Malaysia’s smartphone shipments grew 10% in February 2024

Friday, 5 April 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

In the entry-level price segment, smartphone vendors are intensifying the price competition, leveraging channel incentives to boost both volume and market share. Core specifications, pricing strategies and channel margins are crucial success factors for devices priced under MYR1,000 (US$200), with 5G capability becoming increasingly relevant up to the price point of MYR1,400 (US$290). Successful models such as vivo’s Y17s and Xiaomi’s Redmi 12 were able to strike the right balance between these factors.

For premium smartphones, creating omnichannel shopping experiences for customers is increasingly important. This requires having a good understanding of the customer journey across online and offline channels to craft a smooth and consistent experience. Samsung does this very well as most of their official online stores give customers the option to pick up their devices at physical store outlets. Much of the media activity for the Galaxy S24 launch was online but it was supported by a large network of branded stores equipped with demo units for customers to test Galaxy AI features like Live Translate.

Canalys projects a 9.5% year-on-year growth in the Malaysian smartphone market, reaching 9.8 million units in 2024. As retailer profitability diminishes, further consolidation within the channels is anticipated. Telco channels and large organized retailers are poised to gain market share at the expense of smaller independent resellers. Beyond their advantages in infrastructure and financial resources, organized retailers and telcos are better positioned to monitor customer refresh cycles through installment plans, data packages and other sales initiatives.

The proliferation of affordable 5G devices remains a significant growth catalyst, particularly as major telcos exclusively offer 5G devices. Additionally, 5G data access is now bundled into most prepaid data plans at no additional charge. The expanded availability of 5G in the prepaid market is expected to drive demand for affordable 5G devices, extending beyond telcos to the broader open channel. Smartphone vendors will look to partner with Telcos like Maxis, CelecomDigi and Hotlink to bring their affordable 5G portfolio to the masses.

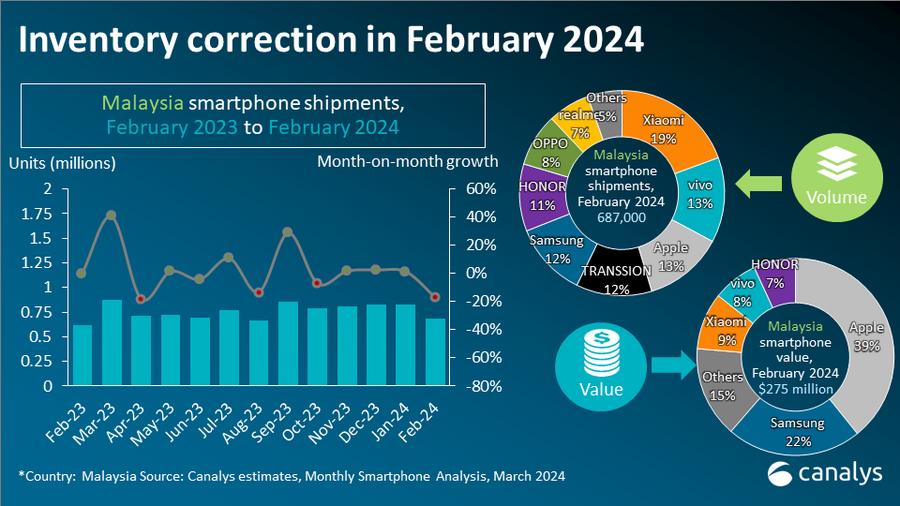

“Malaysia's smartphone market experienced a 10% year-on-year growth in February 2024, reaching 687,000 units. Measures taken by vendors in Q4 2023 to increase sellout and normalize inventory provided room for growth in Q1 2024,” said Sheng Win Chow, Analyst at Canalys. “Further growth is expected in 2024 fuelled by a natural refresh cycle from a sales spike in 2021.”

|

Malaysian smartphone shipments and annual growth |

|||||

|

Vendor |

February 2024 |

February 2024 |

February 2023 |

February 2023 market share |

Annual |

|

Xiaomi |

133 |

19% |

85 |

14% |

56% |

|

vivo |

92 |

13% |

82 |

13% |

12% |

|

Apple |

86 |

13% |

32 |

5% |

168% |

|

TRANSSION |

82 |

12% |

31 |

5% |

169% |

|

Samsung |

81 |

12% |

170 |

27% |

-53% |

|

HONOR |

73 |

11% |

37 |

6% |

95% |

|

OPPO |

57 |

8% |

121 |

19% |

-53% |

|

realme |

46 |

7% |

47 |

7% |

-2% |

|

Others |

37 |

5% |

17 |

3% |

119% |

|

Total |

687 |

100% |

623 |

100% |

10% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO; OPPO includes OnePlus. |

|

||||

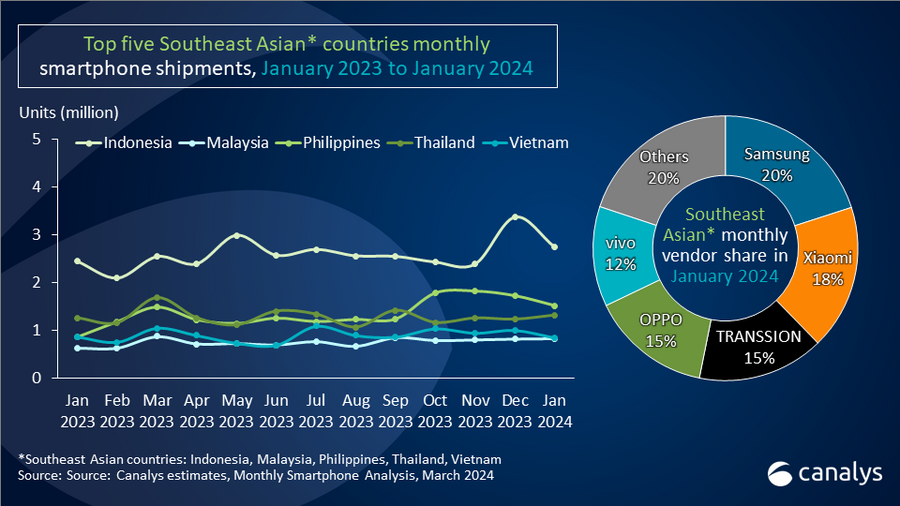

This press release uses Canalys’ Southeast Asian monthly smartphone estimates. To get more data points and insights, contact us.

For more information, please contact:

Le Xuan Chiew: lexuan_chiew@canalys.com

Sheng Win Chow: shengwin_chow@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.