Global smartphone market share Q2 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 29 July

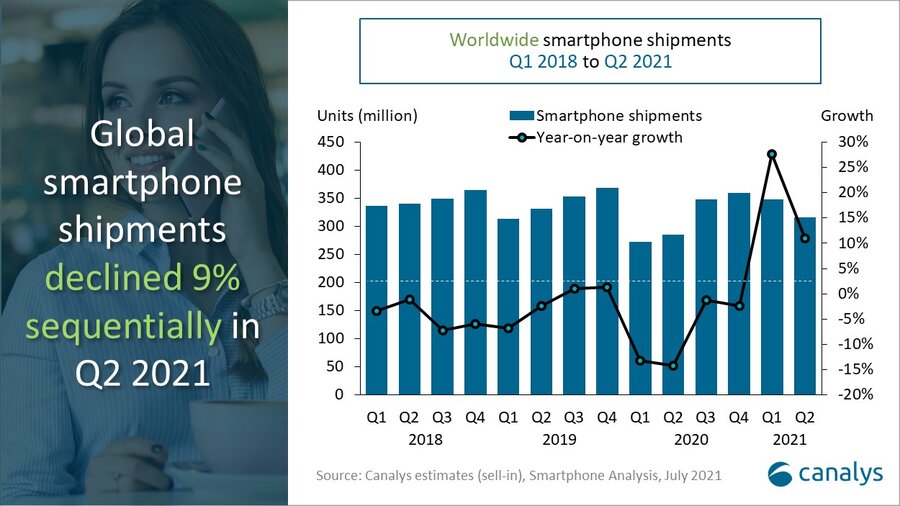

Worldwide smartphone market declines 9% sequentially in Q2 2021 as component shortage bites

In Q2 2021, global smartphone shipments reached 316.0 million units, representing a 9% drop against the previous quarter, as major brands struggled to secure key components to produce devices to meet demand. Samsung was the leading vendor with 58.0 million units at 8% year on year growth. Xiaomi took second place for the first time ever, with 52.8 million units at 83% growth. Apple placed third, with 1% growth to 45.7 million units, while Oppo and Vivo placed fourth and fifth with 32.6 million and 31.2 million units respectively.

Apple saw blockbuster revenue growth for iPhone, despite a unit total which increased only 1%.

“The big difference here is the mix of iPhones selling,” said Canalys Research Analyst Le Xuan Chiew. “Apple launched the low-cost iPhone SE in April 2020, which accounted for 28% of its mix at that time. This year, with no new iPhone SE, its average selling price increased drastically. In addition, its iPhone 12 mini is underperforming against channel expectations despite wholesale discounting, and the iPhone 12 Pro models have become a particularly high mix, at 37%. For comparison, last year, the iPhone 11 Pro models accounted for 17% of iPhones. Apple, like all brands, will run into component headwinds in H2 2021. But its scale has significant weight with supply chain partners, and it will not suffer to the same extent as smaller rivals. It also has hardware margin to play with, should it choose to absorb the cost of component price rises, where some of its rivals may be forced to tweak pricing to maintain profitability.”

“In some regions, channel inventory of smartphones is running dangerously low,” said Canalys Research Manager, Ben Stanton. “The major brands are already practicing regional and channel prioritization to make the most of their limited supplies (see Canalys report: Smartphone shipments set to grow 12% in 2021, despite supply pressure). And as a result, huge internal conflicts have emerged, as regional managers try to secure allocation. Furthermore, many vendors have now also removed sales incentives for a region to overachieve on its targets, to avoid supplies becoming overstretched. Going forward though, as supply constraints ease in 2022, the market is set to explode into life. A war has already started, with brands pouring substantial sums of money into showpiece marketing in international markets. Vivo and Oppo have been at the forefront of this drive, purchasing lucrative sponsorships with the likes of the Indian Premier League, the World Cup, Wimbledon and FC Barcelona.”

|

Worldwide smartphone shipments and growth Canalys Smartphone Market Pulse: Q2 2021 |

|||||

|

Vendor |

Q2 2021 shipments (million) |

Q2 2021 Market share |

Q2 2020 shipments (million) |

Q2 2020 Market share |

Annual |

|

Samsung |

58.0 |

18% |

53.7 |

19% |

+8% |

|

Xiaomi |

52.8 |

17% |

28.8 |

10% |

+83% |

|

Apple |

45.7 |

14% |

45.1 |

16% |

+1% |

|

Oppo |

32.6 |

10% |

25.8 |

9% |

+26% |

|

Vivo |

31.2 |

10% |

24.5 |

9% |

+27% |

|

Others |

95.8 |

30% |

106.8 |

38% |

-10% |

|

Total |

316.0 |

100.0% |

284.7 |

100.0% |

+11% |

|

Note: percentages may not add up to 100% due to rounding Source: Canalys estimates (sell-in shipments), Smartphone Analysis, July 2021 |

|||||

For more information, please contact:

Canalys UK

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Runar Bjørhovde: runar_bjorhovde@canalys.com +44 7787 290 115

Canalys China

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Amber Liu: amber_liu@canalys.com +86 136 2177 7745

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Sanyam Chaurasia: sanyam_chaurasia@canalys.com +91 89820 33054

Canalys Singapore

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Le Xuan Chiew: lexuan_chiew@canalys.com +65 9655 6264

Canalys USA

Brian Lynch: brian_lynch@canalys.com +1 650 927 5489

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.