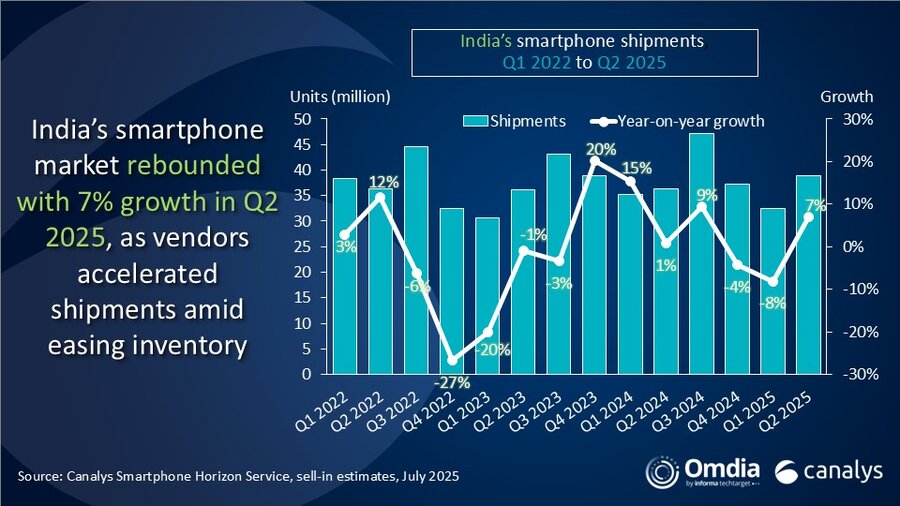

India’s smartphone market rose 7% in Q2 2025 after an early inventory-led slowdown

Monday, 21 July 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

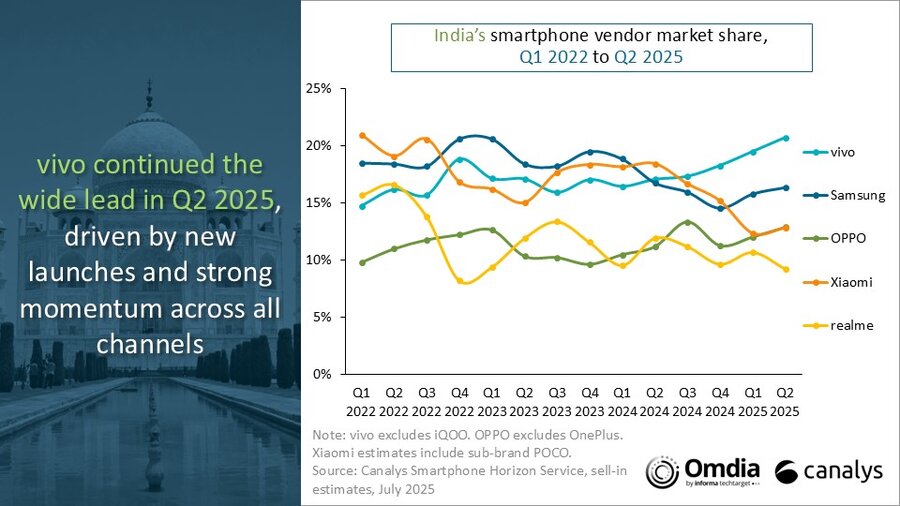

India’s smartphone market rebounded after a sluggish start to the year, driven by easing inventory challenges and renewed vendor activity. According to Canalys (now part of Omdia), smartphone shipments in India grew 7% year on year in Q2 2025 to reach 39.0 million units. The growth was primarily fueled by fresh launches concentrated in the second quarter, following a cautious Q1 where vendors held back due to elevated inventory levels. Recovery came despite a seasonally soft quarter amid multiple headwinds, including extreme weather conditions, US tariff tensions and geopolitical uncertainty. vivo (excluding iQOO) led the market with 8.1 million units shipped and a 21% market share. Samsung followed in second place with 6.2 million units and a 16% market share. OPPO (excluding OnePlus) climbed to third with 5 million units, edging past Xiaomi, which also shipped 5 million. realme completed the top five with 3.6 million units.

“vivo’s new launches were widely embraced by channels, driven by strong partnerships, while rivals maintained a more measured approach in Q2,” said Sanyam Chaurasia, Principal Analyst at Canalys (now part of Omdia). “The V50 series gained traction in Tier 1 and Tier 2 cities via large-format retail and wedding-led campaigns, while the Y-series sustained momentum in smaller cities and semi-urban markets through deep distribution and promoter push. The T-series also scaled steadily online with a broadened portfolio.”

“OPPO also had a solid quarter, buoyed by strong offline momentum from the A5 series and growing online traction via the K13,” added Chaurasia. “In contrast, other vendors focused on selective push strategies amid cautious sentiment. Samsung leveraged its financing strength in the mid-premium segment, particularly for the A36 and A56, through 18- and 24-month zero-cost EMI schemes. While Xiaomi declined year on year, it drove Q2 momentum through the Redmi 14C 5G and A5, and boosted Note 14 series visibility via a targeted design refresh. realme also declined year on year, with online softness partially offset by offline gains from the C73, C75 and 14X, together contributing 35% of its shipments.”

"Heightened competition beyond the top five is reshaping India’s smartphone landscape, as premium incumbents and design-led challengers refine their playbooks,” said Chaurasia. “Apple ranked sixth in Q2 2025, with the iPhone 16 family accounting for over 55% of its shipments, while the iPhone 15 and 13 continued to drive demand across price tiers. The iPhone 16e lost momentum post-launch, as consumers questioned the value of its single-camera design and largely unrealized Apple Intelligence features. Motorola, in seventh place, is deepening its retail reach in smaller cities following a strong urban push. Infinix gained traction through bold design-ID and campaigns targeting gaming and creator communities, overtaking TECNO to become TRANSSION’s lead brand in India and contributing 45% of the group’s 1.8 million shipments. Nothing continued its explosive rise, growing 229% year on year, driven by design-led innovation that resonated with young urban consumers, with volumes led by the CMF Phone 2 Pro, Phone 3a and Phone 3a Pro.”

“With limited organic demand, India’s smartphone market in H2 2025 will hinge more on channel execution than product launches,” stated Chaurasia. “Brands are actively locking inventory with distributors and retailers through channel incentive programs ahead of the upcoming festive season in India. These include high-value rewards – ranging from foreign trips to vehicle rewards – tied to performance during Monsoon sales, Durga Puja and Diwali cycles. Retail infrastructure upgrades are gaining pace, with improved booth setups, structured shelf placements and stricter quarterly targets for promoter engagement and in-store execution. At the same time, brands are doubling down on affordability by expanding long-tenure financing options, especially for mid- to high-end models. While these efforts are expected to boost channel confidence and short-term sell-through, Canalys (now part of Omdia) projects a modest decline for the full-year 2025, as structural demand challenges persist.”

|

India’s smartphone shipments and annual growth |

|||||

|

Vendor |

Q2 2025 |

Q2 2025 |

Q2 2024 |

Q2 2024 |

Annual |

|

vivo |

8.1 |

21% |

6.2 |

17% |

31% |

|

Samsung |

6.2 |

16% |

6.1 |

17% |

2% |

|

OPPO |

5.0 |

13% |

4.1 |

11% |

24% |

|

Xiaomi |

5.0 |

13% |

6.7 |

18% |

-25% |

|

realme |

3.6 |

9% |

4.3 |

12% |

-17% |

|

Others |

11.0 |

28% |

8.9 |

25% |

23% |

|

Total |

39.0 |

100% |

36.4 |

100% |

7% |

|

|

|

|

|||

|

Note: vivo excludes iQOO. OPPO excludes OnePlus. Xiaomi estimates include sub-brand POCO. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

The worldwide Smartphone Horizon service from Canalys (now part of Omdia) provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.