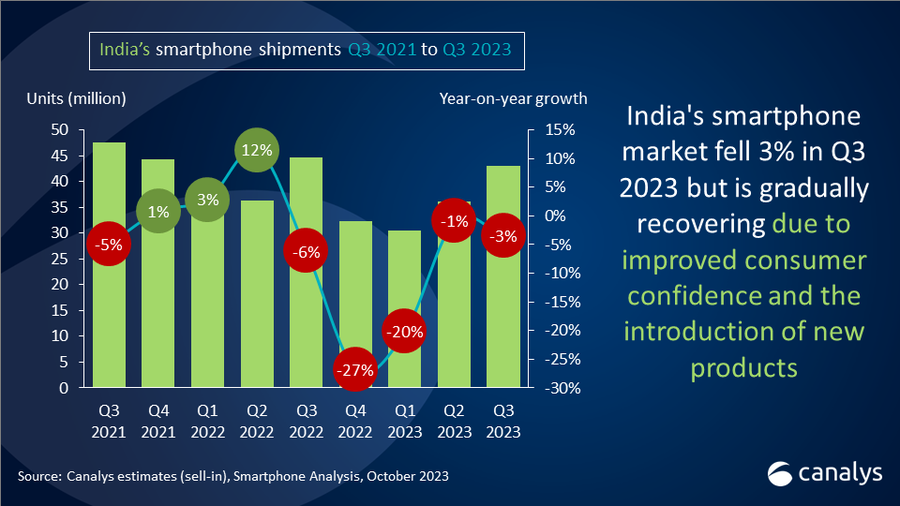

India's smartphone shipments fell 3% in Q3 2023 but gaining traction amid festivities

Thursday, 19 October 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

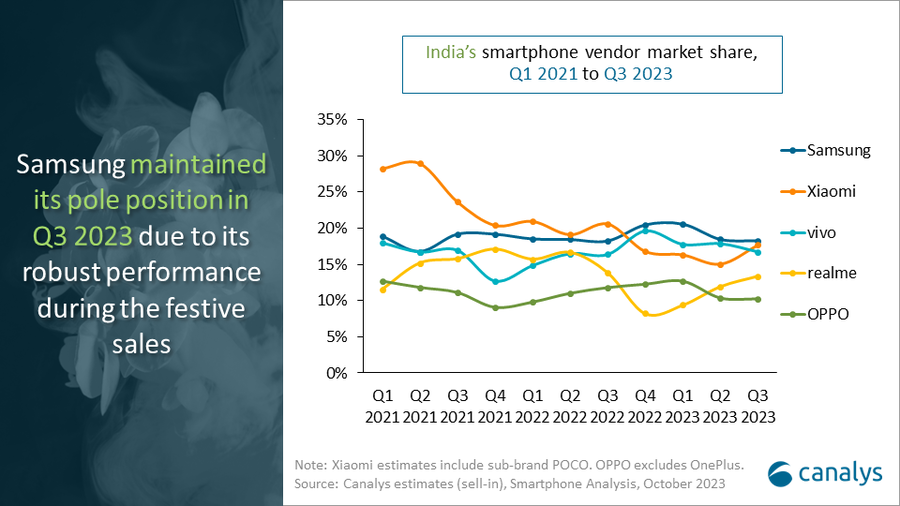

Canalys research reveals that the smartphone market in India recorded 43.0 million shipments in Q3 2023, as the market moves toward gradual recovery. Although there was a 3% year-on-year decline in shipments, the quarter witnessed an improved consumer environment, allowing vendors to capitalize on newly introduced devices. Samsung maintained its top position in Q3 2023 with a market share of 18% and a shipment of 7.9 million units. Xiaomi advanced to the second position, shipping 7.6 million units, primarily fueled by the release of its affordable 5G models. vivo dropped to the third spot, shipping 7.2 million units, while realme and OPPO (excluding OnePlus) completed the top five by delivering 5.8 million and 4.4 million units, respectively.

“In Q3, smartphone brands strategically promoted their festive product lineup, with a strong emphasis around budget-friendly 5G options,” said Sanyam Chaurasia, Senior Analyst at Canalys. “Brands pushed their latest offerings, taking advantage of the fact that most vendors entered the quarter with improved inventory positions. The entry-level segment experienced a surge in demand as vendors introduced mass-market 5G models. For example, Xiaomi expanded its 5G portfolio with the launch of budget-friendly models like the Redmi 12 5G and POCO M6 Pro 5G, contributing to the growth of 5G offerings in their lineup. realme also gained traction in the market with its 11x 5G and 11 5G models, particularly through online channels. Motorola, Infinix and Tecno also drove limited volume through their new affordable 5G devices, as the market steadily transitions toward a dominant presence of 5G-enabled smartphones. On the other hand, the premium segment continued to experience robust growth. It was driven by Samsung's S23 series and older-generation Apple iPhones, such as the iPhone 14 and iPhone 13, being offered at attractive deals during the festive sales. The market also witnessed the re-entry of HONOR via a strategic joint venture route with HTech and launched its HONOR 90 model.”

“While the top five brands witnessed a year-on-year decline, the remaining players have been resilient and stabilized the overall market shipments,” added Chaurasia. “Brands such as OnePlus, Infinix, Tecno and Motorola witnessed strong growth mainly due to expanding channel presence, increased offerings and few carried positive momentum from the chip shortage period of 2021. Amid current challenges, it is tough for vendors to preserve market share, manage inventory and maintain profitability simultaneously. For instance, OPPO has shifted focus and is launching higher-priced models to prioritize profit margins over volume while Samsung has streamlined its portfolio across price bands. Brands need to continuously assess their market presence amid external macro headwinds, local operational hurdles and volatile demand concerns. To thrive in the long term, the top brands should prioritize building strong distribution networks, increasing local manufacturing integration and making positive contributions to the economy.”

“Despite the market gaining consumer confidence in the second half, the road to recovery will be challenged by global economic concerns,” said Chaurasia. “The growth in 2024 hinges on uncertain macroeconomic factors, particularly affecting the vulnerable entry-level segment. However, the Indian economy remains relatively resilient to sudden shocks from these variables and brands are adapting to market dynamics. To maintain market share, vendors should prioritize reducing channel pressures and building a lean product portfolio. They should have ‘hero models’ in each price segment while maintaining balanced inventories across channels.”

|

Indian smartphone shipments and annual growth |

|||||

|

Vendor |

Q3 2023 |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual |

|

Samsung |

7.9 |

18% |

8.1 |

18% |

-3% |

|

Xiaomi |

7.6 |

18% |

9.2 |

21% |

-17% |

|

vivo |

7.2 |

17% |

7.3 |

16% |

-1% |

|

realme |

5.8 |

13% |

6.2 |

14% |

-6% |

|

OPPO |

4.4 |

10% |

5.3 |

12% |

-16% |

|

Others |

10.1 |

24% |

8.5 |

19% |

19% |

|

Total |

43.0 |

100% |

44.6 |

100% |

-3% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO. OPPO excludes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other parameters. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.