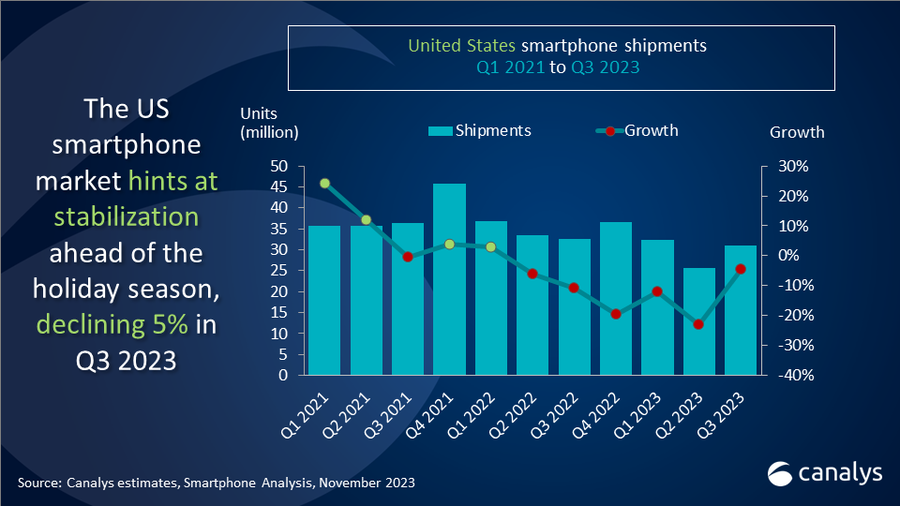

Ahead of holiday season, US smartphone market recovered sequentially in Q3 2023

Friday, 10 November 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

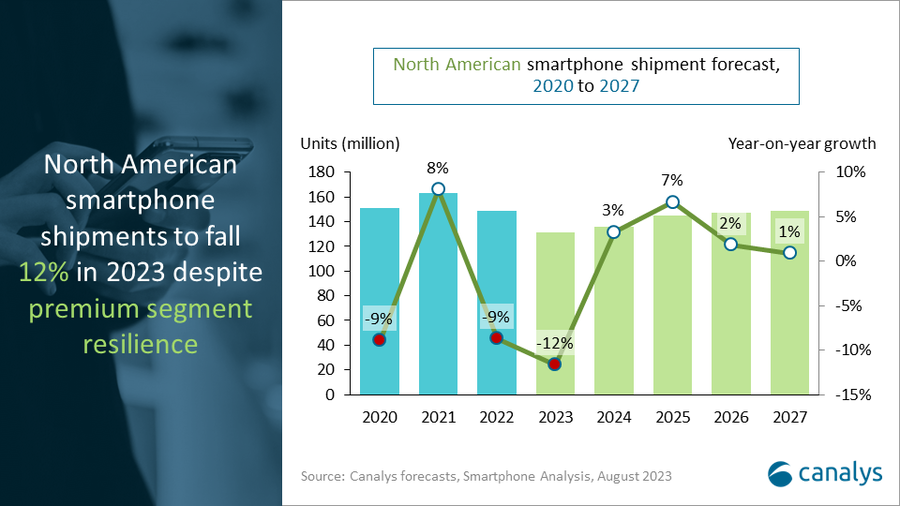

Canalys’ latest research reveals that the US smartphone market shrank another 5% year-on-year in Q3 2023, continuing its downward trajectory. Despite this trend, shipments grew 21% sequentially to 31 million units, driven by Apple’s latest iPhone release and carrier promotions targeting premium device upgrades.

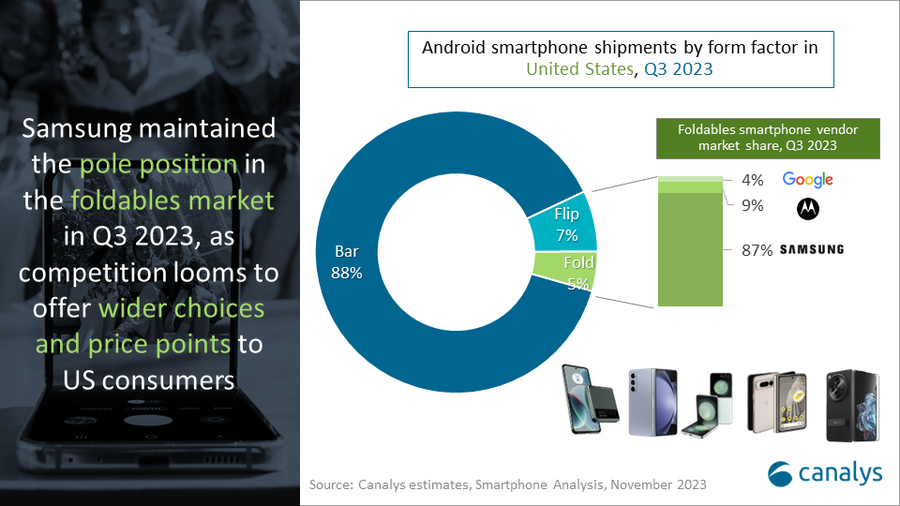

Apple’s shipments declined by a modest 8%, amounting to 17.2 million units. The late arrival of the iPhone 15, compared to the timing of the iPhone 14, contributed to the decline. Samsung's volume recovered slightly compared to Q2 2023 as it shipped 6.8 million units. Its new foldables boosted its performance, which accounted for over 20% of its shipments. Motorola achieved its best quarter since Q2 2022, taking 9% market share and achieving 14% year-on-year shipment growth. TCL and Google Pixel rounded out the top five with each capturing 4% market share, shipping 1.3 million and 1.2 million units, respectively.

“The US smartphone market is stabilizing, but there is no expectation that Q4 will make a turnaround,” said Runar Bjørhovde, Analyst at Canalys. “The wireless telecommunications industry grapples with a prolonged slump, impacting device promotions and subsidies. Despite robust sequential postpaid subscriber net additions and upgrade rates from the tier-1 carriers, device sales still trail last year's figures. Carriers are intensifying their focus on driving service revenue through flexible plans and customer retention initiatives. They remained cautious on aggressive device promotions in Q3, which will continue into Q4 and the holiday season.”

“The iPhone 15 series had a strong start in September 2023, accounting for 34% of all iPhone sales in the US during Q3,” said Le Xuan Chiew, Analyst at Canalys. “The annual refresh of the iPhone portfolio remains paramount to all carriers, even to smaller challengers such as Boost Infinite, to attract switchers. However, fewer current users opt for upgrades to the latest models. Instead, there is a growing trend toward buying older generations, refurbished devices or keeping current phones longer. For Apple, recalibrating its portfolio, marketing strategy and carrier partnerships will become imperative to address these changes in consumer behavior. Lackluster performance in the US can reverberate and impact Apple's global strategy and ambitions swiftly.”

“Prevailing sluggishness of the US market could pave the way for a shake-up of established market dynamics, especially considering the strategic shifts from the leading carriers,” added Bjørhovde. “Carriers are redirecting efforts to refresh and add postpaid offerings and to reshape prepaid business structures. Given the prolonged and persistent high-cost business environment, demand recovery will take longer than expected. Carriers' current strategy will have sustaining implications for consumer purchase behavior while other factors emerge to drive device upgrades and refreshes, such as on-device AI capabilities and foldables. As the US smartphone market stabilizes, Canalys anticipates a mild recovery in 2024. The adjustments made by carriers in 2023 could mark the start of substantial shifts in the market's channel dynamics, prompting vendors to initiate preparations now."

|

United States smartphone shipments and annual growth

|

|||||

|

Vendor |

Q3 2023 |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual |

|

Apple |

17.2 |

55% |

18.6 |

57% |

-8% |

|

Samsung |

6.8 |

22% |

7.8 |

24% |

-12% |

|

Motorola |

2.8 |

9% |

2.4 |

7% |

14% |

|

TCL |

1.3 |

4% |

1.6 |

5% |

-15% |

|

|

1.2 |

4% |

0.6 |

2% |

117% |

|

Others |

1.7 |

5% |

1.6 |

5% |

6% |

|

Total |

31.0 |

100% |

32.5 |

100% |

-5% |

|

|

|

|

|||

|

Note: percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Runar Bjørhovde: runar_bjorhovde@canalys.com

Le Xuan Chiew: lexuan_chiew@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.