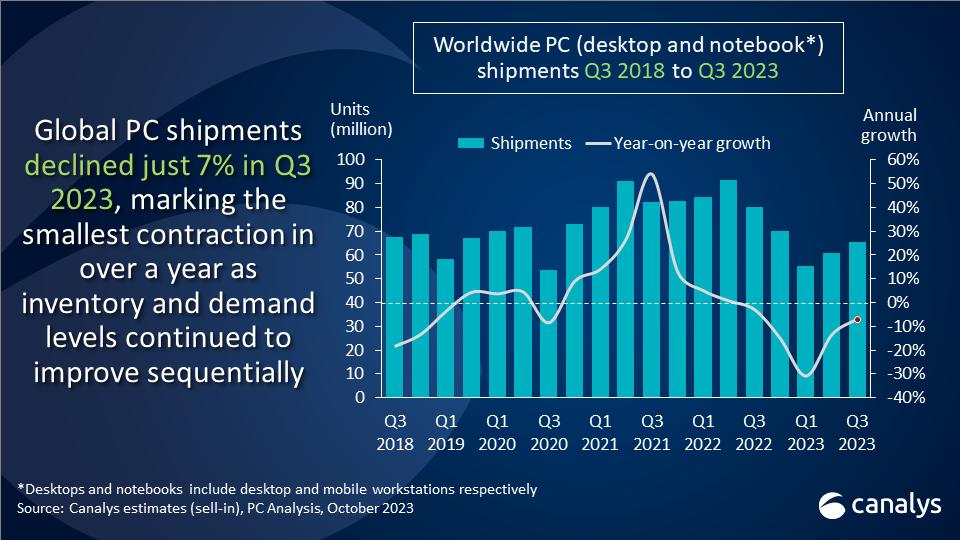

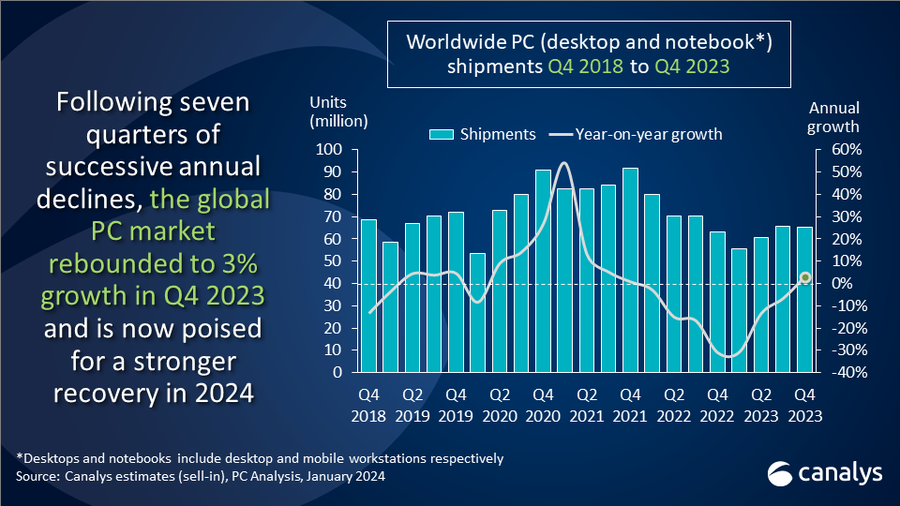

The worldwide PC market ended its streak of annual shipment declines in the last quarter of 2023, posting a modest year-on-year growth of 3%. Total shipments of desktops and notebooks rose to 65.3 million units. Shipments of notebooks hit 51.6 million units, up 4% from 2022, while desktop shipments landed at 13.7 million units, declining 1%. For the full year 2023, PC shipments totaled 247 million units, marking a 13% drop compared to 2022. The market is now poised for growth, with AI-capable PCs set to provide an additional boost during the ongoing refresh cycle and beyond.

“2023 was a challenging year for the PC industry, but companies have remained resilient and can now look forward to an improving landscape,” said Himani Mukka, Research Manager at Canalys. “The cautious optimism across key players in the market has been borne out by a stronger holiday season compared to last year and inventory corrections in the previous quarters have helped support renewed sell-in. As macroeconomic conditions continue to improve, companies and individuals that have delayed their purchasing for many quarters are now set to resume spending on PCs.”

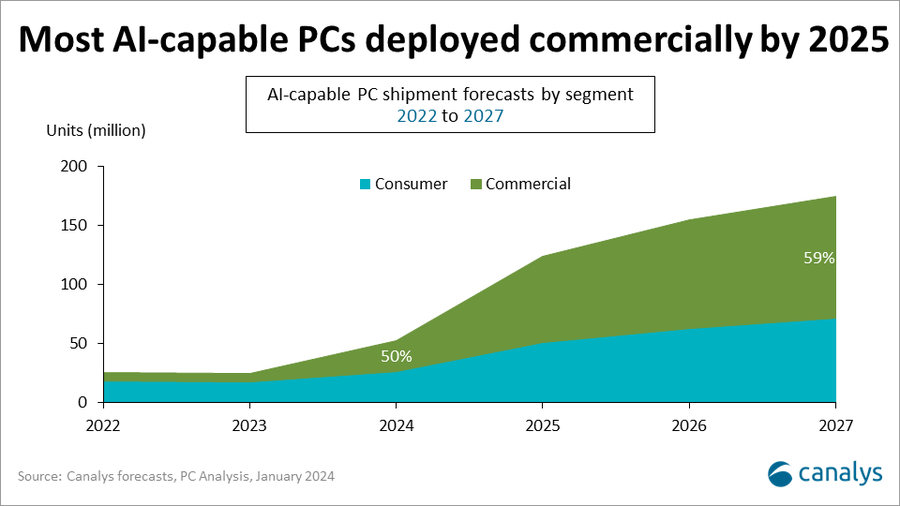

“To capitalize on the demand uptick, the PC industry will now deliver meaningful innovation through on-device AI capabilities in PCs, with 2024 set to be a bumper year for such devices,” said Ishan Dutt, Principal Analyst at Canalys. “A slew of announcements from both OEMs and chipset vendors at CES will set the stage for more products to be brought to market later in the year. We expect one in five PCs shipped this year to be AI-capable, incorporating a dedicated chipset or block, such as an NPU, to run on-device AI workloads. Adoption will ramp up quickly thereafter, especially in the commercial sector, where the benefits of on-device AI related to productivity, security and cost management will become a key consideration for businesses.”

By 2027, Canalys forecasts that over 170 million AI-capable PCs will be shipped, with nearly 60% being deployed in commercial settings.

With AI PCs poised to take center stage in 2024, Canalys has released a complimentary special report to help understand the impact they will have. "Now and Next for AI-capable PCs" provides a comprehensive look into the dawn of AI in personal computing, including definitions and market projections alongside a deep dive into current trends, future opportunities and potential challenges in the AI PC market.

Lenovo sealed the top spot in the PC market rankings for Q4 2023, shipping 16.1 million units and posting 3% annual growth. It was also the largest shipping vendor for the full year 2023, posting 59.1 million units. HP, securing the second position, recorded a 6% year-on-year growth in shipments in Q4. Its overall annual shipments for 2023 amounted to 52.9 million units, a marginal 4% decrease from 2022. Dell retained its third position in both the Q4 2023 and full-year 2023 rankings, shipping 9.9 million units and 40 million units, respectively. Apple secured the fourth position in Q4 2023 by shipping 6.6 million units globally, achieving 9% growth. The vendor maintained fourth spot in the full-year standings as well, experiencing a 14% decline from 2022 with total units reaching 23 million units. Acer secured the fifth position with a 12% year-over-year growth, shipping 4 million units in Q4 2023, but Asus occupied the fifth spot in the full-year rankings for 2023, totaling 16 million units and experiencing a 21% annual decline compared to 2022.

|

Worldwide desktop and notebook shipments (market share and annual growth) |

|||||

|

Vendor |

Q4 2023 |

Q4 2023 |

Q4 2022 |

Q4 2022 |

Annual |

|

Lenovo |

16,094 |

24.7% |

15,608 |

24.7% |

3.1% |

|

HP |

13,937 |

21.4% |

13,204 |

20.9% |

5.6% |

|

Dell |

9,915 |

15.2% |

10,807 |

17.1% |

-8.3% |

|

Apple |

6,577 |

10.1% |

6,019 |

9.5% |

9.3% |

|

Acer |

3,988 |

6.1% |

3,561 |

5.6% |

12.0% |

|

Others |

14,735 |

22.6% |

14,097 |

22.3% |

4.5% |

|

Total |

65,246 |

100.0% |

63,296 |

100.0% |

3.1% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), January 2024 |

|

||||

|

Worldwide desktop and notebook shipments (market share and annual growth) |

|||||

|

Vendor |

2023 |

2023 |

2022 |

2022 |

Annual |

|

Lenovo |

59,106 |

23.9% |

67,731 |

23.9% |

-12.7% |

|

HP |

52,893 |

21.4% |

55,204 |

19.5% |

-4.2% |

|

Dell |

39,979 |

16.2% |

49,747 |

17.5% |

-19.6% |

|

Apple |

23,203 |

9.4% |

27,019 |

9.5% |

-14.1% |

|

Asus |

16,316 |

6.6% |

20,561 |

7.2% |

-20.6% |

|

Others |

55,496 |

22.5% |

63,453 |

22.4% |

-12.5% |

|

Total |

246,994 |

100.0% |

283,714 |

100.0% |

-12.9% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), January 2024 |

|

||||

For more information, please contact:

Himani Mukka: himani_mukka@canalys.com

Ishan Dutt: ishan_dutt@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.