US PC shipments rose 15% in Q1 2025, but growth is set to slow down

Monday, 30 June 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

Data from Canalys, now part of Omdia, shows shipments of desktops and notebooks to the United States grew 15% year on year in Q1 2025, hitting 16.9 million units. A surge in sell-in activity by vendors driven by efforts to navigate tariff announcements has led to significant inventory buildup that will now need to be cleared. This, combined with downward pressure on consumer spending, will lead to a market slowdown for the remainder of the year, with total PC shipments in 2025 forecast to increase by just 2% annually. With a considerable portion of Windows refresh activity set to occur after the Windows 10 end-of-support deadline in October 2025, growth in 2026 is expected to come in at 4%.

Business procurement of PCs is set to remain healthy this year and will help outweigh the stagnation in consumer spending on the category. Commercial PC shipments are anticipated to grow 8% in stark contrast to the 4% decline expected in consumer shipments.

“The pace of transition to Windows 11 among US businesses has been a positive sign for the industry,” said Ishan Dutt, Research Director at Canalys, now part of Omdia. “Commercial demand, particularly from SMBs, is set to accelerate in the second half of 2025 as Microsoft ramps up its awareness drive on the importance of timely refresh. However, consumers’ appetite for big-ticket spending on PCs faces a number of downside risks. Although PCs currently remain exempt, broader tariffs impacting key spending categories have already resulted in inflationary pressure, with the Federal Reserve pausing its planned interest rate cuts in anticipation of further price rises in the remainder of the year. With retail inventories relatively well stocked, sell-in during H2 2025 is likely to be constrained.”

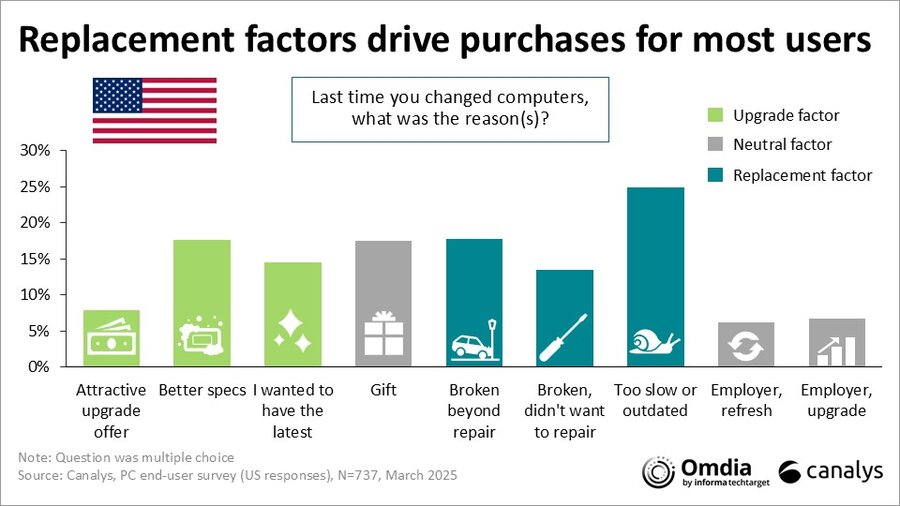

“Despite the sense of urgency driven by the Windows 10 EoS date, consumer demand in the US has remained largely unaffected,” said Kieren Jessop, Research Manager at Canalys, now part of Omdia. “This highlights a key reality: many PC users are indifferent to the Windows 10 EoS until it becomes a significant pain point. Consumer PC purchases tend to be largely driven by factors like poor battery life, slow performance or hardware failures. Overwhelming specifications and unclear messaging also exacerbate the complexity of the PC buying journey. For vendors and channel partners, this underscores the need to simplify the buyer experience through clear, needs-based messaging and streamlined product portfolios. The channel must proactively guide consumers through a coherent and intuitive purchasing process, helping them easily identify devices tailored to their needs.”

|

US desktop and notebook forecast Canalys PC Forecast: 2024 to 2026 |

|

|||||

|

Segment |

2024 shipments |

2025 |

2026 |

2024 |

2025 |

2026 |

|

Consumer |

26,317 |

25,198 |

26,848 |

3.6% |

-4.2% |

6.5% |

|

Commercial |

29,461 |

31,794 |

33,025 |

8.5% |

7.9% |

3.9% |

|

Government |

3,836 |

4,083 |

3,972 |

0.5% |

6.4% |

-2.7% |

|

Education |

9,600 |

9,362 |

9,191 |

1.9% |

-2.4% |

-1.8% |

|

Total |

69,214 |

70,437 |

73,036 |

5.2% |

1.8% |

3.7% |

|

|

|

|

|

|||

|

Note: Unit shipment in thousands. Totals may not add up due to rounding. |

|

|||||

|

US desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q1 2025 |

|||||

|

Vendor |

Q1 2025 shipments |

Q1 2025 |

Q1 2024 |

Q1 2024 |

Annual |

|

HP |

4,116 |

24.3% |

3,639 |

24.6% |

13.1% |

|

Dell |

3,895 |

23.0% |

3,596 |

24.4% |

8.3% |

|

Lenovo |

3,109 |

18.4% |

2,594 |

17.6% |

19.9% |

|

Apple |

2,705 |

16.0% |

2,102 |

14.2% |

28.7% |

|

Acer |

942 |

5.6% |

811 |

5.5% |

16.3% |

|

Others |

2,173 |

12.8% |

2,024 |

13.7% |

7.3% |

|

Total |

16,940 |

100.0% |

14,766 |

100.0% |

14.7% |

|

|

|

|

|||

|

Note: Unit shipment in thousands. Totals may not add up due to rounding. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Ishan Dutt: ishan_dutt@canalys.com

Kieren Jessop: kieren_jessop@canalys.com

Canalys’ (now part of Omdia) PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.