Global PC shipments suffered a drop of 33% in Q1 2023

Monday, 10 April 2023

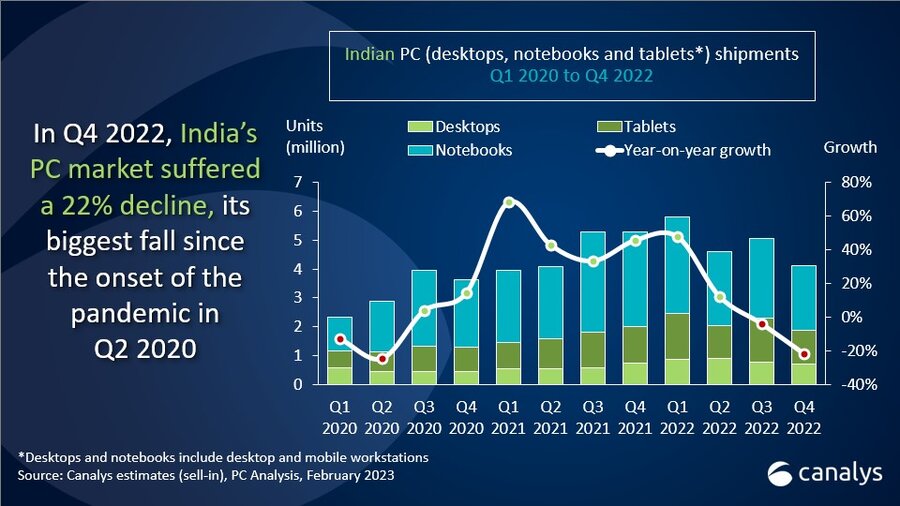

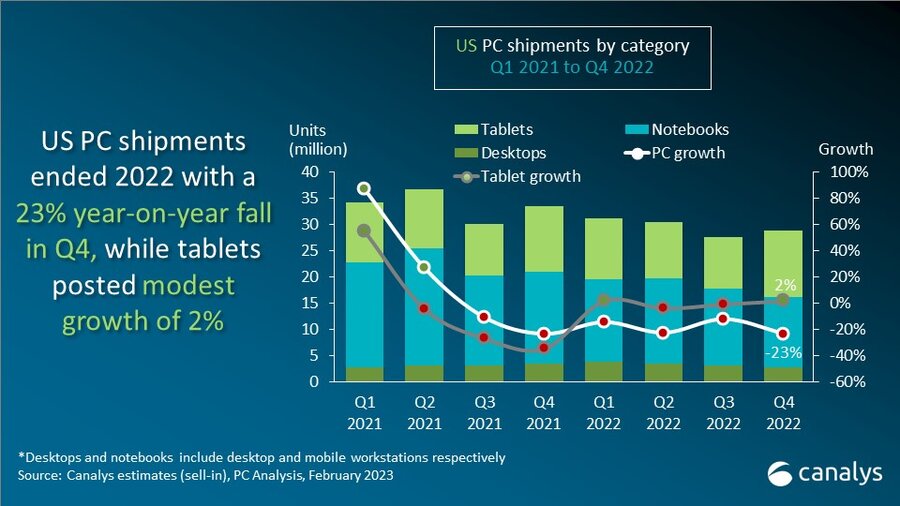

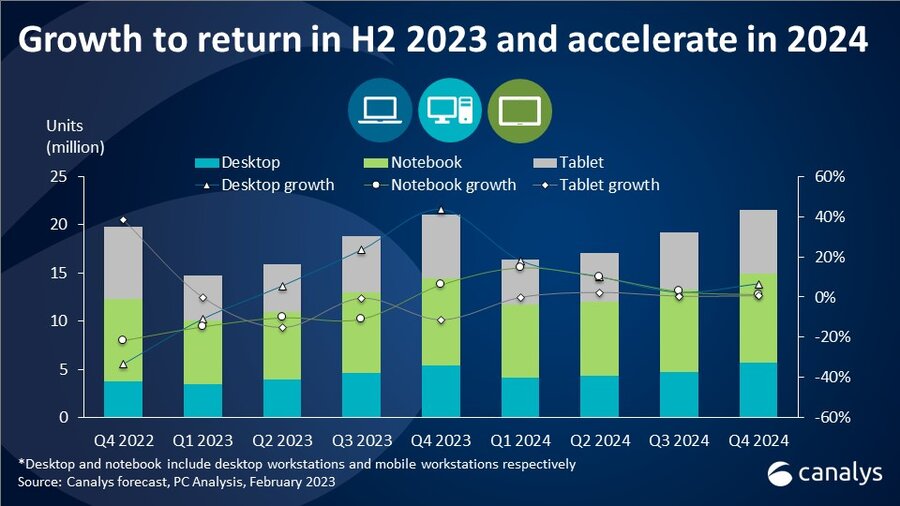

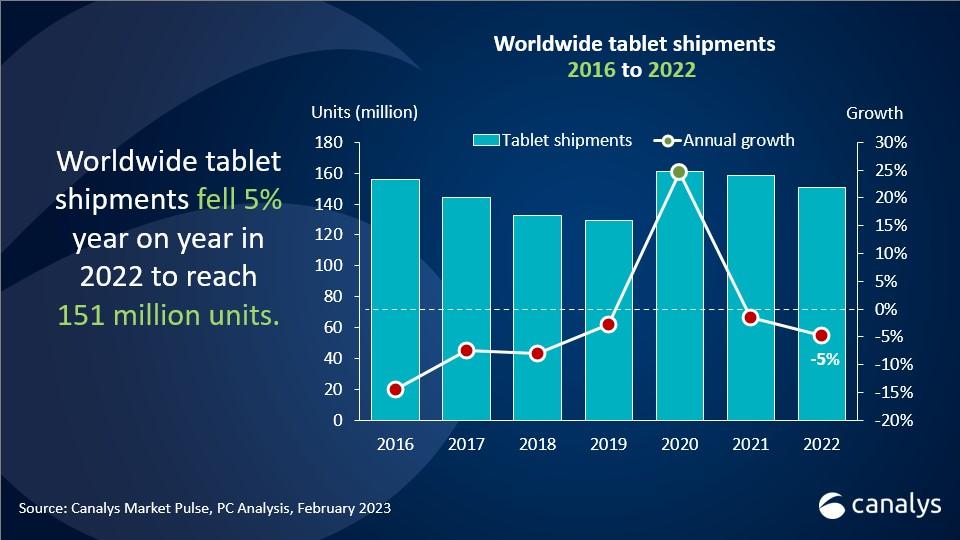

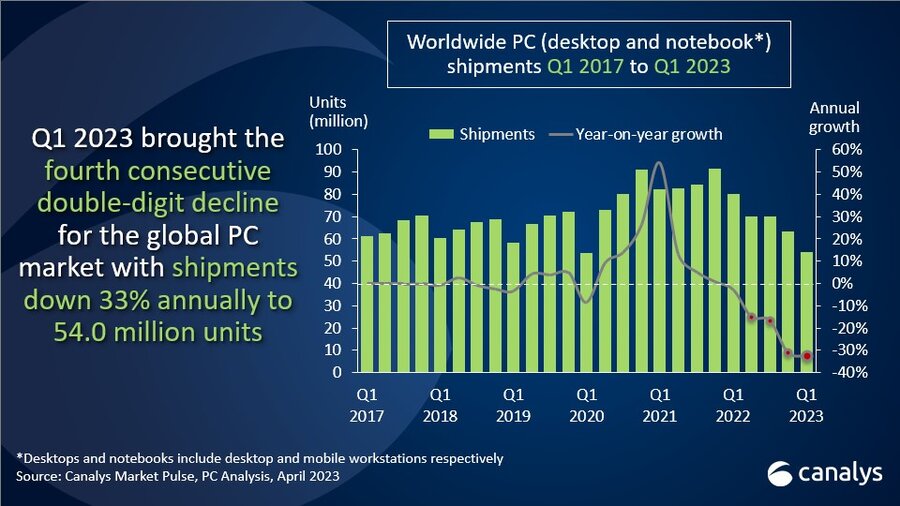

The first quarter of 2023 brought further turmoil to the global PC market, with total shipments of desktops and notebooks declining 33% to 54 million units, representing the fourth consecutive quarter of double-digit annual declines. The weak holiday season toward the end of 2022 extended into the new year as demand for PC remained muted and the channel pushed forward with inventory clearance as a key priority. Of the product categories, notebook shipments suffered a large decline, falling 34% year-on-year to 41.8 million units. Desktop shipments performed slightly better, undergoing a 28% decline to 12.1 million units. Canalys expects Q1 2023 to represent the largest shipment decline for the worldwide PC market this year, with recovery to begin in the second half of this year and gather momentum in 2024.

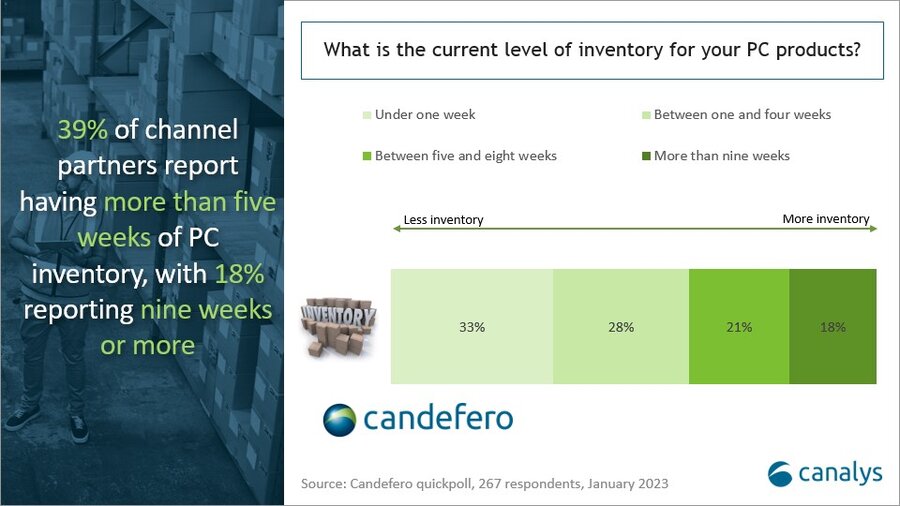

“Most of the issues that plagued the industry in the second half of last year have extended into the start of 2023,” said Ishan Dutt, Senior Analyst at Canalys. “Channel partners have indicated that their inventory levels have been reducing but remain high in absolute terms. 39% of partners surveyed by Canalys in January 2023 reported having more than five weeks of PC inventory, with 18% reporting nine weeks or more. Meanwhile, demand across all customer segments remains dampened, with more pressure arising from further interest rate increases in the US, Europe and other markets, where reducing inflation is a top priority. Consumers and businesses will remain cautious about outlays on new PCs in the short term, with significant market recovery only expected to kick in during the fourth quarter of 2023. The PC market has strong fundamentals to drive long-term growth, with shipment volumes higher than in the pre-pandemic era. A much larger installed base post-COVID-19, the transition to Windows 11, and both refresh and new demand from digital education will all be key drivers as the global economy enters a period of recovery in 2024 and beyond.”

Lenovo, with a market share of 24%, topped the market for shipments of desktops and notebooks but suffered a large annual decline of 30%, down 12.7 million units. HP claimed second place, undergoing a less dramatic drop of 24% to 12.0 million units of shipments. Third-placed Dell posted shipments of 9.5 million units, down 31% and falling below the 10.0-million-unit mark for the first time since Q1 2018. Apple faced the largest decline among the top five vendors, with total shipments of Macs dropping 46% to 4 million units. Asus secured the fifth position with 3.9 million units of shipments.

|

Worldwide desktop and notebook shipments (market share and annual growth) |

|||||

|

Vendor |

Q1 2023 |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

Lenovo |

12,729 |

23.6% |

18,258 |

22.8% |

-30.3% |

|

HP |

11,998 |

22.2% |

15,816 |

19.7% |

-24.1% |

|

Dell |

9,481 |

17.6% |

13,744 |

17.2% |

-31.0% |

|

Apple |

4,048 |

7.5% |

7,422 |

9.3% |

-45.5% |

|

Asus |

3,918 |

7.3% |

5,544 |

6.9% |

-29.3% |

|

Others |

11,804 |

21.9% |

19,279 |

24.1% |

-38.8% |

|

Total |

53,978 |

100.0% |

80,064 |

100.0% |

-32.6% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), April 2023 |

|

||||

For more information, please contact:

Ishan Dutt: ishan_dutt@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.