Canalys: Global smartphone market fell 9% as consumers trim spending

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Tuesday, 18 October 2022

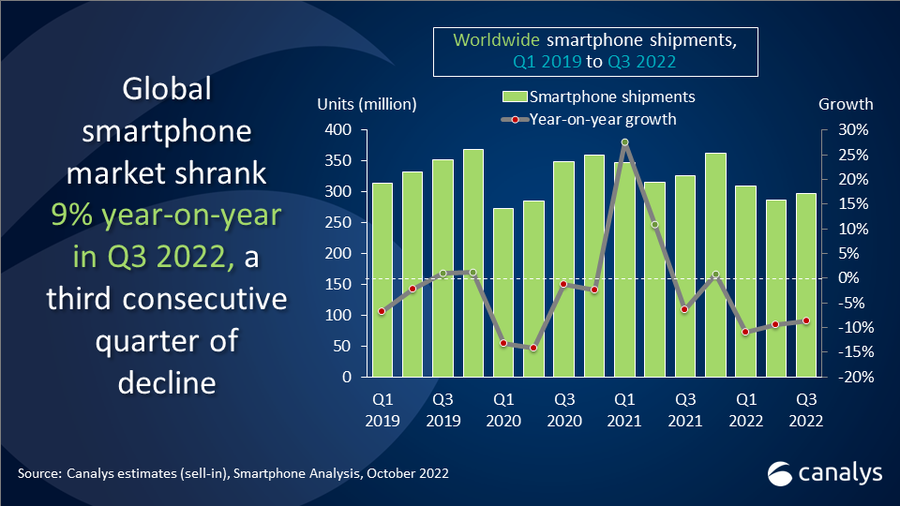

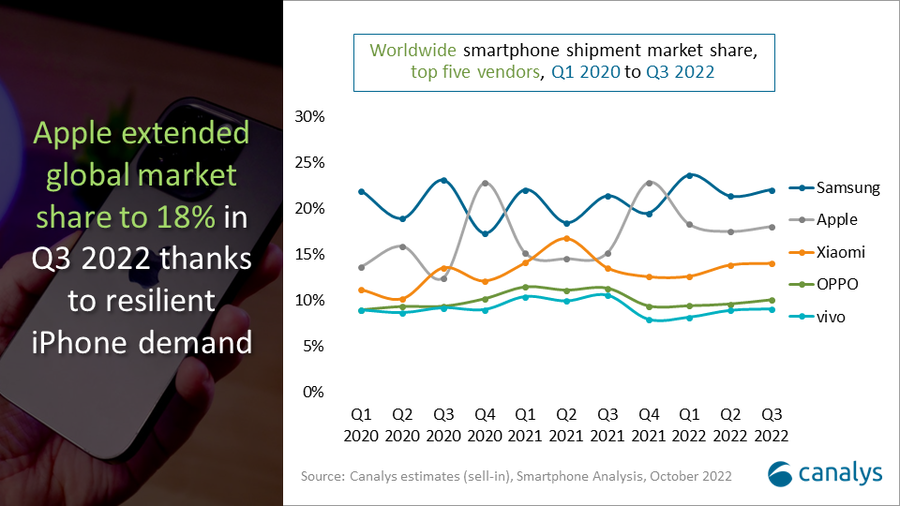

In Q3 2022, the global smartphone market recorded its third consecutive decline this year, dropping 9% year-on-year, marking the worst Q3 since 2014. The gloomy economic outlook has led consumers to delay purchasing electronic hardware and prioritize other essential spending. This will likely continue to dampen the smartphone market for the next six to nine months. Samsung retained its leading position with a 22% market share driven by heavy promotions to reduce channel inventory. Apple was the only vendor in the top five to record positive growth, improving its market position further with an 18% share during the market downturn thanks to relatively resilient demand for iPhones. While Xiaomi, OPPO and vivo continued to take a cautious approach to overseas expansion given domestic market uncertainty, retaining 14%, 10% and 9% global market shares, respectively.

“The smartphone market is highly reactive to consumer demand and vendors are adjusting quickly to the harsh business conditions,” said Canalys Analyst Amber Liu. “For most vendors, the priority is to reduce the risk of inventory building up given deteriorating demand. Vendors had significant stockpiles going into July, but sell-through gradually improved from September owing to aggressive discounting and promotions. The pricing strategy of new products is cautiously crafted, even for Apple, to avoid significant pushback from consumers who now tend to be very sensitive to any price hike,” added Liu.

“As demand shows no signs of improvement moving into Q4 and H1 2023, vendors have to work on a prudent production forecast with the supply chain while working closely with the channel to stabilize market share,” said Canalys Analyst Sanyam Chaurasia. “Going into the sales season, consumers who have been delaying purchases will expect steep discounts and bundling promotions as well as significant price reductions on older generation devices. Compared to the strong demand period of the previous year, a slow but steady festive sale is anticipated in Q4 2022. However, it will be too soon to see the upcoming Q4 as the real turning point of market recovery.”

|

Worldwide smartphone shipment share by top vendors |

||||

|

Vendor |

Q3 2021 market share |

Q3 2022 market share |

||

|

Samsung |

21% |

22% |

||

|

Apple |

15% |

18% |

||

|

Xiaomi |

14% |

14% |

||

|

OPPO |

11% |

10% |

||

|

vivo |

11% |

9% |

||

|

Others |

28% |

27% |

||

|

|

|

|

||

|

Preliminary estimates are subject to change on final release |

|

|||

For more information, please contact:

Amber Liu: amber_liu@canalys.com +86 13721777745

Sanyam Chaurasia: sanyam_chaurasia@canalys.com +91 89820 33054

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.