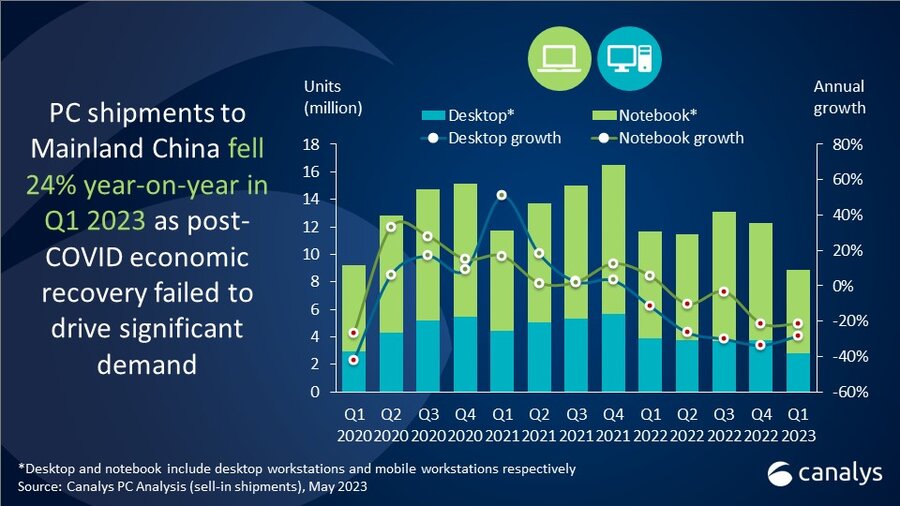

Mainland China PC shipments down 24% in Q1 2023 as recovery momentum falters

Wednesday, 24 May 2023

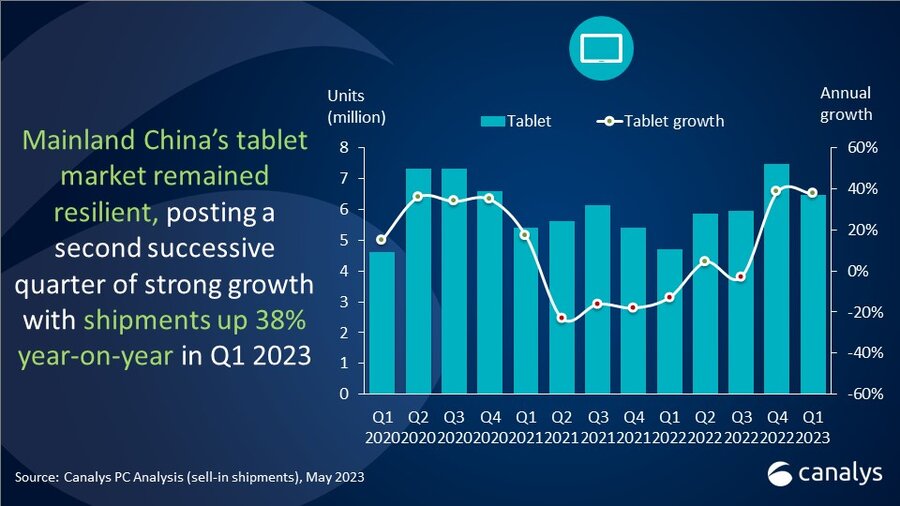

According to Canalys’ research, PC (desktop, notebook and workstation) shipments to Mainland China posted a 24% year-on-year decline in Q1 2023, shipping only 8.9 million units. Business and consumer spending on PCs remained conservative despite a boost in market activity following the reopening of the economy. Desktop (including desktop workstations) shipments dropped 28% to 2.8 million units, while notebook (including mobile workstations) shipments were down 22% to 6.1 million units. The tablet market, on the other hand, experienced growth, with total shipments increasing 38% year-on-year to 6.5 million units.

According to Canalys’ data, PC shipments to the commercial sector in Mainland China fell 27% year-on-year, with small and midsize business demand remaining particularly weak. Shipments to consumers fared slightly better, but still posted a significant drop of 21%. “Mainland China’s post-COVID recovery has not brought about a reprieve for the PC industry so far,” said Emma Xu, Analyst at Canalys. “On the commercial front, overall business investment and spending on IT remained relatively weak despite positive signals from the service sector. This is especially true for small and medium businesses, which continue to operate on tight budgets and are delaying significant outlays on devices under current economic conditions. While overall consumer spending in the country has been relatively strong, it has been largely directed toward areas like travel and hospitality rather than on new PCs. Although signals point to muted performance in the immediate term, there are positive signs of recovery in the latter half of 2023, with the public sector and large enterprises expected to lead in driving PC demand. As customers exhibit short-term caution around spending, vendors will need to adapt their products, attached services, and payment and financing offerings to capitalize on the opportunity.”

Lenovo remained the top vendor in Mainland China but posted a 24% decline as it shipped 3.3 million units in Q1 2023. Huawei enjoyed a strong quarter, growing its PC shipments by 34% to just under a million units of shipments, taking second place in the rankings. Third-placed HP underwent a relatively modest shipment decline of 7% as it reaffirmed its commitment to Mainland China as an important sales and manufacturing market during the quarter. Dell posted the largest decline among the top five vendors in Mainland China, with its PC shipments down by 45%. Asus rounded out the rankings as it took fifth place with 0.7 million units of shipments.

Mainland China’s tablet market showcased resilience with 38% year-on-year growth amid healthy promotional activity and a variety of new product launches. “The penetration of tablets in the region is increasing with an array of readily available diverse and affordable devices,” said Xu. “Vendors are now innovating to bring productivity-focused improvements, including the use of accessories like keyboards, styluses and applications to support work and study. This has bolstered the importance of tablets as a key pillar within wider device ecosystem strategies and helps ensure that vendors can tap into future demand stemming from consumers, businesses and the education sector.”

Apple led the tablet market in Q1 2023 as it more than doubled its shipments to 2.5 million units against a relatively weak Q1 2022 that was plagued by COVID-related disruptions. Huawei grew its tablet shipments by 23% to 1.1 million units but faced increased competition from other local brands expanding their offerings. HONOR and Xiaomi took third and fourth places, growing 66% and 13% year-on-year respectively. Lenovo took the fifth position as the only major vendor to post a year-on-year decline with its shipments down nearly 3% in Q1 2023.

|

People’s Republic of China (Mainland) desktop and notebook shipments (market share and annual growth)

|

|||||

|

Vendor |

Q1 2023 shipments |

Q1 2023 |

Q1 2022 |

Q1 2022 market share |

Annual |

|

Lenovo |

3,254 |

36.7% |

4,289 |

36.8% |

-24.1% |

|

Huawei |

952 |

10.7% |

710 |

6.1% |

34.1% |

|

HP |

903 |

10.2% |

975 |

8.4% |

-7.4% |

|

Dell |

759 |

8.5% |

1,383 |

11.9% |

-45.1% |

|

Asus |

699 |

7.9% |

833 |

7.1% |

-16.0% |

|

Other |

2,306 |

26.0% |

3,462 |

29.7% |

-33.4% |

|

Total |

8,873 |

100.0% |

11,652 |

100.0% |

-23.8% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

People’s Republic of China (Mainland) tablets shipments (market share and annual growth)

|

|||||

|

Vendor |

Q1 2023 shipments |

Q1 2023 |

Q1 2022 |

Q1 2022 market share |

Annual |

|

Apple |

2,476 |

38.4% |

1,200 |

25.6% |

106.4% |

|

Huawei |

1,137 |

17.6% |

926 |

19.7% |

22.7% |

|

HONOR |

701 |

10.9% |

421 |

9.0% |

66.5% |

|

Xiaomi |

679 |

10.5% |

600 |

12.8% |

13.0% |

|

Lenovo |

312 |

4.8% |

320 |

6.8% |

-2.8% |

|

Other |

1,148 |

17.8% |

1,222 |

26.1% |

-6.0% |

|

Total |

6,453 |

100.0% |

4,689 |

100.0% |

37.6% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Emma Xu: emma_xu@canalys.com

Canalys' PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.