PC market decline in Western Europe to bottom out in Q1 2023

Monday, 3 April 2023

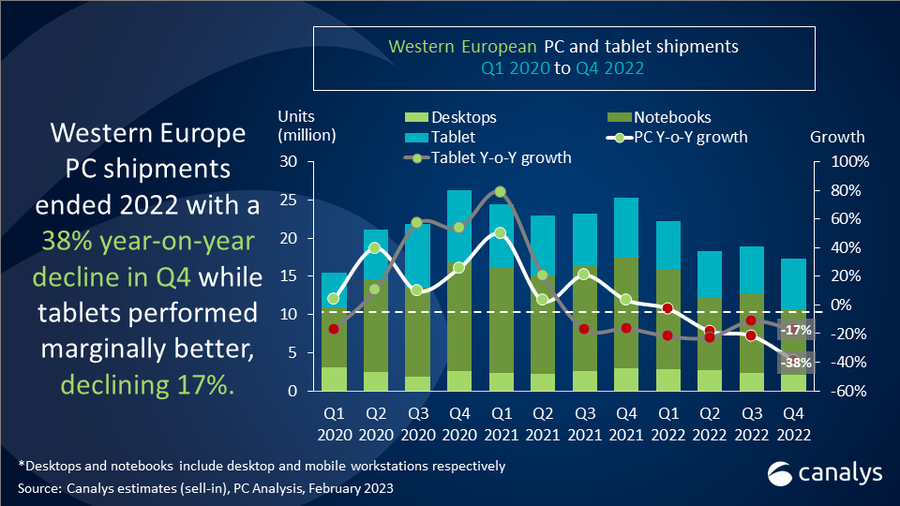

Western European PC (desktop, notebook and workstation) shipments fell by 38% year-on-year to 10.7 million units in Q4 2022 according to the latest Canalys estimates. Notebooks performed worst, with 8.6 million units shipped, 40% less than a year ago. Desktop shipments also faced a significant decline, down 29% to 2.1 million units. The tablet market also suffered from muted consumer spending as shipments dropped 17% to 6.6 million units. For the full year 2022, PC and tablet shipments fell 21% and 18% respectively. The market is expected to face further declines for most of 2023, but return to growth in the final quarter of the year.

“Despite heavy discounting, consumer PC shipments to the region fell 27% between Q3 and Q4 last year,” said Canalys Research Analyst Kieren Jessop. “A substantial sequential drop for the holiday quarter underscores both the impact the current economic situation is having on demand and the extent to which inventories have bloated. However, it’s also important to keep in mind how saturated the market became over the course of the pandemic. From Q2 2020, Western Europe posted eight consecutive quarters with consumer PC shipment volumes that were higher than in the holiday quarter of 2019. Meanwhile, commercial demand waned as businesses faced further pressure from interest rate hikes by the ECB, which have continued in the early months of 2023. Prioritizing budgets away from IT investment has halted the momentum of PC shipments that had started to pick up after COVID-19 restrictions were lifted.”

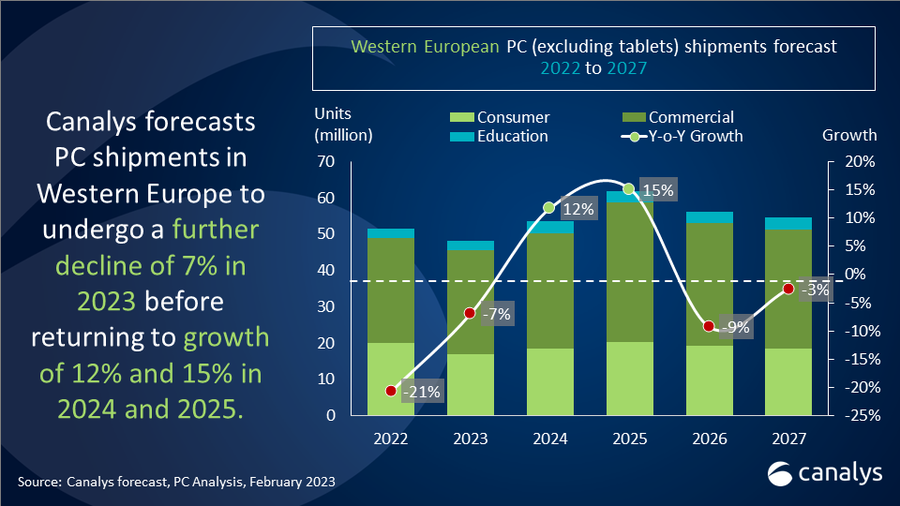

“Fortunately, early signals indicate we are likely in the bottom of the PC market’s trough,” said Jessop. “While economic concerns remain in the short-term, measures of consumer and business sentiment are improving from lows in 2022. European-based channel partners are reporting reductions in their inventory levels, paving the way for new sell-in shipments as demand recovers later in the year. And despite the cloud of economic uncertainty, employment rates in Western Europe have remained resilient. Looking further ahead, 2024 will bring an acceleration in growth as delayed consumer purchases re-emerge and businesses begin a more widespread transition towards Windows 11.” Canalys expects PC shipments to Western Europe to drop a further 7% in 2023 before returning to 12% growth in 2024. Tablets are expected to fare worse, with shipments dropping 10% this year and rebounding to just 4% growth next year.

During Q4 2022, each vendor in the top five shipped fewer PCs to Western Europe than in Q3. Lenovo and HP ranked first and second for both the quarter and full year, but faced large shipment declines of 35% and 43% respectively. Third-placed Dell underwent a drop of similar magnitude, with strong exposure to commercial demand contraction leading to a 42% annual decline in shipments. Apple placed fourth for the quarter and full year and faced the largest sequential drop shipping 39% less Macs in Q4 than in Q3, which had seen substantial channel-fill and fulfillment of backlogged orders from supply constraints earlier in the year.

|

Western Europe desktop, notebook, and workstation shipments (market share and annual growth) Canalys PC Market Pulse: Q4 2022 |

|||||

|

Vendor |

Q4 2022 shipments |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Lenovo |

2.9 |

26.9% |

4.4 |

25.4% |

-34.9% |

|

HP |

2.5 |

23.8% |

4.4 |

25.6% |

-42.8% |

|

Dell |

1.6 |

14.6% |

2.7 |

15.6% |

-42.4% |

|

Apple |

1.4 |

13.2% |

1.8 |

10.5% |

-22.8% |

|

Asus |

0.9 |

8.1% |

1.2 |

6.6% |

-24.9% |

|

Others |

1.4 |

13.4% |

2.8 |

16.2% |

-49.2% |

|

Total |

10.7 |

100.0% |

17.4 |

100.0% |

-38.5% |

|

|

|

|

|||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding |

|

||||

|

Western Europe desktop, notebook, and workstation shipments (market share and annual growth) Canalys PC Market Pulse: 2022 |

|||||

|

Vendor |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Lenovo |

13.9 |

26.9% |

16.8 |

25.9% |

-17.6% |

|

HP |

12.2 |

23.7% |

16.6 |

25.5% |

-26.1% |

|

Dell |

7.3 |

14.2% |

9.4 |

14.5% |

-21.9% |

|

Apple |

6.3 |

12.2% |

6.7 |

10.3% |

-5.3% |

|

Acer |

3.4 |

6.6% |

5.5 |

8.5% |

-38.0% |

|

Others |

8.4 |

16.3% |

10.0 |

15.4% |

-15.9% |

|

Total |

51.6 |

100.0% |

64.9 |

100.0% |

-20.5% |

|

|

|

|

|||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding |

|

||||

Apple’s launch of the 10th generation iPad in Q4 helped extend its pole position in Western Europe’s tablet market as it stayed flat year-on-year in Q4. However, for the full year 2022, it saw shipments decline 16%, in line with the wider market. Samsung placed second for the quarter and year as impressive holiday performance meant it was the only major vendor to post growth. Lenovo had a weak Q4 as its tablet shipments fell 62% year-on-year, knocking it down to fourth place, below Amazon. Huawei held onto fifth place despite undergoing a massive shipment decline of 66%.

|

Western Europe tablet shipments (market share and annual growth) Canalys PC Market Pulse: Q4 2022 |

|||||

|

Vendor |

Q4 2022 shipments |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Apple |

3.4 |

51.8% |

3.4 |

43.3% |

0.0% |

|

Samsung |

1.4 |

21.3% |

1.2 |

15.3% |

16.3% |

|

Amazon |

0.5 |

7.1% |

0.7 |

8.7% |

-32.0% |

|

Lenovo |

0.4 |

6.6% |

1.2 |

14.7% |

-62.2% |

|

Huawei |

0.2 |

2.4% |

0.5 |

6.0% |

-66.0% |

|

Others |

0.7 |

10.6% |

0.9 |

12.0% |

-26.2% |

|

Total |

6.6 |

100.0% |

7.9 |

100.0% |

-16.5% |

|

|

|

|

|||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding |

|

||||

|

Western Europe tablet shipments (market share and annual growth) Canalys PC Market Pulse: 2022 |

|||||

|

Vendor |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Apple |

11.1 |

44.1% |

13.4 |

43.2% |

-16.8% |

|

Samsung |

5.1 |

20.4% |

4.9 |

15.8% |

5.5% |

|

Lenovo |

3.0 |

12.1% |

4.8 |

15.4% |

-36.2% |

|

Amazon |

2.3 |

9.0% |

2.1 |

6.8% |

8.0% |

|

Huawei |

0.9 |

3.6% |

2.2 |

7.1% |

-59.3% |

|

Others |

2.7 |

10.7% |

3.6 |

11.7% |

-25.0% |

|

Total |

25.2 |

100.0% |

30.9 |

100.0% |

-18.4% |

|

|

|

|

|||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Kieren Jessop: kieren_jessop@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.