Latin America’s smartphone market up 2% in Q2 2025, as Xiaomi and HONOR surged

Thursday, 28 August 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

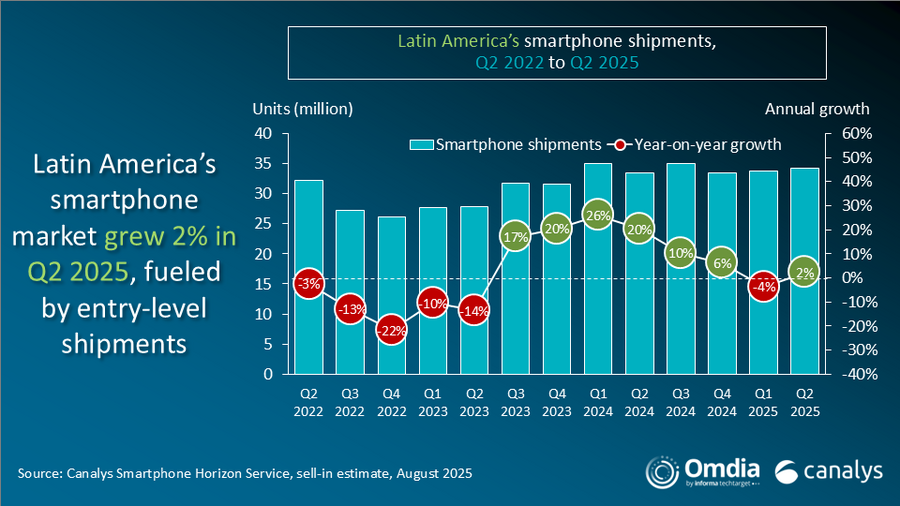

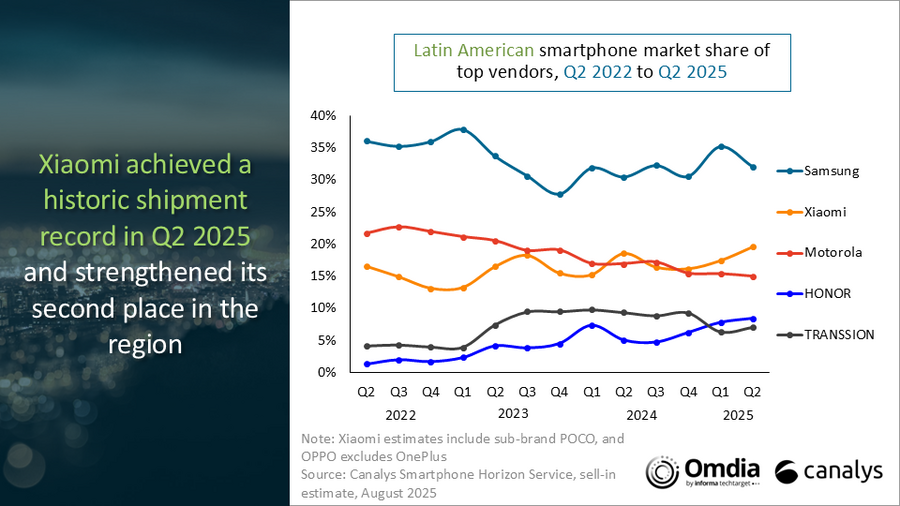

According to the latest research from Canalys, part of Omdia, Latin America’s smartphone market grew by a modest 2% year on year in Q2 2025 to 34.3 million units. Samsung defended its dominant lead, growing 8% year on year to 11.0 million units. The Galaxy A06 and A16 models comprised over 60% of Samsung’s shipments, underscoring the importance of affordability in reaching volume scale. Xiaomi held second place, growing 8% with a record shipment of 6.7 million units. Motorola ranked third with shipments declining 10% to 5.1 million units. HONOR and TRANSSION rounded the top five with contrasting results; HONOR grew 70%, shipping a record high of 2.9 million units, while TRANSSION fell 23% to 2.4 million units.

“Latin America’s smartphone market continues to deliver consistently strong demand, returning to growth in Q2 2025 after an inventory-correction caused decline in Q1,” said Miguel Pérez, Senior Analyst at Canalys, part of Omdia. “Samsung’s momentum has returned, powered by its trusted brand and targeted positioning of the low-end Galaxy A-series. Meanwhile, Xiaomi and HONOR achieved record quarterly shipments to date, demonstrating adaptability in a competitive landscape. 4G versions of Redmi A5 and 14C boosted Xiaomi’s growth, especially in Argentina, Colombia and Central America. HONOR’s performance was largely driven by its X-series models alongside the ‘Lite’ version of the Magic7 and 400 series. Central America has become HONOR’s core base, surpassing Mexico as its largest market in the region during the first two quarters of 2025.”

“Despite marginal growth in Latin America’s smartphone market in Q2 2025, regional markets varied significantly,” added Pérez. “Brazil, the region’s largest market, declined by 3% compared to Q2 2024, as some demand saturation occurred following a strong competitive push over the past few years. Shipments into Mexico dropped by 10% as sluggish demand caused year-on-year declines for all the leading vendors. Meanwhile, the growth in Q2 stemmed from Central America, Colombia and Argentina, which all grew by strong double-digit rates. The latter two markets showed strong recovery after almost two years of socioeconomic and political adjustments.”

“The entry-level segment largely drove the region’s growth in Q2 2025, but smartphone vendors need to be careful not to get overly reliant upon these segments for long-term performance,” commented Pérez. “Persistent macroeconomic uncertainty looms amid the fear of tariffs from the US and the entry-level demand segment can quickly become fragile. Long-term competitiveness will depend upon diversified operational models from vendors, offering additional products across the mid-to-high-end as well as the wider connected devices ecosystem. Additionally, a complete channel coverage strategy is key to support scale and drive trust toward the brands.”

|

LATAM smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q2 2025 |

|||||

|

Vendor |

Q2 2025 shipments (million) |

Q2 2025 |

Q2 2024 |

Q2 2024 |

Annual |

|

Samsung |

11.0 |

32% |

10.2 |

30% |

8% |

|

Xiaomi |

6.7 |

20% |

6.2 |

19% |

8% |

|

Motorola |

5.1 |

15% |

5.7 |

17% |

-10% |

|

HONOR |

2.9 |

8% |

1.7 |

5% |

70% |

|

TRANSSION |

2.4 |

7% |

3.2 |

9% |

-23% |

|

Others |

6.1 |

18% |

6.5 |

20% |

-7% |

|

Total |

34.3 |

100% |

33.5 |

100% |

2% |

|

|

|

|

|||

|

Note: percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Miguel Perez: miguel perez@canalys.com

The worldwide Smartphone Horizon service from Canalys, part of Omdia, provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.