US PC market decline eases with shipments down 6% in Q2 2023

Monday, 25 September 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

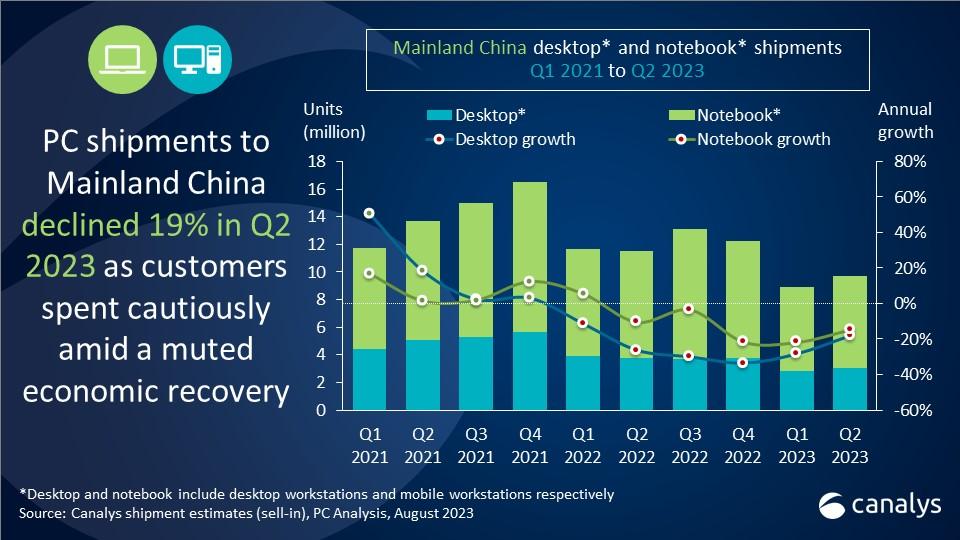

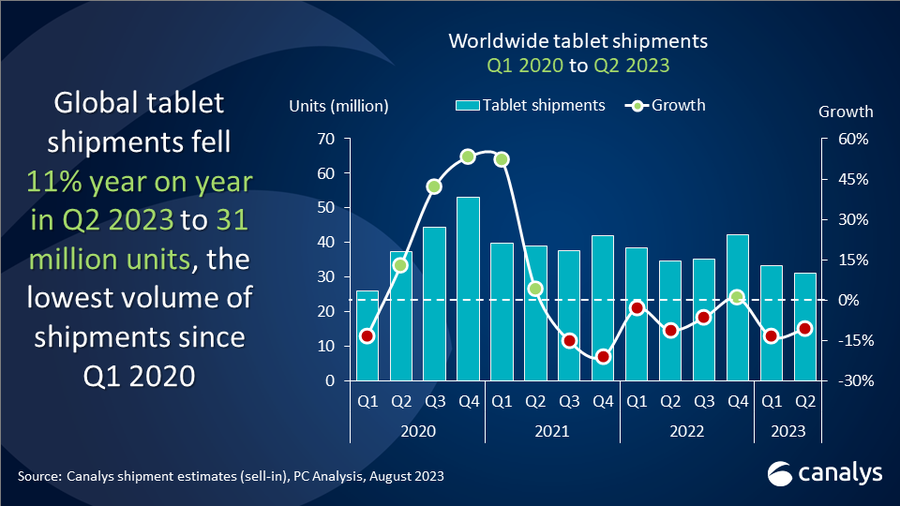

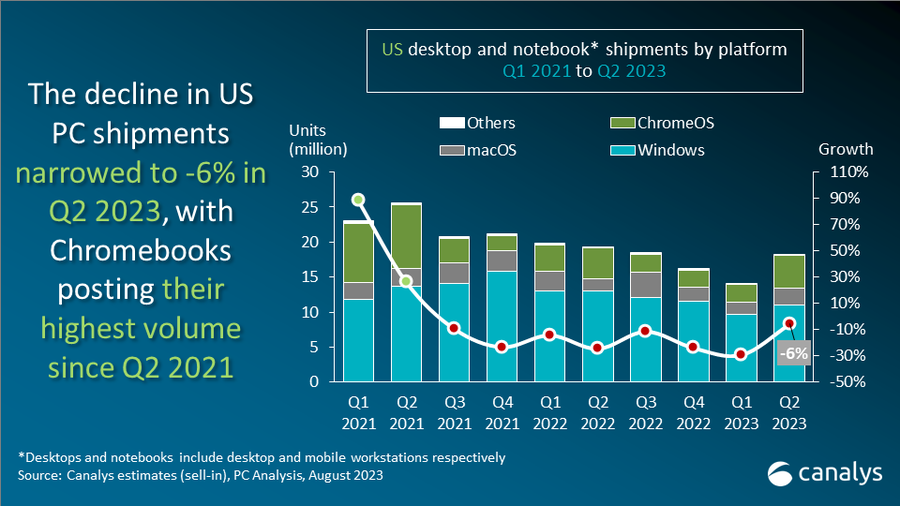

The latest Canalys data reveals that PC shipments (desktops, notebooks and workstations) in the US declined just 6% year-on-year to 18.2 million units in Q2 2023, marking a significant improvement compared to earlier quarters this year. Notebook (including mobile workstations) shipments were down 4% to 15.2 million units, bolstered by the return of Chromebook demand in the education sector. Desktops (including desktop workstations) suffered a steeper decline, with shipments falling 12% to 3.0 million units. The US tablet market faced a similarly modest decline, with shipments down 5% to 10.3 million units.

“Despite undergoing another year-on-year decline, the US PC market showed promising signs of improvement in the second quarter,” said Ishan Dutt, Principal Analyst at Canalys. “With the buildup of channel inventories now largely cleared, pockets of demand strength are now being reflected in vendors’ sell-in shipment performance. A key area that helped drive volumes was the return of demand from education institutions, backed by the latest wave of federal funding, ahead of a licensing cost increase for ChromeOS. This helped propel Chromebook shipments to 4.7 million units, the highest level since peak deployments during the first half of 2021.”

PC shipments to the commercial sector were down just 4%, while the consumer sector posted a larger drop of 10%. “Consumers are still deprioritizing spending on PCs compared to other goods and services amid economic challenges,” added Dutt. “Recovery in this segment is likely to only emerge in Q4, with strong discounting expected during an extended period of holiday season promotions. Businesses, however, are displaying more resilient demand for PCs. Dell, the leading commercial vendor in the US, has highlighted its home market as a particular area of strength.”

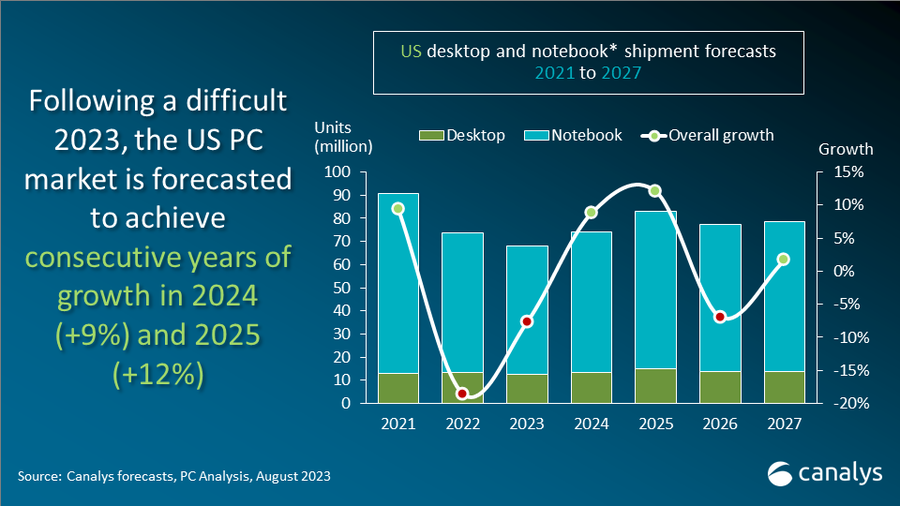

Although businesses and consumers are likely to exhibit some caution in spending on PCs in the short term, the industry can now look forward to further improvement in the US. Canalys expects an even smaller shipment decline of 4% in Q3 2023 before the market bounces back to 12% growth in Q4. Beyond that, the market is forecasted to grow 9% in 2024 and 12% in 2025.

“The long-term outlook for PCs in the US remains positive,” said Dutt. “As macroeconomic pressures subside, the strong fundamentals around post-pandemic PC usage behavior and the larger installed base across all segments will be a boon to the industry. From an innovation perspective, the expected demand boost from the transition away from Windows 10 is now set to be bolstered by the emergence of AI-capable PCs. While this new device category may not significantly increase shipment volumes, it will create strong revenue opportunities for both vendors and the channel as adoption becomes more widespread, particularly within businesses.”

Major PC vendors, along with renowned channel partners, distributors and media professionals, will gather at the Canalys Forums North America in Palm Springs California from 13-15 November 2023 to discuss hot topics, including cloud, cybersecurity and partner ecosystems. Do not miss this opportunity to network, gain insights and “make waves” in 2024 and beyond. Registrations are live!

|

US desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q2 2023

|

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

HP |

4,833 |

26.5% |

4,559 |

23.6% |

6.0% |

|

Dell |

4,813 |

26.4% |

5,535 |

28.7% |

-13.1% |

|

Lenovo |

3,019 |

16.6% |

3,326 |

17.2% |

-9.2% |

|

Apple |

2,310 |

12.7% |

1,742 |

9.0% |

32.6% |

|

Acer |

1,067 |

5.9% |

1,339 |

6.9% |

-20.3% |

|

Others |

2,163 |

11.9% |

2,818 |

14.6% |

-23.2% |

|

Total |

18,205 |

100.0% |

19,319 |

100.0% |

-5.8% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), August 2023 |

|

||||

|

US tablet shipments (market share and annual growth) Canalys PC Market Pulse: Q2 2023

|

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

Apple |

5,348 |

52.2% |

4,451 |

41.3% |

20.1% |

|

Amazon |

1,795 |

17.5% |

2,659 |

24.7% |

-32.5% |

|

Samsung |

1,511 |

14.7% |

1,826 |

16.9% |

-17.3% |

|

TCL |

517 |

5.0% |

635 |

5.9% |

-18.5% |

|

Microsoft |

341 |

3.3% |

354 |

3.3% |

-3.7% |

|

Others |

737 |

7.2% |

856 |

7.9% |

-13.9% |

|

Total |

10,249 |

100.0% |

10,781 |

100.0% |

-4.9% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), August 2023 |

|

||||

For more information, please contact:

Ishan Dutt: ishan_dutt@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

.jpg)