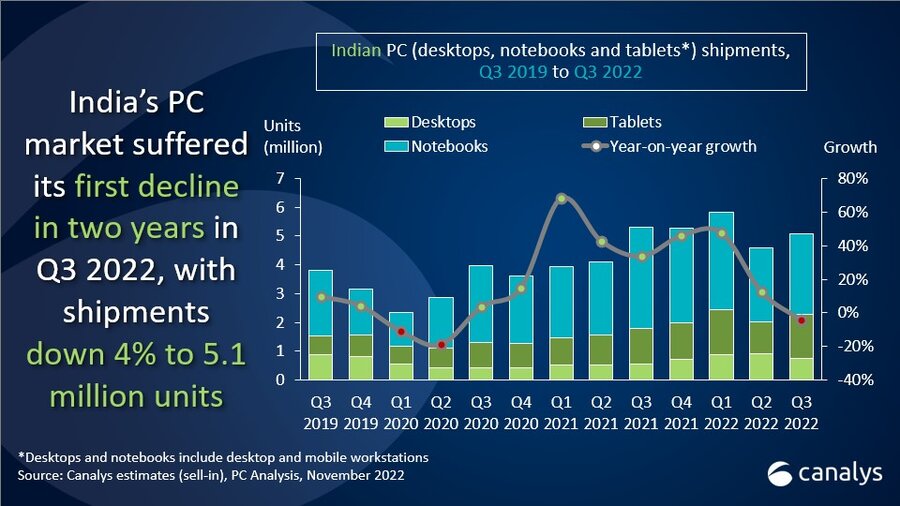

Indian PC market ends growth streak with 4% fall in Q3 2022

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 21 December 2022

Following eight consecutive quarters of growth, the Indian PC market (desktops, notebooks and tablets) suffered a downturn. Shipments fell 4% year on year to 5.1 million units. As the largest category by volume, notebook shipments caused the overall market decline, decreasing sharply by 21%. Desktop and tablet shipments saw significant annual growth, up 36% to 766,000 units and 24% to 1.5 million units respectively in Q3.

|

Indian PC (including tablets) shipments (market share and annual growth) Canalys PC Market Pulse: Q3 2022 |

||||||

|

Vendor |

Q3 2022 shipments |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

|

|

Lenovo |

1,095 |

21.6% |

1,429 |

27.0% |

-23.4% |

|

|

HP |

940 |

18.5% |

1,268 |

24.0% |

-25.9% |

|

|

Acer |

532 |

10.5% |

398 |

7.5% |

33.7% |

|

|

Apple |

456 |

9.0% |

283 |

5.3% |

61.1% |

|

|

Dell |

455 |

9.0% |

726 |

13.7% |

-37.3% |

|

|

Others |

1,593 |

31.4% |

1,187 |

22.4% |

34.2% |

|

|

Grand Total |

5,071 |

100.0% |

5,292 |

100.0% |

-4.2% |

|

|

|

|

|

||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), November 2022 |

|

|||||

“The education sector was a bright spot for the Indian PC market,” said Canalys Analyst Ashweej Aithal. “Public sector tenders that had been postponed over the last two years began to materialize, driving the segment to 181% shipment growth across all product categories in Q3. This enormous gain can be attributed to the subpar performance in Q3 last year, when the government was still reeling from the devastating effects of the pandemic. Looking ahead, the segment is expected to bring continued strength, especially for tablets, which enjoy a favorable position in India’s digital education expansion strategy. But with businesses’ budgets for IT spending being reprioritized due to the uncertain economic climate, shipments to the commercial segment suffered, falling 11% compared with a year ago. Both enterprises and SMBs delivered weaker demand for PCs because of inflation and a series of interest rate hikes by the Reserve Bank of India in the second half of 2022.”

“On the consumer side, demand has been relatively lackluster during the festive season,” said Aithal. “Household spending growth declined substantially following a surge in Q2. Despite some promotional activity by vendors and retailers, consumer shipments fell 12% year on year as inventory clearance remained an issue. The opening of schools and colleges around the country has also diminished consumer spending on PCs and tablets as the need for devices to support remote learning has dropped off significantly. Sluggish consumer demand is expected to continue into the start of 2023, as the weakening rupee puts additional upwards pressure on prices.”

|

Indian desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q3 2022 |

||||||

|

Vendor |

Q3 2022 shipments |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

|

|

HP |

940 |

26.5% |

1,268 |

31.2% |

-25.9% |

|

|

Lenovo |

837 |

23.6% |

830 |

20.4% |

0.8% |

|

|

Dell |

454 |

12.8% |

726 |

17.9% |

-37.5% |

|

|

Acer |

450 |

12.7% |

371 |

9.1% |

21.3% |

|

|

Asus |

380 |

10.7% |

376 |

9.3% |

1.1% |

|

|

Others |

484 |

13.7% |

491 |

12.1% |

-1.4% |

|

|

Grand Total |

3,545 |

100.0% |

4,061 |

100.0% |

-12.7% |

|

|

|

|

|

||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), November 2022 |

|

|||||

In PCs (excluding tablets), HP held onto the top spot in India but saw its shipments suffer a massive decline of 26% as it lost almost 5% market share compared with a year ago. Lenovo came second with a flat performance in Q3, shipping 837,000 units as it overtook HP in the commercial segment. Third-placed Dell underwent the largest decline of the major vendors, with shipments down 38%. Acer and Asus rounded out the top five, posting growth of 21% and 1% respectively to secure over 9% of the market each.

|

Indian tablet shipments (market share and annual growth) Canalys PC market pulse: Q3 2022 |

||||||

|

Vendor |

Q3 2022 shipments |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

|

|

Samsung |

357 |

23.4% |

292 |

23.7% |

22.3% |

|

|

Lava* |

310 |

20.4% |

- |

- |

- |

|

|

Apple |

261 |

17.1% |

153 |

12.4% |

70.6% |

|

|

Lenovo |

258 |

16.9% |

599 |

48.7% |

-56.9% |

|

|

realme* |

82 |

5.4% |

- |

- |

- |

|

|

Others |

257 |

16.8% |

187 |

15.2% |

37.4% |

|

|

Grand Total |

1,526 |

100.0% |

1,231 |

100.0% |

24.0% |

|

|

|

|

|

||||

|

*Lava and realme shipments tracked from Q4 2021 and Q3 2022 respectively Note: unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), November 2022 |

|

|||||

In tablets, Samsung remained top of the market with 22% shipment growth and 23% market share. Local vendor Lava came second, having seen significant traction in the low-end Android space, including in education deployments. Apple secured third place as it fulfilled backlogged demand from Q2 and promotional activity helped drive 71% shipment growth. Fourth-placed Lenovo underwent a significant 57% decline in shipments, while realme, a relatively new entrant to the Indian market, grabbed fifth place.

For more information, please contact:

Ashweej Aithal: ashweej_aithal@canalys.com +91 97386 19281

Ishan Dutt: ishan_dutt@canalys.com +65 8399 0487

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.