Latin American smartphone points to rebound in the second half of 2023

Tuesday, 23 May 2023

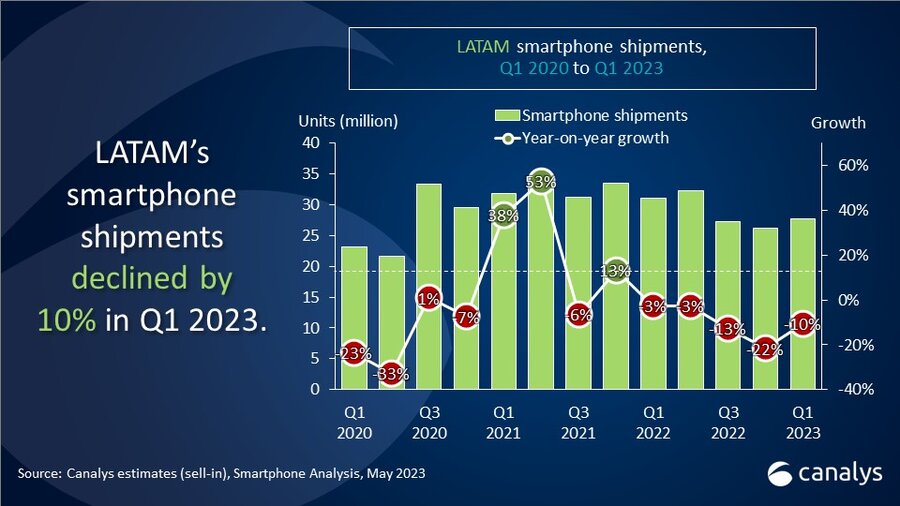

Canalys' latest research reveals that shipments to the Latin American smartphone market declined by 10% year-on-year in Q1 2023 to 28 million units. This is the fifth consecutive quarter of annual declines following a strong 2021 and 2022 which were defined by high inventory levels across the region.

“It was a challenging start to 2023 for LATAM,” said Miguel Perez, Mexico-based Senior Consultant at Canalys. “There was a huge variation in performance between vendors and markets, reflecting a difficult business environment. Some vendors had to continue prioritizing reducing their channel inventory levels, while others reached healthy levels early in the quarter, experiencing growth in Q1. Although the annual decline in Q1 2023 reflects a continued difficult environment, healthier inventory levels and increases in general consumer spending point toward signs of a rebound in the second half of the year. It will be important for vendors to now position themselves well in the market for the anticipated rebound."

"The competitive dynamics between the top three vendors remain as steady as ever, while competition remains fierce outside of the top three,” added Perez. “Samsung has been first placed in every single quarter for over a decade due to a strong positioning developed over time with good channel management which has allowed a broader presence to the brand, given the intensifying competition. Despite declining by 21% in Q1 2023, Samsung remains unchallenged for the top spot. Motorola had a solid start to the year, mainly driven by the new E and G series product launches, delivering strong performances in Argentina, Brazil and Mexico. Xiaomi secured third place despite facing local headwinds in Mexico, Colombia and Peru, countries which counted for over 60% of its shipments last year."

Apple continues to expand its presence in the region and its shipments grew 13% in Q1 2023. Although purchasing power in Latin America is restricted compared to other developed countries, the region has garnered focus in Apple's growth strategy, especially at a time when the brand is facing a challenging environment in North America and Europe. OPPO grew the most among the top five vendors, increasing its shipments by 35%. Since its entry, OPPO has prioritized growing a sturdy base in Mexico but has now expanded its presence into Colombia, Peru and Chile.

"Facing uncertainty, vendors will continue prioritizing inventory management and profitability,” added Perez. “However, there are vendors with high growth ambitions who will invest significantly throughout 2023. Vendors without capital to invest and a clear channel strategy will quickly find themselves left behind. The channel remains open-minded to new brands, initiatives and collaborations. Consequently, vendors must highlight their commitment and willingness to stand out to build a strong relationship with the channel."

In the face of economic challenges, cautious inventory management, profitability and cooperation with partners are essential for vendors to maintain or grow their market share. Established OEMs will focus on primary markets, leveraging brand awareness and local channel relationships. Meanwhile, emerging brands may seek local opportunities to cater to the needs of specific segments. Brands that maintain healthy inventory levels, offer competitive deals and invest in communication will have a strong advantage as the market is expected to recover in the latter half of 2023.

|

LATAM smartphone shipments and annual growth

|

|||||

|

Vendor |

Q1 2023 shipments (million) |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

Samsung |

10.5 |

38% |

13.4 |

43% |

-21% |

|

Motorola |

5.9 |

21% |

5.5 |

18% |

7% |

|

Xiaomi |

3.7 |

13% |

4.3 |

14% |

-15% |

|

Apple |

1.7 |

6% |

1.5 |

5% |

13% |

|

OPPO |

1.3 |

5% |

0.9 |

3% |

35% |

|

Others |

4.7 |

17% |

5.3 |

17% |

-12% |

|

Total |

27.7 |

100% |

30.9 |

100% |

-10% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding.

|

|

||||

For more information, please contact:

Miguel Perez: miguel_perez@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other parameters. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2023. All rights reserved.