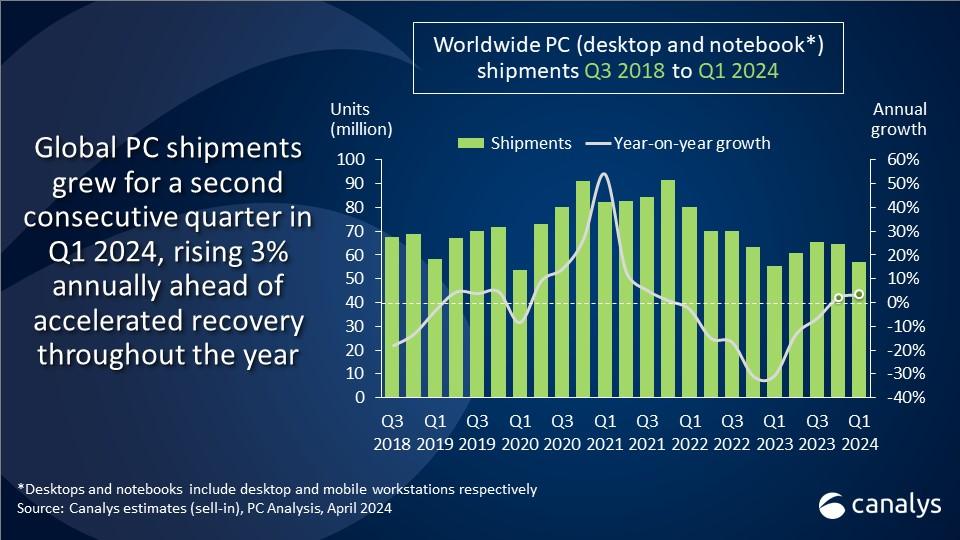

Global PC shipments up 3% in first quarter of 2024

Tuesday, 9 April 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

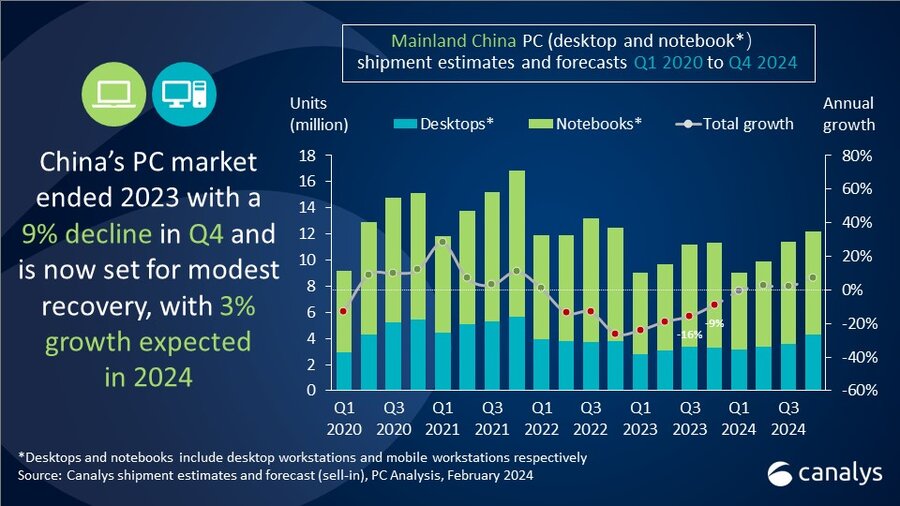

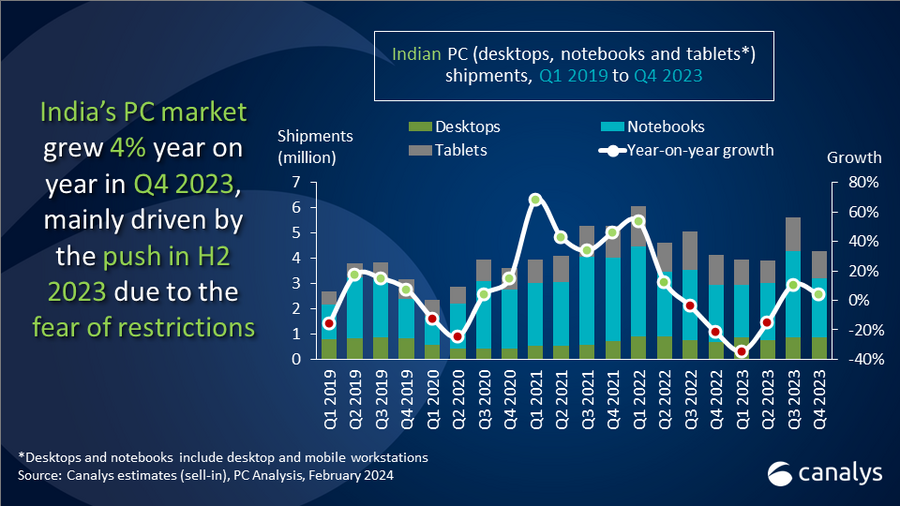

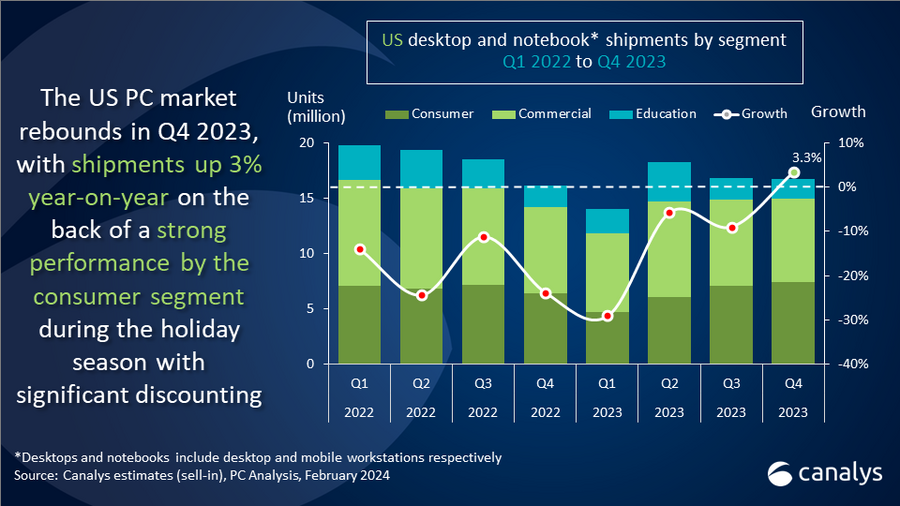

The worldwide PC market had a healthy start to 2024, with total shipments of desktops and notebooks growing 3.2% annually to 57.2 million units in Q1 2024. Notebook shipments (including mobile workstations) were up 4.2% to 45.1 million units, while desktop shipments (including desktop workstations) were relatively flat, down just 0.4% at 12.1 million units. Though modest, this growth highlights the ongoing recovery in PC demand across all segments, with purchases set to accelerate throughout the year, supported by the tailwinds of Windows 11 refresh and AI-capable PCs.

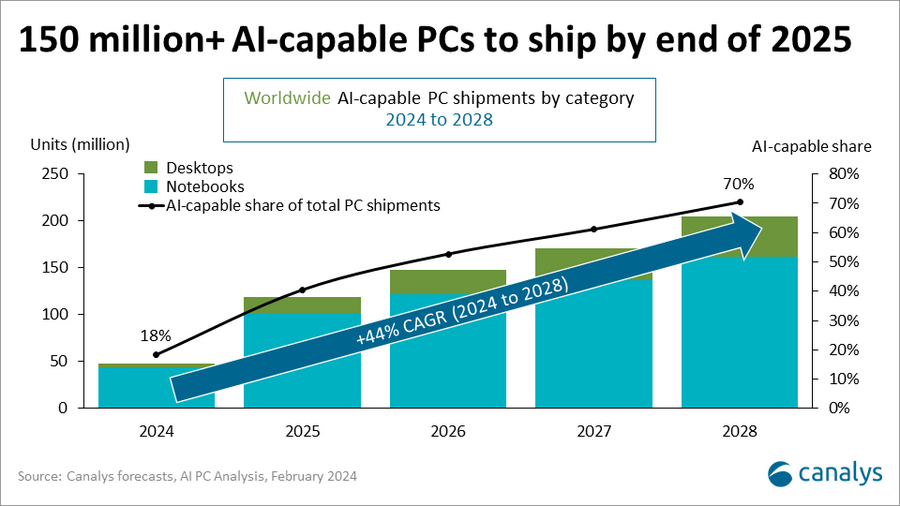

“Growth in the first quarter of 2024 bodes well for a strong PC market throughout the year,” said Ishan Dutt, Principal Analyst at Canalys. “Vendors and the channel have been working through some final stages of inventory corrections, and macroeconomic conditions in certain markets continue to limit demand. But the strength of the refresh opportunity, particularly from businesses, is beginning to come to the fore. The market is set to go from strength to strength in the coming quarters as customers prioritize upgrades in preparation for a large-scale transition to Windows 11. The current PC installed base is larger and older than ever, presenting a huge opportunity for OEMs and their partners. The wider introduction of AI-capable PCs in the second half of the year will also give the market a boost, delivering much-needed innovation and a compelling value proposition to users who have held off on buying new PCs during the post-pandemic downturn.” Canalys forecasts that nearly 50 million PCs shipped in 2024 will be AI-capable, integrating a dedicated AI accelerator such as an NPU.

Lenovo led the PC market in Q1 2024 with a 24% market share, delivering strong growth of 8% and shipping 13.7 million notebooks and desktops. Second-placed HP posted a flat performance, shipping 12.0 million units. Dell secured third place but suffered a minor shipment decline of 2% year on year. Apple took fourth place in the vendor rankings with growth of 2.5%, boosted by the launch of new MacBook Air products late in the quarter. Acer rounded out the top five vendors with 3.7 million PCs shipped.

|

Worldwide desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q1 2024 |

|||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

|

Lenovo |

13,735 |

24.0% |

12,746 |

23.0% |

7.8% |

|

HP |

12,029 |

21.0% |

11,999 |

21.6% |

0.3% |

|

Dell |

9,273 |

16.2% |

9,481 |

17.1% |

-2.2% |

|

Apple |

5,361 |

9.4% |

5,231 |

9.4% |

2.5% |

|

Acer |

3,727 |

6.5% |

3,523 |

6.4% |

5.8% |

|

Others |

13,117 |

22.9% |

12,475 |

22.5% |

5.1% |

|

Total |

57,242 |

100.0% |

55,455 |

100.0% |

3.2% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), April 2024 |

|

||||

For more information, please contact:

Ishan Dutt: ishan_dutt@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and broken down by market, vendor and channel, with additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.