Global EV sales up 49% to 6.2 million units in H1 2023, with 55% of vehicles sold in Mainland China

Monday, 2 October 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

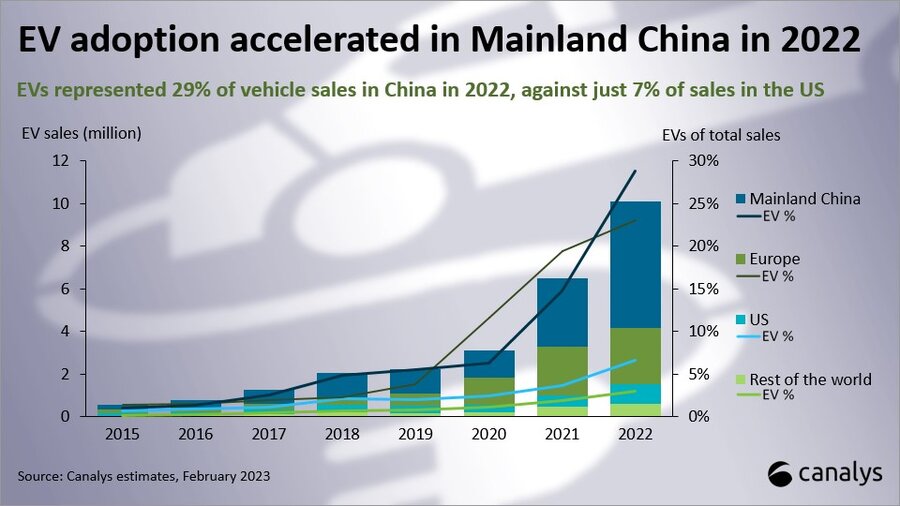

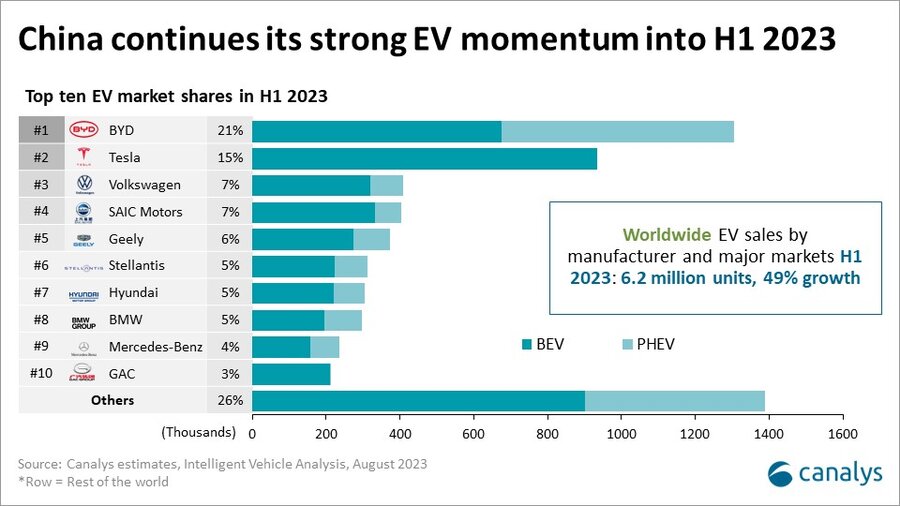

Canalys’ latest research shows worldwide sales of electric vehicles (EVs*) grew by 49% to 6.2 million units in H1 2023. EVs constitute 16% of the global light vehicle market, marking a significant increase of 12.4% from the first half of 2022.

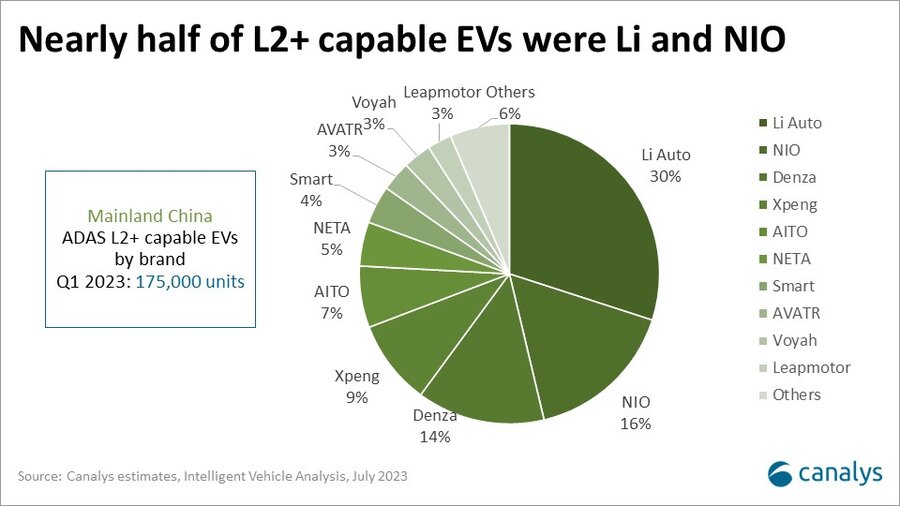

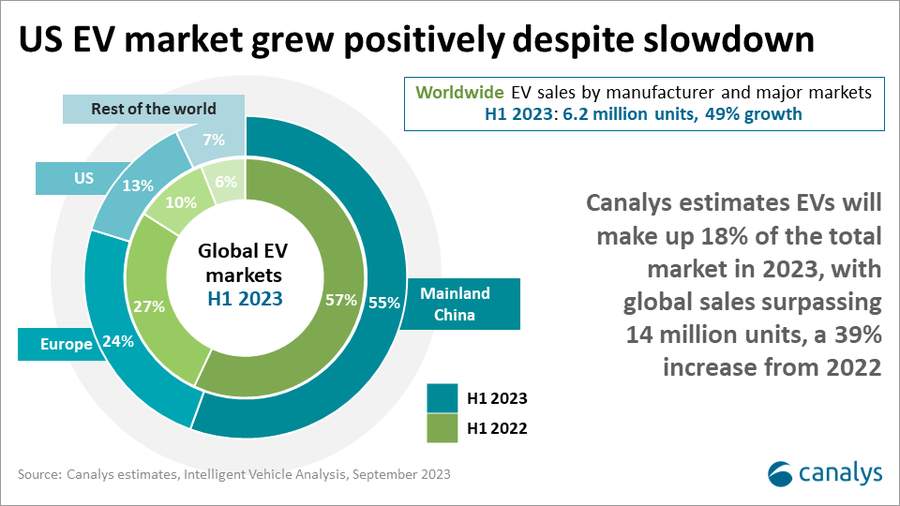

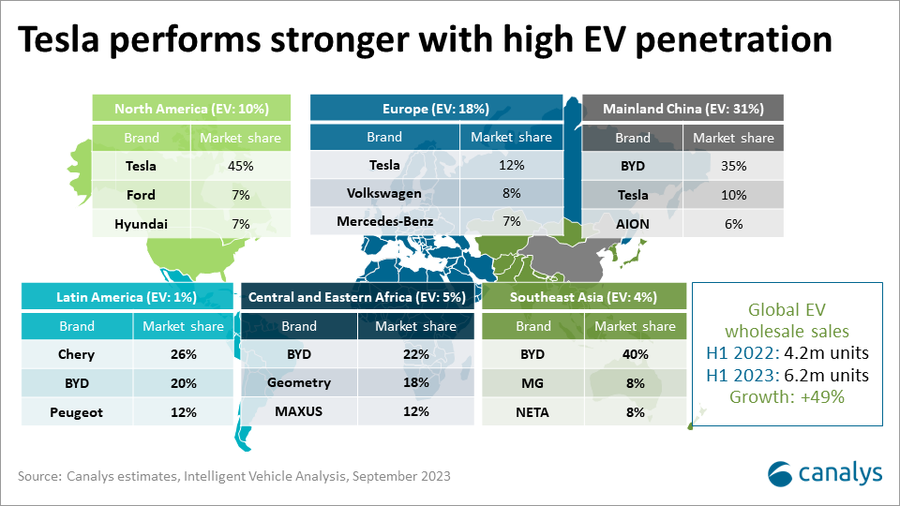

The first half of 2023 saw strong growth in the EV market, reflecting increasing EV popularity. Mainland China was by far the largest EV market, with 55% of global EV sales in H1 2023, a total of 3.4 million units. This represents 31% of all light vehicle shipments in the region, up from 15% in the full year 2021. “China’s growth rate in H1 2023 stood at 43%, a notable decrease from the extraordinary 118% seen in H1 2022. The end of Mainland China’s EV support scheme caused disruption, uncertainty, and a price war,” said Canalys Principal Analyst Jason Low. “While a huge choice of EVs is available in China, no single model has over 10% market share. BYD is the leading EV brand in China, but the Tesla-led price war has been challenging for smaller brands,” Low added.

Compared to overseas markets, China retains a crowded and highly competitive market, which is on the verge of consolidation and reshuffling. “Price wars have caused more automakers to focus on cost reduction, but excessive emphasis on cost reduction can lead to decreased investment in new technology. With electrification and smart technologies, automobiles have transitioned from mature industrial products to continuously iterative technological products. As a result, automakers must rapidly improve their software and hardware capabilities, establish intelligent ecosystems related to automobiles, and cultivate new brand cultures and automotive concepts,” added Low.

Europe is the second largest EV market, with a 24% share and 1.5 million units shipped. In Europe, EV adoption saw an impressive surge with a year-on-year growth of 34%, a significant leap from the modest 9% recorded in H1 2022. “There is good demand for EVs in Europe. Easing supply-chain problems and higher shipments have boosted growth. EVs now account for more than 19% of all vehicles sold in the region,” said Canalys Analyst Ashwin Amberkar. “While Tesla convincingly leads the European EV market, several Chinese EV brands have ventured into Europe, yielding mixed outcomes. It is worth noting that EV adoption still faces challenges in major European markets, including Italy and Spain.”

“In comparison, the US is still behind in global EV sales with just 13% market share, but it is showing positive signs of growth, totaling 815,000 units. This surge has catapulted the US to become one of the fastest-growing EV markets worldwide, with EVs contributing 97% year-on-year growth, up from 62% in H1 2022. The implementation of new EV subsidies in the US has had varying impacts on different OEMs in the market. While Tesla remains a dominant force in the US EV market for 2023, there is an increasing demand for a wider range of EV options to satisfy the growing consumer interest in electric vehicles.”

As the world moves towards sustainability, the EV market is set for significant growth in the latter half of the year. Canalys estimates EVs will make up 18% of the total market in 2023, with global sales surpassing 14 million units, a 39% increase from 2022.

Tesla leads the global BEV market with high EV penetration. It grew by 65% year-on-year, selling over 935,000 units of EVs in H1 2023 when compared with 565,000 units in H1 2022. It consistently ranks in the top three in key regions, with double-digit market shares. Model Y continues to hold the top position with over 13% market share. This is followed by Model 3 reclaiming its volumes in H1 2023 with 7%. However, Model X and Model S account for less than 1% share globally.

BYD sold over 1.3 million units of BEVs and PHEVs in H1 2023 across the world, up 104% and doubling in sales year-on-year. BYD’s top-selling models, Yuan PLUS, Dolphin, and Song Pro, collectively hold 9% of global EV sales. Apart from extraordinary performance in China, the emerging markets in the Asia Pacific, Middle East, and Africa also achieved impressive results.

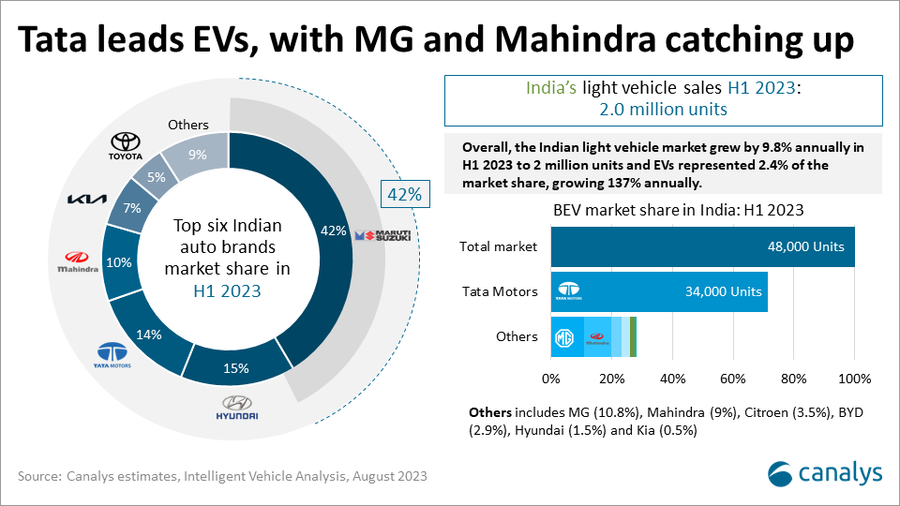

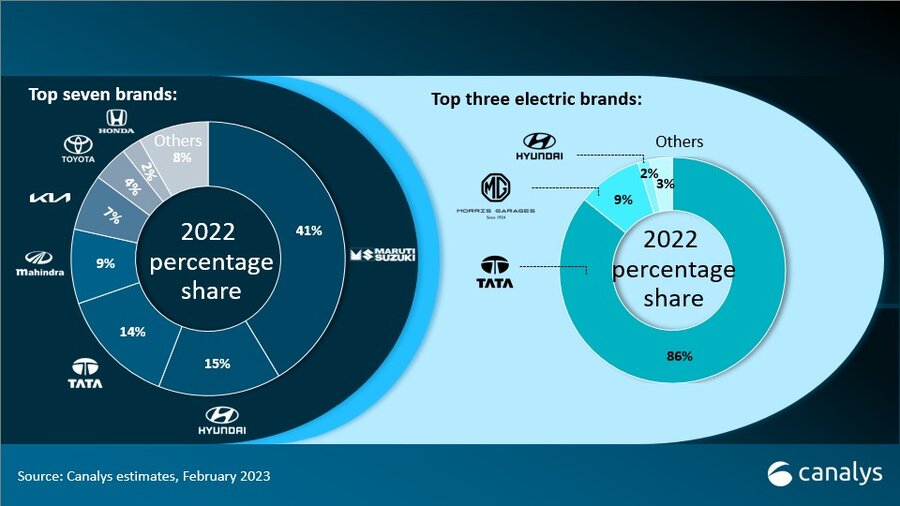

Additionally, there are some regional players overseas. For instance, Tata Motors in India recorded shipments of over 30,000 units in the first half of 2023, leading the Indian market. Canalys forecasts the Indian automotive industry is poised to make a major leap in the electric vehicle (EV) market in the second half of this decade, as a number of automakers align their mobility strategies with the government’s objective of EVs accounting for 30% of all vehicles sold by 2030.

MG ranks second in Southeast Asia and is among the top three in several countries, including Australia (third place), India (second place) and the United Kingdom (first place).

Hyundai ranks third in the North America region (second in Canada and third in the United States) and has a strong presence in its home country, South Korea.

*EVs include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

For more information, please contact:

Jason Low: jason_low@canalys.com +86 159 2128 2971

Ashwin Amberkar: ashwin_amberkar@canalys.com +91 9902019473

Gain detailed insights into the transformation of the global automotive market with Canalys' industry-leading Intelligent Vehicle Analysis service. We focus on critical aspects, from brand analysis to model evaluation. With our specialized research on electric vehicles (EVs), new energy vehicles, and intelligent vehicles, Canalys provides insightful data about car connectivity, convenience, driver assistance, and safety features. The Canalys Intelligent Vehicle Analysis Service goes beyond the typical market research product. It is a tailored solution designed to empower businesses with the tools they need to make informed decisions and stay competitive in the rapidly changing automotive landscape.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.