Global tablet shipments up for sixth quarter, Chromebook demand rebounded in Q2 2025

Tuesday, 5 August 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

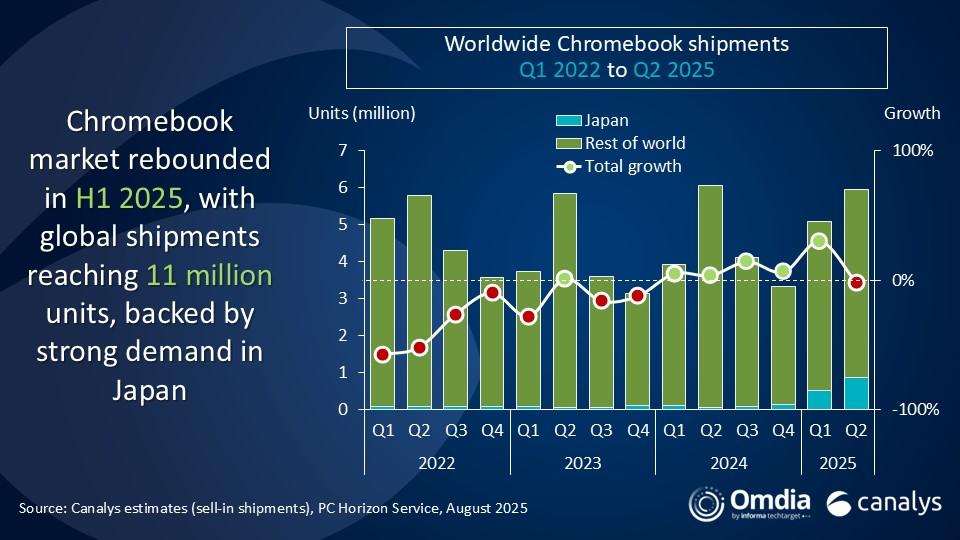

According to the latest data from Canalys, now part of Omdia, worldwide tablet shipments reached 39 million units in Q2 2025, growing 9% annually and 5% sequentially. This strong performance was primarily driven by healthy demand in China and EMEA. Meanwhile, the Chromebook market enjoyed a significant boost from the ongoing refresh of education devices under Japan’s GIGA School Program, which helped propel shipments to 11 million units in the first half of the year. In addition to Japan’s program, public-sector funding for education devices from several different markets will support elevated Chromebook shipments throughout 2025 and beyond.

“The global tablet market continued its remarkable growth trajectory in the second quarter, supported by consumer subsidies in China and a ramp-up in commercial tenders around the world,” said Himani Mukka, Research Manager at Canalys, now part of Omdia. “The market also benefited from a wave of new product launches, particularly in the gaming segment. Growing consumer interest in this use case has seen gaming tablets emerge as a niche growth category, especially in Asia. Notable releases included Xiaomi’s Redmi K Pad (8.8”) and Vivo’s Pad5, while Lenovo’s Legion Tab shipments more than doubled quarter on quarter. Vendors are also making tablets a key element as they advance their connected ecosystem strategies. HONOR unveiled its strategy in Q1 with its “Alpha” plan, followed in May by Xiaomi’s “Human x Car x Home” initiative, which aims to seamlessly integrate smartphones, tablets, smart home devices and even electric vehicles. The recently launched Xiaomi Pad 7 Ultra has been positioned as the central control hub within the ecosystem.”

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q2 2025 |

Q2 2025 |

Q2 2024 |

Q2 2024 |

Annual |

|

Apple |

14,108 |

36.1% |

13,773 |

38.6% |

2.4% |

|

Samsung |

6,656 |

17.1% |

6,776 |

19.0% |

-1.8% |

|

Huawei |

3,231 |

8.3% |

2,501 |

7.0% |

29.2% |

|

Lenovo |

3,098 |

7.9% |

2,485 |

7.0% |

24.7% |

|

Xiaomi |

3,051 |

7.8% |

2,144 |

6.0% |

42.3% |

|

Others |

8,891 |

22.8% |

8,042 |

22.5% |

10.6% |

|

Total |

39,035 |

100% |

35,721 |

100% |

9.3% |

|

|

|

|

|

||

|

Note: unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Horizon Service (sell-in shipments), August 2025 |

|

||||

In the tablet market, Apple retained its leading position, shipping 14.1 million iPads in Q2 2025, marking 2% growth year on year. Samsung held onto second place with 6.7 million units shipped during the quarter. The next three vendors saw strong annual growth, driven largely by demand in Mainland China. Huawei overtook Lenovo to rank third, with 3.2 million tablets and a healthy 29% growth, while Lenovo and Xiaomi rounded out the top five with 3.1 million and 3 million units shipped, respectively. Xiaomi narrowed the gap with Lenovo, thanks to its robust offline channel presence in the Chinese market.

“Meanwhile, Chromebooks are experiencing a period of revitalization, driven by the ongoing GIGA School Program refresh in Japan,” said Kieren Jessop, Research Manager at Canalys, now part of Omdia. “Shipments to Japan grew more than twentyfold year on year, as government-funded procurement began to pick up momentum. This renewed demand is expected to continue through mid-2026.”

“Japan’s education ecosystem has been especially active in recent months, with vendors, distributors and EdTech partners ramping up awareness efforts through campaigns and expos to secure a larger share of the ongoing refresh cycle,” added Jessop. “At the ‘EDIX Tokyo 2025’ education exhibition held in April, leading PC manufacturers and platform providers showcased their devices and operating systems, highlighting benefits to key education stakeholders. Beyond GIGA-related shipments, the outlook for Chromebooks in the broader Asian market is positive, with many countries prioritizing Chromebooks for their education deployments in 2025.”

|

Worldwide Chromebook shipments (market share and annual growth) |

|||||

|

Vendor (company) |

H1 2025 |

H1 2025 |

H1 2024 |

H1 2024 |

Annual |

|

Lenovo |

3,453 |

31.3% |

2,720 |

27.3% |

26.9% |

|

HP |

2,586 |

23.4% |

2,705 |

27.1% |

-4.4% |

|

Acer |

2,215 |

20.1% |

2,020 |

20.2% |

9.6% |

|

Dell |

1,454 |

13.2% |

1,523 |

15.3% |

-4.5% |

|

Asus |

843 |

7.6% |

591 |

5.9% |

42.8% |

|

Others |

484 |

4.4% |

421 |

4.2% |

15.0% |

|

Total |

11,035 |

100% |

9.980 |

100% |

10.6% |

|

|

|

|

|

||

|

Note: unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Horizon Service (sell-in shipments), August 2025 |

|

||||

In the first half of 2025, Lenovo led the global Chromebook market, bolstered by its strong role in Japan’s GIGA School Program. The vendor shipped 3.5 million units, marking a 27% year-on-year growth. HP followed in second place, though it ceded share to Lenovo and posted a modest 4% annual decline. Acer, a key brand across Asian markets, recorded a healthy 10% increase, shipping 2.2 million units. Dell ranked fourth with 1.5 million units, down 5% from the previous year. ASUS completed the top five, benefiting from GIGA-related demand to post a significant 43% year-on-year growth, with shipments reaching 0.8 million units.

For more information, please contact:

Himani Mukka: himani_mukka@canalys.com

Kieren Jessop: kieren_jessop@canalys.com

Canalys’(now part of Omdia) PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.