Europe new energy vehicles market Q4 2019

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 11 March 2020

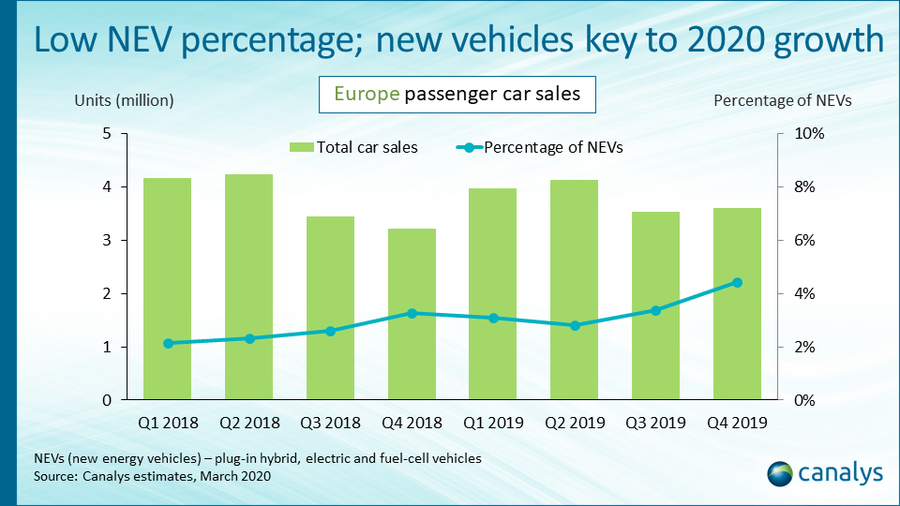

According to the latest research from Canalys, 160,000 new energy vehicles (NEVs) were delivered to customers in Europe in Q4 2019, a 52% increase. Despite the growth, NEVs still only represented 4.4% of the 3.7 million cars delivered in Q4 2019. In full-year 2019, approximately 520,000 NEVs out of a total of 15.3 million cars were delivered in Europe.

Sales of NEVs, which comprise plug-in hybrid vehicles (PHEVs), electric vehicles (EVs) and fuel-cell vehicles (FCEVs), increased in Q4, though from a low base, meaning NEVs still represent a small percentage of total sales. “The industry needs a boost, and it should come, in part, from the new, more affordable, compact EVs launching in the first half of 2020 from mainstream brands such as Honda, Mini, Opel/Vauxhall, Peugeot and VW. Priced between €30,000 and €40,000 (US$34,000 and US$45,000), with improved ranges of between 200 and 500 kilometers (120 to 310 miles), early customer interest is encouraging. But there is much more to be done by car-makers, local authorities and governments to convince consumers to make the switch to a NEV,” said Chief Analyst for automotive at Canalys, Chris Jones.

“2019 was another challenging year in the European car market. While there was year-on-year sales growth for both Q4 and the full year, the growth is misleading due to the negative sales impact of the WLTP fuel economy and emissions test, introduced in 2018. Underlying demand for new cars in 2019 in most European countries was muted and the impact of the COVID-19 virus will prove an inhibitor to consumer sales well into 2020. The supply chain has been adversely affected, with shortages of key components affecting the whole global automotive industry, not just NEVs. Car manufacturers are also likely to prioritize supply for vehicles that are more profitable. Margin is low on NEVs, in some cases non-existent, so manufacturers will seek to protect profits.”

Each quarter, Canalys produces a comprehensive intelligent vehicle sales database showing the advanced driver assistance, connectivity, convenience and safety features in new cars.

For more information, please contact:

Canalys China

Johnny Xie: johnny_xie@canalys.com +86 159 2128 2961

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Canalys Singapore

Jermaine Tan: jermaine_tan@canalys.com +65 9798 6301

Canalys UK

Sandy Fitzpatrick: sandy_fitzpatrick@canalys.com +44 7887 725868

Canalys USA

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2020. All rights reserved.