Global tablet shipments up 8% sequentially as market revives before holiday season

Friday, 6 November 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

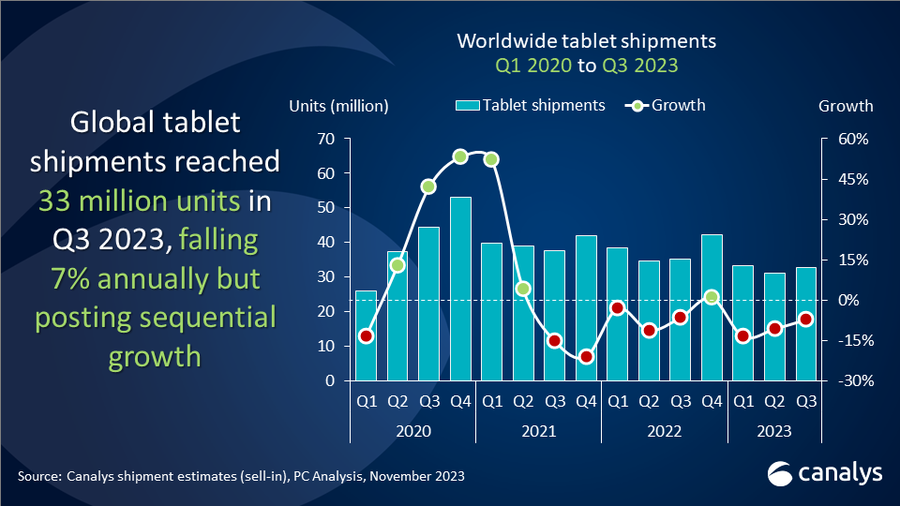

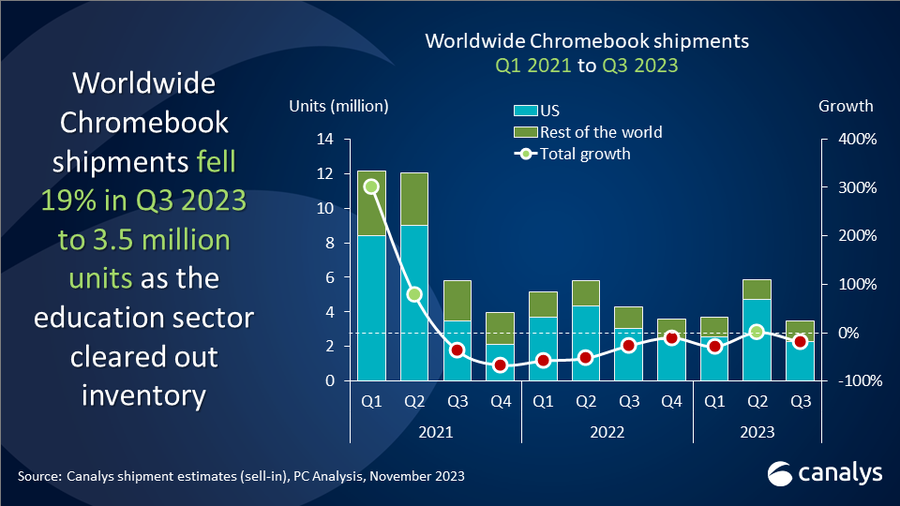

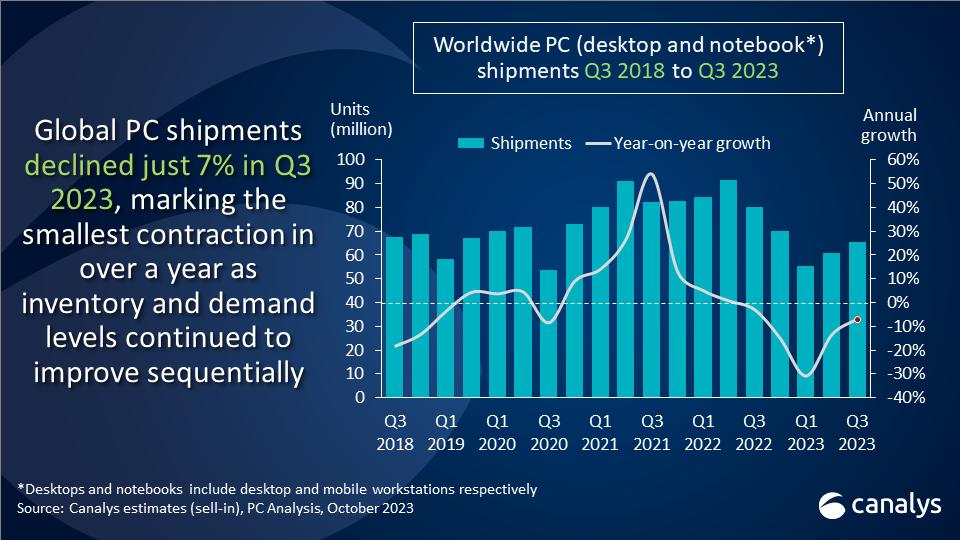

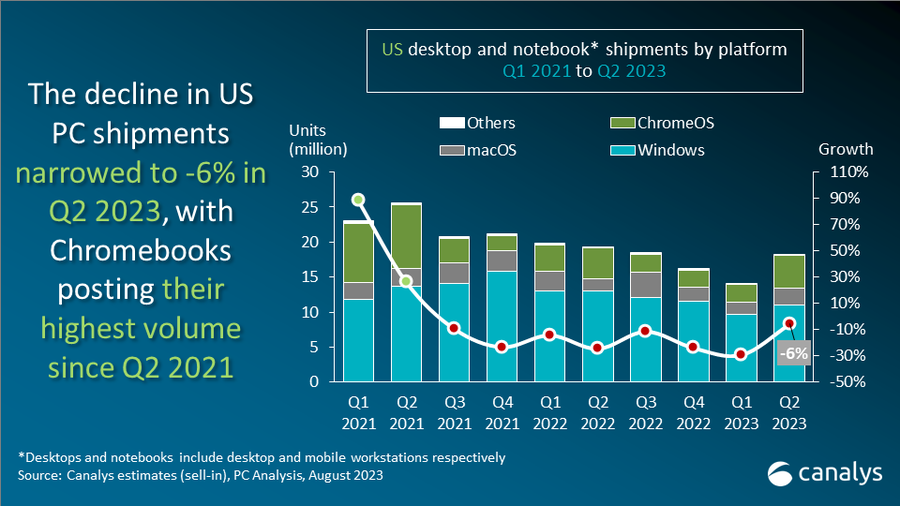

According to the latest Canalys data, worldwide tablet shipments reached 33 million in Q3 2023, marking a 7% annual decline. But this represents an 8% sequential increase, reflecting a revival of the tablet market ahead of the crucial holiday season and the strong performance of new entrants in the space. Meanwhile, Chromebook shipments fell 19% to 3.5 million in Q3 2023. This is because much of the back-to-school inventory cleared through the channel.

“With inventories stabilizing, tablet shipments are starting to increase sequentially,” said Himani Mukka, Research Manager at Canalys. “This bodes well for the upcoming holiday season, where continued discounting and new product launches are set to drive the market back to year-on-year growth. There has been a shift in preferences to premium devices with larger screens, influenced by evolving user needs around productivity and content consumption. Additionally, tablet vendors must start prioritizing the integration of generative AI capabilities into their devices to maintain a competitive edge. Leading players Apple and Samsung have already signaled greater intent around incorporating AI experiences across their hardware portfolios. As PCs and smartphones both gear up for significant advances in on-device AI, vendors must ensure that their tablets keep pace to deliver consistency in user experiences and maintain interoperability across device ecosystem.”

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor |

Q3 2023 |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual |

|

Apple |

12,542 |

38.3% |

14,381 |

40.8% |

-12.8% |

|

Samsung |

6,219 |

19.0% |

6,610 |

18.8% |

-5.9% |

|

Lenovo |

2,600 |

8.0% |

2,712 |

7.7% |

-4.1% |

|

Huawei |

1,872 |

5.7% |

1,461 |

4.1% |

28.2% |

|

Xiaomi |

1,618 |

4.9% |

736 |

2.1% |

119.7% |

|

Others |

7,853 |

24.0% |

9,328 |

26.5% |

-15.8% |

|

Total |

32,705 |

100% |

35,228 |

100% |

-7.2% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

Smartphone manufacturers are making headway in the tablet market, particularly Chinese vendors with innovative offerings and competitive pricing. In Q3 2023, Huawei and Xiaomi surpassed Amazon in the vendor rankings. Apple held first place, shipping 12.5 million iPads for a 38% market share in Q3. Second-placed Samsung shipped 6.2 million tablets, down 6%, while Lenovo shipped 2.6 million tablets to hold onto third place. Huawei and Xiaomi took fourth and fifth place, respectively, with the latter making its debut in the top five with the highest growth of the major vendors.

The worldwide Chromebook market suffered a moderate decline in Q3 2023 after a solid back-to-school season in the previous quarter. Much of the residual inventory has now cleared out from the bump in education demand. Acer regained first place in Chromebook shipments with a relatively low drop of 16% compared with Q2, but shipments still fell 17% year-over-year. Meanwhile, second-placed HP faced a larger sequential drop of 57% after previously taking the top spot. Dell maintained third place, with its Q3 shipments roughly matching HP’s. Lenovo and Asus took the final places in the top five rankings.

|

Worldwide Chromebook shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q3 2023 |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual |

|

Acer |

884 |

25.3% |

1,069 |

24.9% |

-17.3% |

|

HP |

674 |

19.3% |

802 |

18.7% |

-16.0% |

|

Dell |

672 |

19.3% |

934 |

21.8% |

-28.0% |

|

Lenovo |

644 |

18.5% |

768 |

17.9% |

-16.1% |

|

Asus |

387 |

11.1% |

397 |

9.2% |

-2.4% |

|

Others |

229 |

6.6% |

323 |

7.5% |

-29.2% |

|

Total |

3,489 |

100.0% |

4,292 |

100.0% |

-18.7% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

“Chromebooks’ growth trajectory rapidly changed for the worse in Q3 2023 as shipments fell 40% quarter on quarter after previously strong education demand from the US market,” said Kieren Jessop, Analyst at Canalys. “Earlier this year, OEMs rushed to prebuild models before the increase in the ChromeOS license fee and to take advantage of the final funding round of the US government’s Emergency Connectivity Fund. But the consequence has been a strong downward turn in Q3 as much of the inventory built up throughout the year has now been cleared out.”

“Google recently announced Chromebook Plus laptops, with double the performance of standard Chromebooks but still firmly priced for the low end. Also offering some AI capabilities focused on improving the video call experience, the Plus series is the latest effort from the Chrome team to boost its standing outside of the education and consumer segments, which continue to account for over 80% of Chromebook shipments. Chromebook Plus machines will likely do better in the small business segment than their predecessors. But they face stark competition as the PC industry’s latest obsession with AI-enabled devices may prove difficult for Chromebooks to keep up with,” said Kieren Jessop, Analyst at Canalys.

For more information, please contact:

Himani Mukka: himani_mukka@canalys.com

Kieren Jessop: kieren_jessop@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

.jpg)