Indian smartphone market rebounds 20% in Q4 2023, closing full year with 2% decline

Thursday, 18 January 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

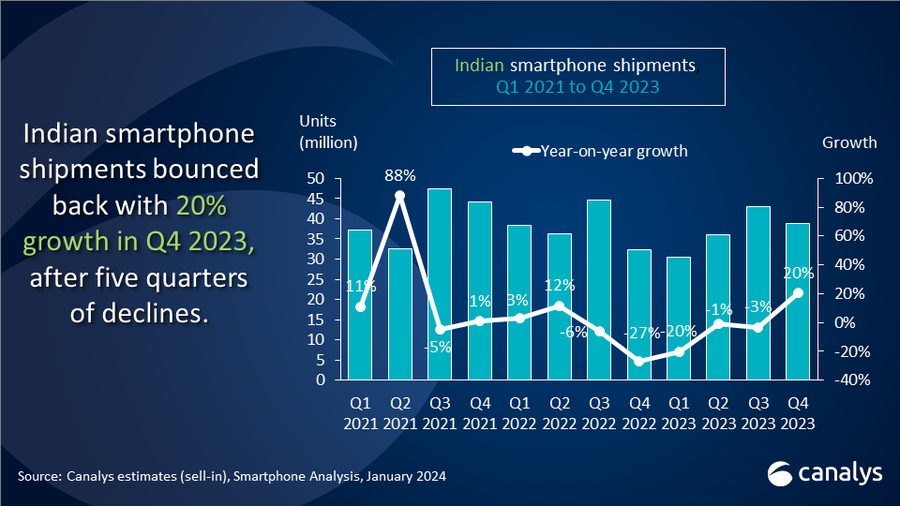

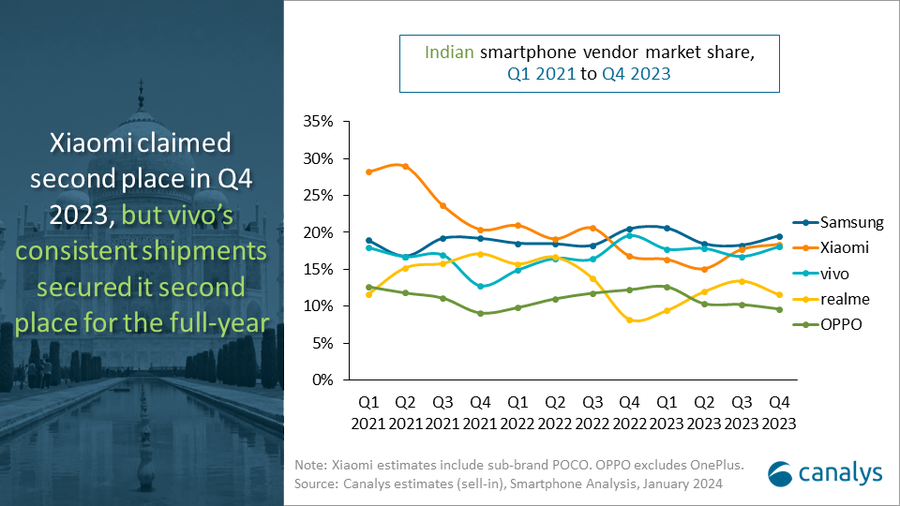

The latest Canalys research shows Indian smartphone vendors capitalized on robust festival season demand and propelled Q4 shipments to 38.9 million units, a stellar 20% year-on-year rebound. Samsung maintained pole position in Q4 2023 with a market share of 20% and shipments of 7.6 million units. Xiaomi continued its robust performance, claiming second place by shipping 7.2 million units. vivo secured third position with shipments of 7.0 million units, while realme and OPPO (excluding OnePlus) rounded out the top five by shipping 4.5 million and 3.7 million units, respectively.

For 2023, India’s smartphone market maintained stability with 148.6 million shipments overall, a minor drop of 2%. The market demonstrated resilience, thanks to improved consumer confidence in the latter part of the year, and despite vendors facing inventory challenges, minimal inflation improvements and fluctuating demand for most of the year.

“In 2023, growing investment in mainline retail space proved beneficial not only for vendors but also allowed the overall market to stabilize,” said Sanyam Chaurasia, Senior Analyst at Canalys. Brands such as Xiaomi and realme saw their highest offline shipment share in Q4. Xiaomi democratized its portfolio, contributing equally to offline and online channels, making its highest offline channel contribution quarter. Its Redmi 12 5G and recently launched Redmi 13C series contributed to its offline share, each surpassing a million shipments. Similarly, realme also shipped devices with equal channel contribution, with the Narzo series driven by ecommerce, while the remaining portfolio continued to dominate offline channels. To further enhance their positions in the premium space, brands should continually focus on bolstering the confidence of their channel partners.

“The premium segment witnessed robust growth, thanks to easy financing options, incentive schemes for retailers and rising disposable income,” said Chaurasia. “With the celebration of Diwali in November 2023, Apple got the opportunity to push the latest iPhone 15 series during the festive sales, contributing more than 50% to its shipments in Q4. Additionally, discounts on the previous-generation iPhone 14 and iPhone 13 models during online sales resulted in Apple’s record shipments, allowing it to capture 7% market share in India. Similarly, Samsung had set aggressive retail targets for its premium Galaxy S23 series to drive premium segment growth. Along with this, Samsung’s latest Galaxy S23 FE launch in Q4 drove shipments, thanks to compelling banking deals.”

“Vendors are entering 2024’s ‘Election Year’ with improved indicators for the consumer market with manageable inflation, a steady interest rate and clear visibility of a stable government to come into power,” said Chaurasia. “Canalys expects the Indian smartphone market to grow by mid-single digits in 2024, driven by affordable 5G and the pandemic period replacement cycle. But the biggest challenge for vendors this year will be to manage the rising bill of materials costs.”

|

Indian smartphone shipments and annual growth |

|||||

|

Vendor |

Q4 2023 |

Q4 2023 |

Q4 2022 |

Q4 2022 |

Annual |

|

Samsung |

7.6 |

20% |

6.7 |

21% |

14% |

|

Xiaomi |

7.2 |

18% |

5.5 |

17% |

31% |

|

vivo |

7.0 |

18% |

6.4 |

20% |

10% |

|

realme |

4.5 |

12% |

2.7 |

8% |

69% |

|

OPPO |

3.7 |

10% |

4.0 |

12% |

-5% |

|

Others |

8.9 |

23% |

7.3 |

22% |

23% |

|

Total |

38.9 |

100% |

32.4 |

100% |

20% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO. OPPO excludes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

|

Indian smartphone shipments and annual growth |

|||||

|

Vendor |

2023 |

2023 |

2022 |

2022 |

Annual |

|

Samsung |

28.4 |

19% |

28.6 |

19% |

-1% |

|

vivo |

26.1 |

18% |

25.4 |

17% |

3% |

|

Xiaomi |

25.1 |

17% |

29.6 |

20% |

-15% |

|

realme |

17.4 |

12% |

20.9 |

14% |

-16% |

|

OPPO |

15.7 |

11% |

17.0 |

11% |

-7% |

|

Others |

35.8 |

24% |

30.2 |

20% |

18% |

|

Total |

148.6 |

100% |

151.6 |

100% |

-2% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO. OPPO excludes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other parameters. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.