Japan smartphone market 2020 forecast

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 1 April 2020

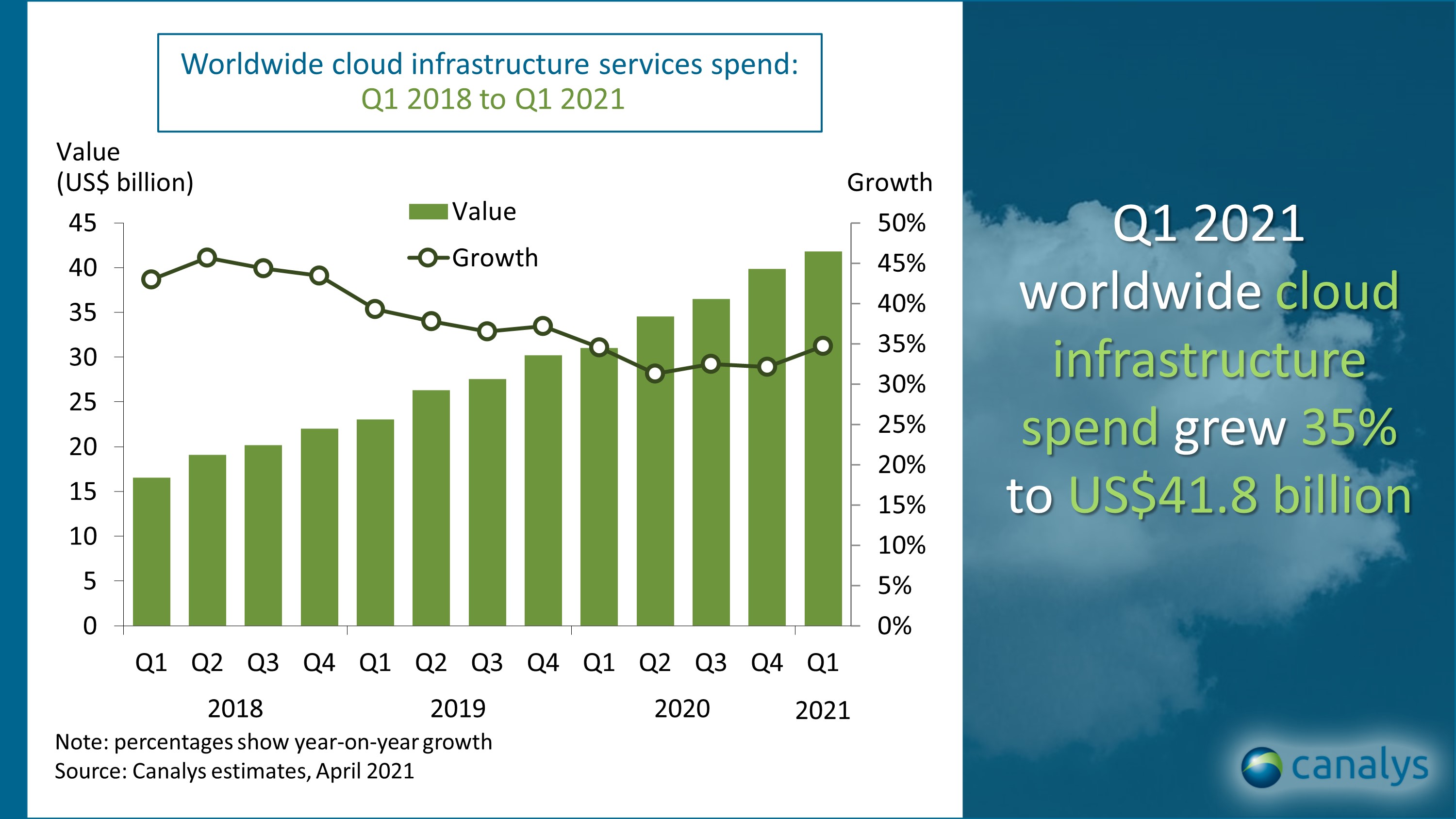

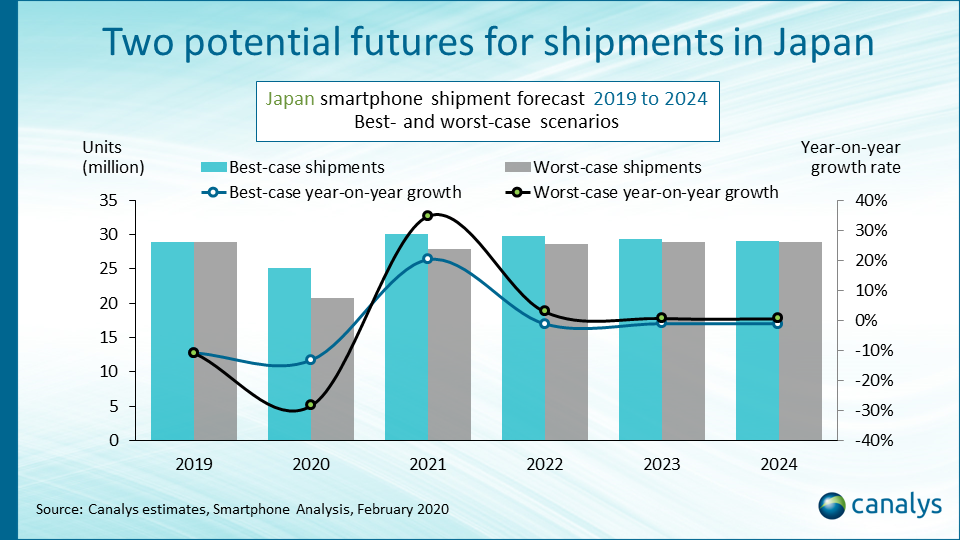

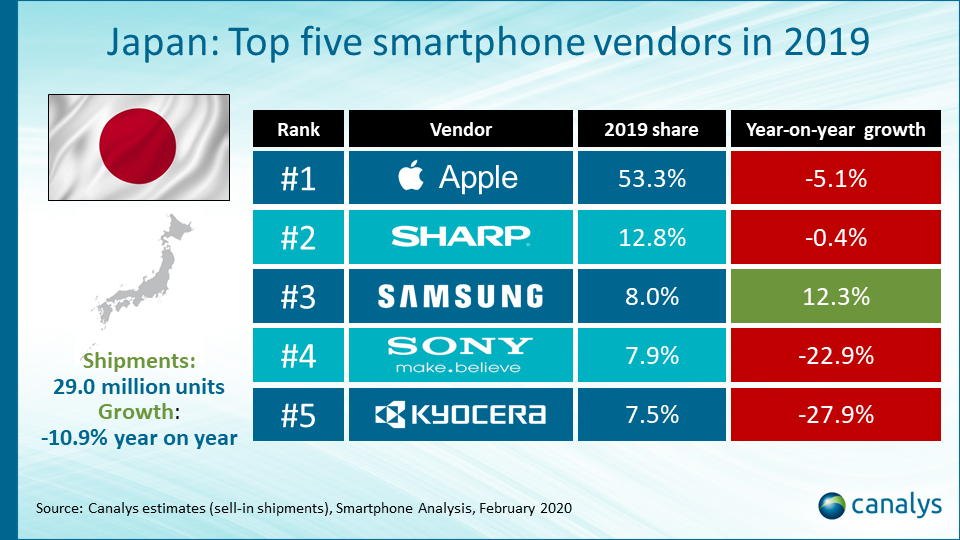

Canalys forecasts Japan’s smartphone market will struggle in 2020, following a 10.9% year-on-year fall in shipments in 2019 compared with 2018. Market players are dealing with the full impact of new regulations on subscription pricing this year. The hope that 5G would stimulate the market is fading, and the unprecedented postponement of the 2020 Summer Olympics is certain to hurt business. Canalys expects delays to 5G smartphone uptake and 5G infrastructure developments, given local operators are cautious with spending on device subsidies and CAPEX in the face of such uncertainty. In the best-case scenario, Japan’s smartphone shipments are expected to fall by 13% to 25.1 million units this year. In the worst-case scenario, they will fall 28% to 20.7 million units. In both cases, Japan will be one of the worst performing in terms of shipments of the top 10 smartphone markets.

“The cascading effects of the COVID-19 pandemic will start to show in the Japanese smartphone market from late Q1,” said Canalys Research Analyst Shengtao Jin. “Japan has closed schools and advised the public to exercise social distancing. The Bank of Japan’s decision to raise the ceiling of asset purchase and the government’s plan to roll-out a massive JPY56 trillion (US$517 billion) stimulus package, amounting to 10% of Japan’s GDP, shows that the government is deeply concerned about the impact of the pandemic. The postponement of the Olympics places further strain on the cashflow of Japanese businesses, which have already spent heavily on capital expenditure in preparation for the anticipated spending spree during the games. The stimulus package will bring much needed assurance to vulnerable small and medium-sized businesses, which employ 90% of the country’s workforce.”

The demand shock caused by the pandemic will affect all vendors. “Unemployment will rise, and people are being discouraged from heading out to malls and operator retail shops, which account for the bulk of smartphone sales. Moreover, as people have little appetite for pricey 5G plans and devices in an economic crisis, operators will have an even longer payback period to recover their massive initial outlay on 5G deployment.”

The new telecommunications regulation took effect in October last year, and is forcing operators to separate handset prices and usage bills in a bid to help consumers make more informed decisions. The clearer pricing structure and reduced subsidies will mostly affect vendors such as Apple and Samsung, which have a big share of the flagship segment. “The incumbent operators are also feeling the heat too, as Docomo, Au and Softbank rolled out more competitive packages to defend against MVNOs and the country’s fourth operator, Rakuten, which recently launched an unlimited data plan for a fraction of what the incumbents charge,” said Jin. “We expect the non- telecommunications channel, including eretailers, retailers and direct stores, to play a bigger role in smartphone distribution. Meanwhile, the premium segment will be under pressure while the low-to-mid-range segment will continue to boom as buyers have become more price-conscious.”

Apple: Apple suffered a rare 9.9% drop in Japan in Q4 2019, as the premium segment was hardest hit by the new regulation. Despite total iPhone shipments falling in Japan, Apple’s third biggest market globally, it managed to tighten its grip on the overall market. Its share in 2019 increased to 53.3%, against 50.1% in 2018 and 48.0% in 2017. But Apple must urgently strengthen its mid-range portfolio in 2020, as this market is blossoming in Japan, which will further strengthen Apple’s installed base. On the other hand, the delayed Olympics and microeconomic situation, which will cast a shadow over many 5G launches this year, may become a silver lining for Apple, which will try to catch up with its own 5G portfolio by the end of the year.

Samsung: Samsung is determined to increase its share of the Japanese market in 2020. It made a surprise move into the budget segment in Q4 2019, with its Japanese edition of the A20 with an IP68 rating, which accounted for half of Samsung’s shipments in the quarter. The strategy came at the right time, when Japanese consumers were feeling more price-conscious. Later in 2020, Samsung hopes to seize opportunities in the premium Android market, as local players lag in innovation. But Samsung’s biggest challenges will come from Oppo and Xiaomi in the growing budget segment.

Chinese vendors: Oppo shipped 269,000 devices in 2019, mostly from the Reno A series – devices tailor-made for Japanese customers with an IP68 rating. Oppo’s celebrity endorsement tactics with Sashihara also played a part in popularizing its brand. Xiaomi made its move into the competitive Japanese market in 2019, timing its entry to target early 5G adopters. Both vendors have secured important operator channel deals, paving the way to take more share from local vendors. It is expected that in the medium term, Chinese vendors’ best opportunity lies in the growing mid-range segment, where their track record indicates they are poised to excel. As in the premium segment, consumers tend to look beyond specifications and performance.

For more information, please contact:

Canalys China

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Louis Liu: louis_liu@canalys.com +86 136 2177 7745

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Adwait Mardikar: adwait_mardikar@canalys.com +91 96651 38668

Canalys Singapore

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Matthew Xie: matthew_xie@canalys.com +65 8319 8343

Canalys EMEA

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Mo Jia: mo_jia@canalys.com +33 785 683 766

Canalys USA

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2020. All rights reserved.