India’s PC and tablet market set for 14% growth in 2024

Thursday, 21 March 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

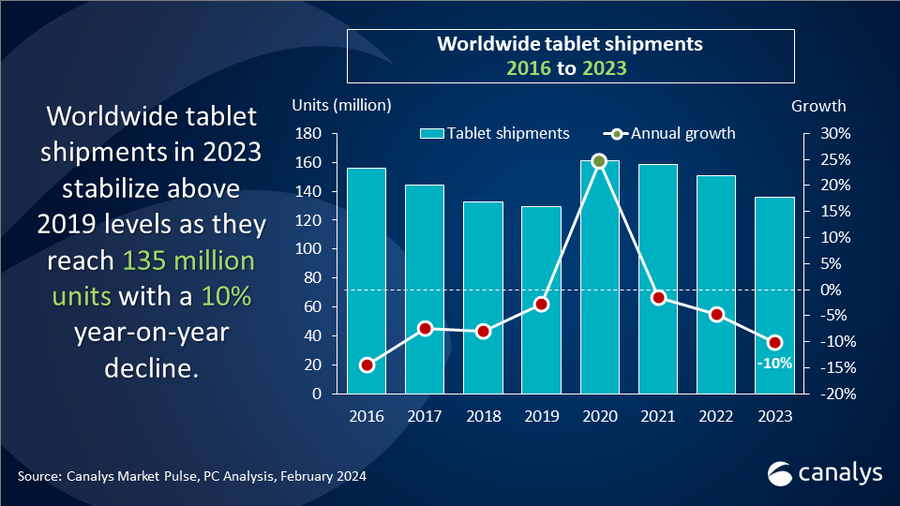

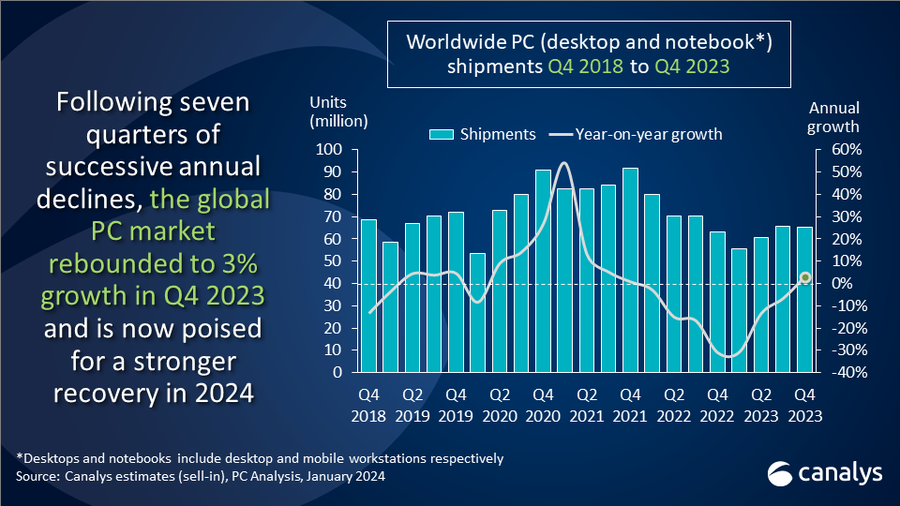

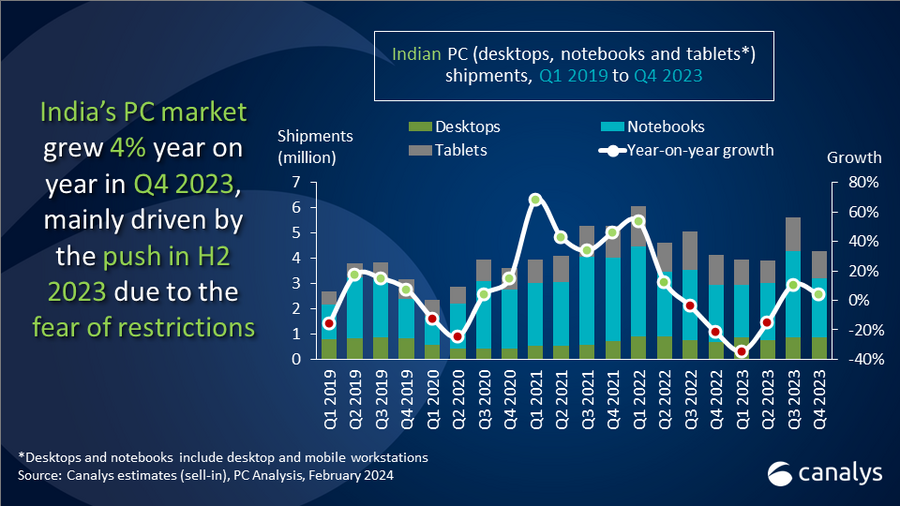

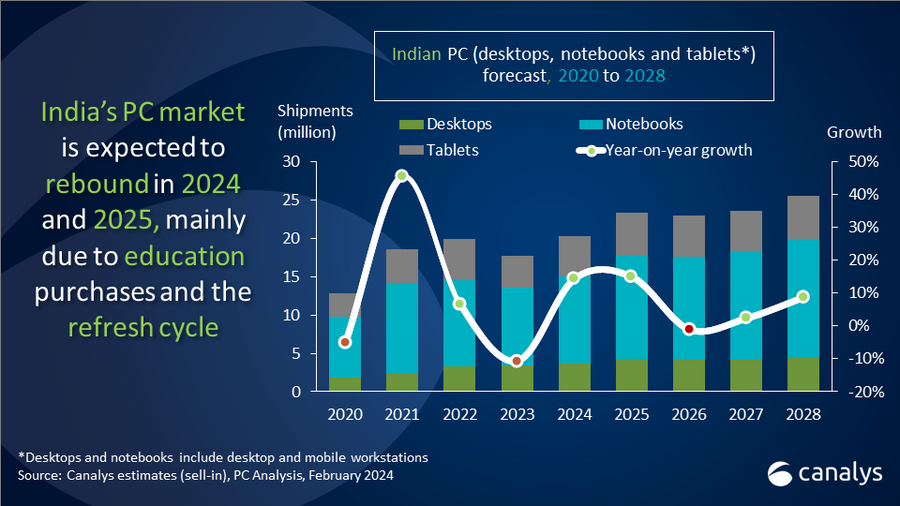

The Indian PC market (including desktops, notebooks and tablets) grew 4% year on year in Q4 2023, with 4.3 million units shipped. This growth was primarily driven by a 27% increase in desktop shipments, which reached 884,000 units. Notebooks grew more modestly, by 3% to 2.3 million units, while tablet shipments suffered a 9% decline, with 1.1 million units shipped. Despite this quarterly growth, PC shipments fell by 11% overall in 2023. But we anticipate a strong rebound in 2024, with all three categories expected to see robust growth. Tablets are predicted to be the main driver of this growth, with an impressive 24% year-on-year increase.

“At the tail end of 2023, India’s PC market faced high inventory levels in the channel, driven by a supply push due to fears of import restrictions,” said Canalys Analyst Ashweej Aithal. “With the government subsequently easing these restrictions, vendors focused primarily on inventory correction. Successful efforts here helped support a second consecutive quarter of shipment growth. But there is now strong optimism for market recovery in 2024 across all customer segments. The 2023 holiday season already showed positive signs related to consumer sentiment toward discretionary spending. In the commercial space, the specter of recession had led to subdued IT procurement by both enterprises and SMBs in the first half of 2023, but these delayed deployments are starting to take place and will accelerate this year. Finally, public sector tenders have been experiencing delays, with the majority being put on hold due to the upcoming general elections in Q2 2024. Despite these challenges, a notable highlight was the government’s ‘Make in India’ initiative, which spurred many OEMs to ramp up local manufacturing efforts to their fullest capacity.”

|

Indian PC (including tablets) shipments (market share and annual growth) Canalys PC Market Pulse: Q4 2023 |

|||||

|

Vendor |

Q4 2023 |

Q4 2023 |

Q4 2022 |

Q4 2022 |

Annual |

|

HP |

1,067 |

24.9% |

957 |

23.2% |

11.5% |

|

Lenovo |

728 |

17.0% |

563 |

13.6% |

29.3% |

|

Acer |

611 |

14.3% |

364 |

8.8% |

67.7% |

|

Dell |

440 |

10.3% |

474 |

11.5% |

-7.2% |

|

Apple |

289 |

6.7% |

575 |

13.9% |

-49.8% |

|

Others |

1,149 |

26.8% |

1,195 |

28.9% |

-3.9% |

|

Total |

4,282 |

100.0% |

4,128 |

100.0% |

3.7% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2024 |

|

||||

Looking ahead, Canalys predicts robust double-digit percentage growth in both the commercial and consumer segments. In 2024, the PC market is expected to see a 14% year-on-year increase, followed by further year-on-year growth of 15% in 2025. Solid commercial procurement is anticipated to be the driving force behind this growth.

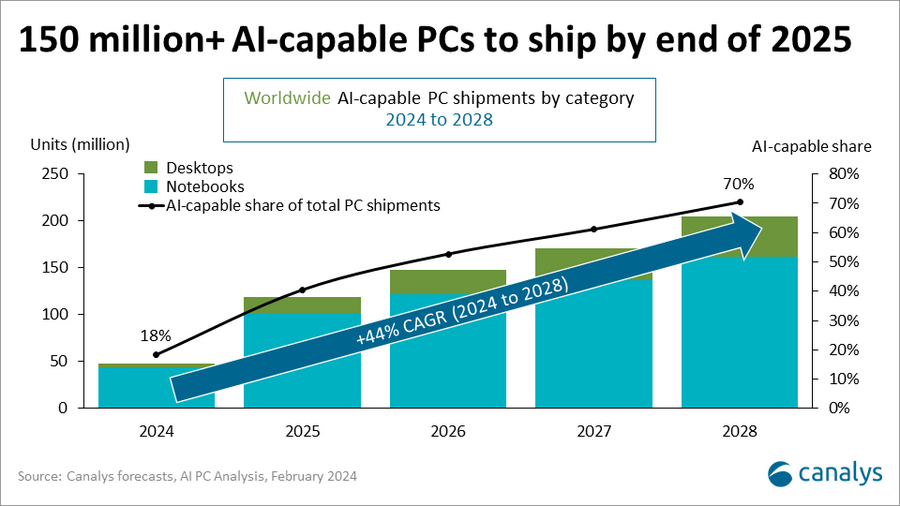

“Both AI and locally manufactured PCs will take center stage in 2024,” added Aithal. “AI-capable PCs are expected to experience a substantial boost in the coming commercial refresh cycle as the end of Windows 10 approaches. With these devices commanding relatively high prices in the short term, commercial uptake, especially by large enterprises, is expected to be stronger initially.”

In terms of production, most OEMs have shifted their focus to local assembly, in line with government initiatives. “With nearly 27 manufacturing firms approved under the PLI 2.0 scheme, there’s anticipation of a substantial increase in devices manufactured in India,” said Aithal. “This aligns with broader efforts to strengthen domestic manufacturing capabilities and promote self-reliance in the technology sector.”

|

Indian desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q4 2023 |

|||||

|

Vendor |

Q4 2023 |

Q4 2023 |

Q4 2022 |

Q4 2022 |

Annual |

|

HP |

1,067 |

33.1% |

957 |

32.3% |

11.5% |

|

Lenovo |

571 |

17.7% |

495 |

16.7% |

15.3% |

|

Acer |

486 |

15.1% |

295 |

9.9% |

65.0% |

|

Dell |

439 |

13.6% |

473 |

16.0% |

-7.3% |

|

Apple |

147 |

4.6% |

171 |

5.8% |

-14.0% |

|

Others |

514 |

16.0% |

573 |

19.3% |

-10.3% |

|

Total |

3,224 |

100.0% |

2,965 |

100.0% |

8.8% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2024 |

|

||||

|

Indian tablet shipments (market share and annual growth) Canalys PC market pulse: Q4 2023 |

|||||

|

Vendor |

Q4 2023 |

Q4 2023 |

Q4 2022 |

Q4 2022 |

Annual |

|

Samsung |

275 |

26.0% |

354 |

30.4% |

-22.1% |

|

Lenovo |

157 |

14.8% |

68 |

5.8% |

130.9% |

|

Apple |

141 |

13.3% |

404 |

34.7% |

-65.0% |

|

Acer |

125 |

11.8% |

69 |

6.0% |

79.2% |

|

Xiaomi |

93 |

8.8% |

31 |

2.7% |

201.8% |

|

Others |

267 |

25.2% |

238 |

20.4% |

12.3% |

|

Total |

1,058 |

100.0% |

1,164 |

100.0% |

-9.0% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2024 |

|

||||

For more information, please contact:

Ashweej Aithal (India): ashweej_aithal@canalys.com

Ishan Dutt (Singapore): ishan_dutt@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry. With AI rapidly becoming vital to the PC industry, Canalys also provides shipment data, forecasts and market insights for the emerging category of AI-capable PCs.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2024. All rights reserved.