Mainland China’s cloud infrastructure market growth accelerated in Q1 2025

Thursday, 10 July 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

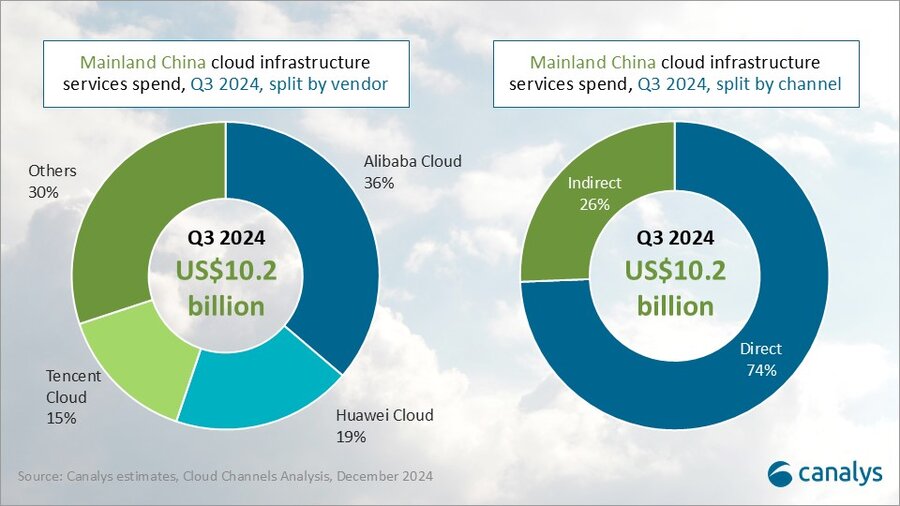

According to the latest data from Canalys (now part of Omdia), cloud infrastructure services spending in Mainland China reached US$11.6 billion in Q1 2025, representing a 16% year-on-year increase. AI-related demand has firmly established itself as a primary driver of cloud adoption. In response, cloud providers are actively ramping up investments in AI infrastructure and model development to capture this growing opportunity. To bridge the gap between foundation model capabilities and real-world business needs, vendors are pursuing multiple strategic approaches, including providing access to turn key AI models, expanding their partner ecosystem and launching AI agent development platforms. In its latest Enterprise AI Contracts Database, Omdia captured multiple new deals between enterprises and cloud service providers in Mainland China, where the former are deploying pre-trained turn key models and additional services to accelerate their AI adoption timelines. In Q1 2025, Alibaba Cloud accounted for 33% of Mainland China’s cloud services market, followed by Huawei Cloud at 18% and Tencent Cloud at 10%.

Canalys (now part of Omdia), has revised its historical cloud infrastructure services revenue estimates to reflect additional guidance from the industry. These updates improve data quality while maintaining methodological consistency.

Mainland China’s cloud infrastructure services market continued to accelerate in Q1 2025. As enterprises accelerate their AI deployments, the market potential of Mainland China’s cloud services sector is being steadily unlocked. The substantial computational demands of foundation models are driving a marked increase in enterprise dependence on cloud-based GPU resources.

Customer demand for AI is reshaping the way cloud computing is used. “AI is accelerating cloud adoption across the board. On one hand, organizations that previously relied on on-premises data centers are now migrating to the cloud to support AI workloads,” said Rachel Brindley, Senior Director at Canalys (now part of Omdia). “On the other hand, enterprises with existing cloud infrastructure are increasingly integrating AI into their internal data and business processes, fueling sustained demand for GPU, IaaS services and foundation model capabilities.”

Meanwhile, the continued iteration of foundation models is driving AI capabilities toward more practical forms. To better align model capabilities with real-world requirements, cloud vendors are adopting a range of strategic approaches. Alibaba Cloud, for instance, has fully open-sourced its Qwen 3 model to accelerate AI adoption and commercialization through openness and ecosystem expansion. Others are advancing the development of AI agent platforms to support systematic application delivery. Tencent Cloud introduced the Tencent Cloud Agent Development Platform, while Huawei Cloud launched ModelArts Versatile. These platforms provide scenario-adaptive frameworks that enhance enterprise integration and enable scalable deployment of AI solutions.

“Leading cloud providers are actively exploring pathways for AI adoption, unlocking capabilities and building ecosystems through model open-sourcing, while accelerating task execution and scenario delivery via AI agent platforms,” said Yi Zhang, Senior Analyst at Canalys (now part of Omdia). “These two approaches, ecosystem expansion and application delivery, are emerging as key models for translating AI capabilities into tangible business value.”

As AI productization accelerates, ecosystem partners are becoming increasingly vital, whether through model open-sourcing or AI agent deployment. In Q1 2025, partner-driven cloud revenue accounted for 25% of the market. This share is expected to grow as ecosystem collaboration becomes a key enabler for turning AI capabilities into business value.

Alibaba Cloud maintained its leading position in Mainland China’s cloud market in Q1 2025, with a 33% market share and 15% year-on-year growth. AI-related workloads have recorded triple-digit growth for seven consecutive quarters, becoming the core engine of its cloud business. In April, it introduced Qwen3, its first hybrid inference model capable of dynamically switching between thinking and non-thinking modes, and fully open-sourced all eight models in the series to further strengthen its AI ecosystem. As part of its international expansion strategy, Alibaba Cloud launched a series of “Go Global” summits for Chinese enterprises from May to broaden platform adoption. At the same time, it continued to expand its global footprint, announcing in July the opening of its first Global AI Capability Center (AIGCC) in Singapore, the launch of a third data center in Malaysia, and plans to bring a new data center in the Philippines online by October.

Huawei Cloud, Mainland China’s second-largest cloud service provider, delivered robust performance in Q1 2025, achieving 18% year-on-year revenue growth and expanding its market share to 18%. In June, Huawei Cloud introduced a series of AI advancements, including the launch of Pangu 5.5, the latest version of its foundation model suite, with upgrades across five core domains: NLP, CV, multimodal learning, prediction and scientific computing. The update delivered an eightfold improvement in inference efficiency. It also unveiled ModelArts Versatile, an enterprise-grade agent platform designed to simplify the development of AI agents through scenario-driven templates. To further strengthen its ecosystem, Huawei Cloud announced a CNY150 million (approximately US$21 million) incentive program targeting four strategic areas, including Ascend AI services and the GaussDB database. Its cloud marketplace, KooGallery, also gained traction, with annual transactions exceeding one million and over 50% of customers transacting through the platform.

Tencent Cloud held a 10% market share in Q1 2025, though GPU supply constraints temporarily limited its growth due to internal prioritization. In June, the company updated its Hunyuan AI models, Turbo S and T1, with Turbo S entering the global top eight on the Chatbot Arena benchmark. It also launched the Tencent Cloud Agent Development Platform (TCADP), which integrates its proprietary large models and supports external access to high-performance models like DeepSeek-R1 and V3, enabling rapid development of intelligent agent applications. On the international front, Tencent Cloud expanded its presence in Japan with the launch of a new cloud region, its third availability zone in the country, aimed at boosting cloud adoption across the Asia-Pacific region.

Canalys defines cloud infrastructure services as the sum of bare metal as a service (BMaaS), infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS) and container-as-a-service (CaaS) and serverless that are hosted by third-party providers and made available to users via the Internet.

For more information, please contact:

Rachel Brindley: rachel_brindley@canalys.com

Yi Zhang: yi_zhang@canalys.com

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.