Xiaomi regains SEA smartphone crown after a four-year gap amid a flat market

Wednesday, 13 August 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

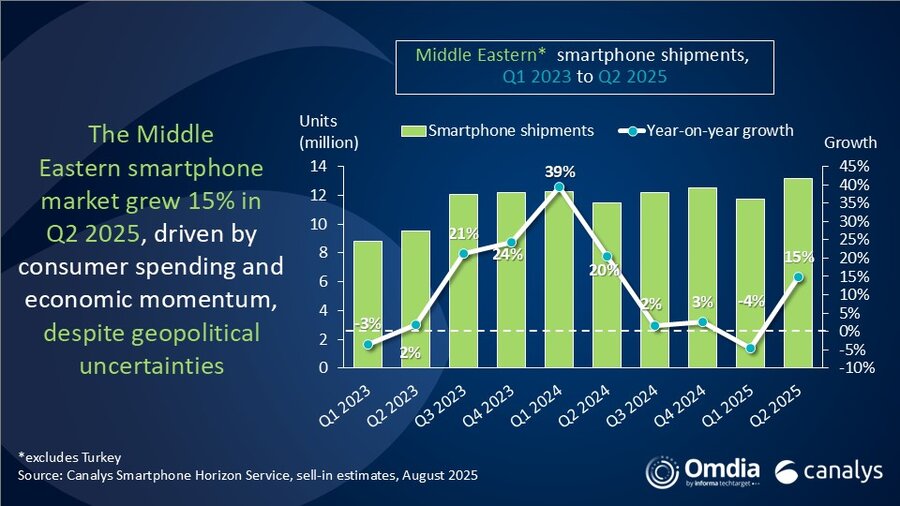

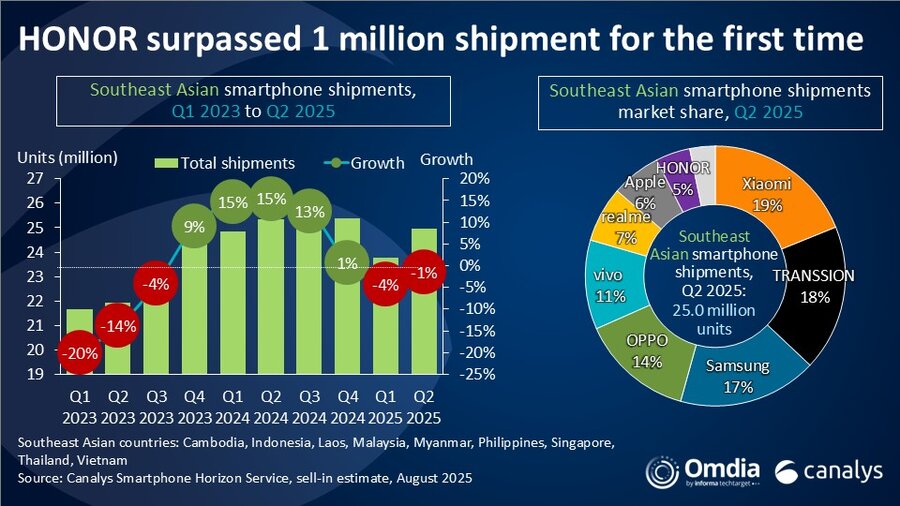

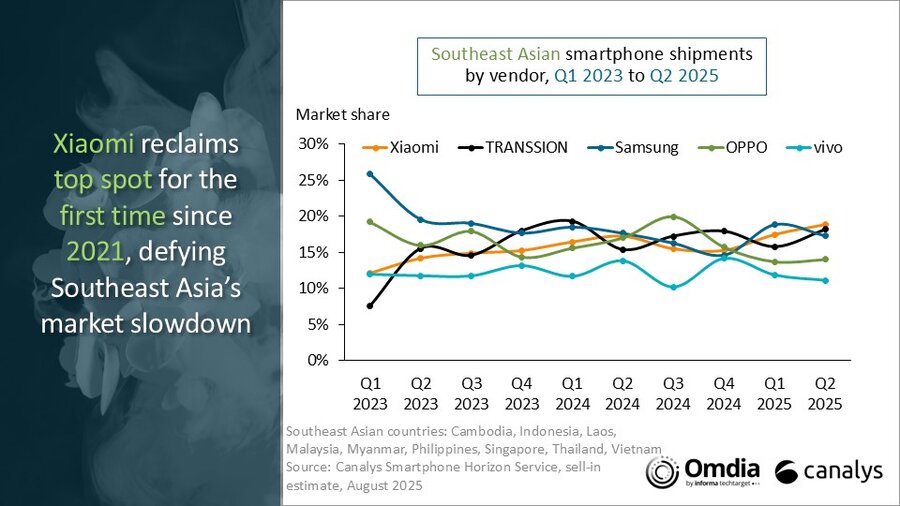

According to the latest research from Canalys, part of Omdia, Southeast Asia’s smartphone market declined 1% year on year in Q2 2025 to 25.0 million units, as tariff uncertainty continues to cloud the region’s outlook. Xiaomi reclaimed the top spot for the first time since Q2 2021, shipping 4.7 million units and capturing a 19% market share, up 8% from a year ago, driven by strong Redmi series sales and expanded channel reach. TRANSSION climbed to second place with 4.5 million units and an 18% market share, recording a robust 17% year-on-year increase on the back of new launches in the entry-level portfolio. Samsung ranked third with 4.3 million units and a 17% market share, down 3% year on year, though demand for its 5G-capable devices grew in markets like Vietnam and Singapore, supported by the improved value proposition of its Galaxy A06 5G and A16 5G models. OPPO (excluding OnePlus) was placed fourth with 3.5 million units and a 14% market share, falling 19% as competition in the entry-level tier intensified. vivo rounded out the top five, shipping 2.8 million units and taking 11% market share, down 21% year on year amid a strategic pivot toward improving profitability.

“The ongoing US–China trade tensions are creating significant knock-on effects, as vendors realign supply chains away from China to prioritize shipments for the US,” said Research Manager Le Xuan Chiew at Canalys, part of Omdia. “This inevitably impacts production and stock allocation from manufacturing hubs such as China and Vietnam to both Southeast Asia and the US, disrupting inventory planning and constraining product availability. At the same time, currency volatility, particularly a weakened US dollar, is influencing local purchasing power and retail pricing, forcing vendors to adjust prices or promotions to remain competitive. Although shipment volumes stayed relatively steady, looming tariff uncertainties and persistent macroeconomic headwinds are dampening consumer sentiment, especially in the mass market segment. Vendors have seen mixed results; some capitalized on agile product and channel strategies, while others struggled amid intensifying competition.”

“In this environment, flexibility in portfolio and channel strategies is proving critical,” added Chiew. “Xiaomi’s Q2 2025 performance was driven by the expansion of its direct-to-consumer and operator channels, creating a solid foundation to scale its sub-brands; POCO shipments more than doubled, while the premium Xiaomi 15 series grew 54% year on year, a milestone for a brand long perceived as a budget flagship. Samsung likewise strengthened channel diversification and premium positioning by expanding its enterprise strategy, an advantage rooted in its legacy as a trusted partner to large enterprises and government sectors. This reflects Samsung’s growing focus on vertical integration and B2B engagement, setting it apart from competitors while supporting higher ASPs and unlocking cross-device revenue beyond traditional retail channels.”

“Differentiating beyond price in the mass market segments is an ongoing challenge for all vendors,” said Senior Analyst Sheng Win Chow at Canalys, part of Omdia. “Xiaomi and TRANSSION are leading in the lower price bands with competitive pricing and aggressive trade push incentives. While competition is fierce at the entry level, some brands are finding success by moving upmarket. A standout premiumization story is HONOR, whose shipments surged 121% year on year in Q2 2025, surpassing 1 million units for the quarter. The success of higher-priced models like the X9c and 400 series has enabled HONOR to achieve strong volume growth while maintaining significantly higher ASP than competitors. vivo, despite a 21% overall shipment decline, achieved strong momentum in its mid-range portfolio, with the V-series shipment growing 92% year on year to account for nearly 21% of its shipments, up from just 9% in Q2 2024. Capturing a bigger share of the premium mid-range segment helps improve margins and reinforce the long-term viability in a competitive market.”

“TikTok Shop’s rapid expansion into devices and electronics is opening new growth avenues for Southeast Asia’s smartphone players,” said Chow. “Once known mainly for low-value items drop shipped from China, the platform is now working directly with local sellers and brands, investing heavily in building partnerships and authorized brand stores, much like Shopee and Lazada in their early days. Brands like Infinix and Xiaomi are already witnessing success using TikTok Shop to sell lower-priced online-exclusive models and clear older inventory with aggressive discounts and live-selling events. The expansion of a third major e-commerce player willing to support discount subsidies and advertising spend presents a significant opportunity for smartphone vendors in an increasingly competitive market.”

|

Southeast Asian smartphone shipments and annual growth |

|||||

|

Vendor |

Q2 2025 |

Q2 2025 |

Q2 2024 |

Q2 2024 |

Annual |

|

Xiaomi |

4.7 |

19% |

4.4 |

17% |

8% |

|

TRANSSION |

4.5 |

18% |

3.9 |

15% |

17% |

|

Samsung |

4.3 |

17% |

4.5 |

18% |

-3% |

|

OPPO |

3.5 |

14% |

4.3 |

17% |

-19% |

|

vivo |

2.8 |

11% |

3.5 |

14% |

-21% |

|

Others |

5.1 |

21% |

4.8 |

19% |

7% |

|

Total |

25.0 |

100% |

25.3 |

100% |

-1% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO excludes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Le Xuan Chiew: lexuan_chiew@canalys.com

Sheng Win Chow: shengwin_chow@canalys.com

The worldwide Smartphone Horizon service from Canalys (now part of Omdia) provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.